The U.S. has been the best house on the block. U.S. stocks have significantly outperformed international stocks since the financial crisis. But this year, for the first time in a long time, international markets are outperforming the U.S. Our lonely stock market rally is not so lonely any longer. Are we on the verge of a change in leadership? Is it time to dust off the passport in search of overseas opportunities?

Another hot summer day in Rome

Just over a year ago, on a Friday morning in late June, it was shaping up to be yet another hot summer day in Rome, where I was vacationing with my family. I sat in the Café delle Terme, just off the Piazza della Repubblica, sipping an espresso. I glanced at the stuffed cannoli nearby, which looked tempting. Outside, Fiats and Vespas whizzed by. Perspiring tourists made their way on foot. On the surface, things seemed utterly normal. But I knew things weren’t normal. I anxiously checked my phone to see how the European markets were opening after the previous day’s historic Brexit vote. The vote had blindsided investors. Markets across Europe were plummeting. The U.K. market opened down 9%. European markets were off 7%. The British pound was getting crushed, dropping 11% to its lowest level since 1985. European banks plummeted 18%. Meanwhile, gold and U.S. Treasuries rose in a flight to quality.

Investors were stunned by the referendum result. European economies had already been exhibiting signs of slowing, and now, with the Brexit vote, investors feared they might slip back into recession. Some analysts warned that more than half a million jobs would be lost. What’s more, there was a growing concern that a rising tide of populism on the Continent might trigger other member states to exit the EU. There was talk of a collapse of the eurozone. Some investors even fretted that given Europe’s interconnected banking system, the turmoil could trigger the next global financial crisis. As I drank the last sip of espresso and kept glancing between the market action on my phone and those tempting cannoli, I realized that while Italy was getting on with its day, things were definitely not normal. Panicked investors wiped $2 trillion off the global stock markets that day.

Our investment team convened a conference call to discuss our response. In this case, it was a transatlantic conference call. I wasn’t the only one in Europe at the time. We had another team member in London – the very epicenter of the market turmoil. With a presence in the U.K. and on the European continent that day, we had a bird’s-eye view of the market action. We were as surprised as anyone by the Brexit vote. But, after much discussion, our team arrived at a very different conclusion than did most investors. While we acknowledged the uncertainty associated with such a historic move – and we figured the process, like any divorce, would likely be messy – we were confident that the U.K. and the rest of Europe would survive. Britain was a large and diverse enough economy that it could stand on its own, just as it had for centuries – long before it became a member of the EU. Instead of holding membership in the single common market, it would have to negotiate a bilateral agreement with the EU. That would take time, to be sure – and again, the process would likely be messy, causing some volatility – but it was doable. After all, the U.S. and many other countries around the world, including some European countries outside the EU, have bilateral agreements with the EU. We concluded that other key EU member states – Germany, France and Italy – were unlikely to exit the union, despite currents of populism bubbling up among their populations too. We were fairly confident that this wasn’t the beginning of a global financial meltdown as some had suggested. We agreed that the right move was not to sell, but rather to stick with our existing position in international stocks. We weren’t ready to add to our exposure just yet. Instead, we decided on a wait-and-see approach. We wanted to wait for the dust to settle a bit and assess events as they unfolded further. But we agreed to remain vigilant for potential buying opportunities over time. We knew things might get rocky in the near term, but we figured the volatility would ultimately prove to be temporary. We expected markets to recover over time. As it turns out, that’s exactly what happened. The recovery proved to be much faster than we expected.

One year after Brexit

The July 2016 cover of the Economist magazine featured a tattered British Union Jack and the title “Anarchy in the U.K.” Looking back over the events of last year, that cover couldn’t be more off base. The Sex Pistols would be insulted by the reference. The FTSE 100, the U.K.’s blue-chip index, has gained nearly 20% since Brexit, hitting numerous all-time highs along the way. European stocks have done even better than U.K. stocks. The Euro Stoxx 50, an index of leading eurozone stocks, has outperformed the FTSE 100 and has also hit new highs.

What has driven such a remarkable recovery after the tumultuous market action I witnessed that hot June day in a café in Rome one year ago? Investors have come to realize that despite Brexit, the European economy has finally – after years of several false starts – embarked on a path of sustainable growth. Although the U.K. economy has shown some signs of slowing lately, it has managed to avoid a recession, defying the predictions of many analysts in the wake of Brexit. The export sector has continued to expand, although it has clearly been helped in part by the pound’s 14% decline since Brexit. The U.K. manufacturing sector also continues to perform well, with the most recent Purchasing Manager’s Index (PMI) posting a robust reading of 56.7 (PMI levels above 50 indicate expansion of the manufacturing sector, while those below 50 indicate contraction). The three-year moving average of the PMI has steadily climbed from slightly below 50 in August 2016, shortly after Brexit, to a new high currently. And the job market in the U.K. has been remarkably resilient. Unemployment has dropped to 4.6%, its lowest level since 1975.

In a significant departure from the past, the eurozone economies, including Germany, France, Italy and Spain, posted stronger GDP growth in the first quarter than did the U.S. economy. The PMI for the eurozone has also increased steadily, to 56.7%, signaling strength in the manufacturing sector. Unemployment in the eurozone has declined too, reaching a new low since Brexit of 9.5%. Even loan growth, which at one point had slipped into reverse, as Europe’s troubled banks sought to repair their balance sheets, has now recovered and remains robust. The U.S. is no longer the best house on the block.

The rise and fall of the euroskeptics

Against this backdrop of an improving economy, the political landscape in Europe has improved as well (from the perspective of most investors, that is), which has allowed investors to breathe a sigh of relief. In the wake of Brexit, and Donald Trump’s election victory in the U.S., many believed that Europe’s nascent populist movements, which consist primarily of far-right, nationalist, anti-establishment and euroskeptic parties, would sweep into power across the Continent. According to this view, we were witnessing the dawn of a major political regime shift. The electoral upsets spawned a domino theory in which populist forces would overturn established political parties across Europe in 2017. The rejection of Italian Prime Minister Matteo Renzi’s proposed changes to the constitution, which had the effect of pushing him out of power, was yet further evidence that the populist sentiment in Europe was growing. Italy’s far-right, nationalist Five Star Movement, led by comedian Beppe Grillo, was gaining ground. Rome elected a Five Star Movement candidate, Virginia Raggi, as its mayor. The city of Turin followed suit, also electing a Five Star Movement candidate. But in the Netherlands, Geert Wilders’ far-right Freedom Party came in second in the Dutch elections, winning just 13% of the votes, trailing the Liberal Party, which garnered 21% of the votes. In Germany, the right-wing party Alternative for Deutschland was also gaining influence, winning regional elections in several states and posting better results than even the Christian Democrats in Angela Merkel’s home state. But the rising tide of populism seems to have receded, at least for now. The euroskeptic parties are in retreat. In Austria, for example, Nobert Hofer of the Freedom Party rode a populist wave of discontent over the issue of migration in his bid for the presidency. However, he ultimately lost the election to the left-wing independent candidate, Alexander Van der Bellen. Similarly, in France, the National Front – the far-right, euroskeptic party led by Marine Le Pen, who took over the reins from her father, Jean-Marie Le Pen, in 2011 – had steadily gained influence, increasing its share of regional elections. And yet Le Pen ultimately lost the presidential election to Emmanuel Macron.

Even Theresa May, the U.K. prime minister charged with leading the Brexit effort, has lost considerable power. She called for a parliamentary election three years earlier than required, hoping to increase her Conservative Party’s seats in parliament, thereby giving her a stronger negotiating hand with respect to Brexit. However, in a shocking rebuke by voters, the Conservative Party ended up losing seats to the Labour Party, leaving the Conservatives short of a majority and thus unable to form a government. May ended up having to turn to Northern Ireland’s Democratic Unionist Party, a small, socially conservative party, to form a coalition government. May’s plan had been to push for a “hard Brexit,” which entails leaving the EU’s single market and restricting freedom of movement of EU citizens. However, with the election debacle, she may be forced to accept a “soft Brexit” instead, in which the U.K. would no longer be a member of the EU and would not have a seat on the European Council, but it would keep unfettered access to the European single market by retaining membership in the European Economic Area. This is the setup that Norway, Iceland and Denmark have. Switzerland has a similar arrangement involving a series of regularly negotiated treaties with the EU. These countries continue to make payments to the EU and agree to accept the “four freedoms” of movement of goods, services, capital and people. This is a considerably different picture of Brexit than what was envisioned by most observers shortly after the referendum.

“I’m beginning to think that Brexit may never happen. The problems are so enormous, the divisions within the two major parties are so enormous. I can see a scenario in which this doesn’t happen.”

– Sir John Vincent Cable, U.K. MP and former Business Minister, July 9, 2017

Some observers are even questioning whether Brexit will happen at all at this point. In our view, this seems to be a stretch. Our best guess is that something along the lines of a soft Brexit will ultimately prevail, allowing all parties to save face.

A global synchronized expansion

So far, we’ve been focusing on Europe in the wake of Brexit, but it’s not just Europe that’s doing well. Other international markets are doing well too. Global stock markets had their best first half in years. Twenty-six of the 30 largest stock markets have produced gains this year, the best first-half performance since before the financial crisis. While the U.S. stock market, as measured by the S&P 500, rose 8% in the first half, many foreign markets, such as South Korea, India and Spain, posted double-digit gains. The MSCI EAFE Index, a broad measure of international developed market stocks, gained 14% in the first half. Emerging markets have done even better, with the MSCI Emerging Markets Index posting a gain of 18% so far this year.

What’s driving the gains in international markets? You guessed it – economic growth. Economies around the world have bounced back since the financial crisis in 2008-2009. Although the recovery has been tepid, most economies have been steadily gaining momentum. We are experiencing what economists call a “global synchronized expansion,” which, as the phrase implies, means that every major region – the U.S., Europe, Japan, China and Latin America – is growing simultaneously. We have not seen a global synchronized expansion like this since 2010. Every G20 economy is expected to grow this year, and 12 of the G20 economies are expected to accelerate or at least grow at the same pace as last year. This too hasn’t happened since 2010.

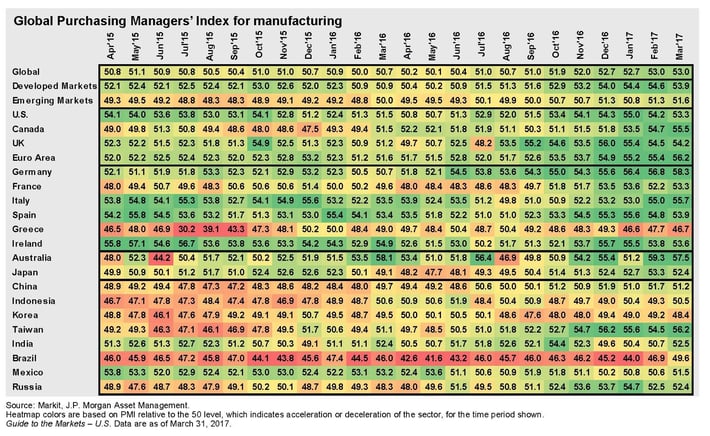

To get a sense of how widespread the improvement has been among economies around the world, look no further than the Purchasing Managers’ Index, the indicator of the health of the manufacturing sector that we referenced earlier. PMI data are forward-looking and considered to be a good predictor of the direction of an economy. Figure 1 shows the “PMI heat map.”

Figure 1. Global Purchasing Managers’ Index of manufacturing activity

You can see a discernable shift in colors from the middle of 2016 until today – from a lot of yellow to mostly green. Recall that readings above 50 indicate expansion, while levels below 50 indicate contraction. Only three markets have readings of below 50 – Korea, Greece and Brazil. The one market that stands out with a consistent streak of red is Brazil, which has been suffering from its worst recession in history in the wake of the collapse in oil prices in 2015, and later the political crisis related to a corruption scandal that has embroiled three presidential administrations. (Former President Lula Da Silva has been found guilty of corruption; his successor, Dilma Rousseff, has been impeached and removed from office; and her replacement, Michel Temer, has been charged with corruption and accused of obstruction of justice. And you thought the turmoil in Washington these days was bad!)

The global PMI figure has improved steadily, as evidenced by the shift in color over time from yellow to green. The figure has improved from 50.4 in June 2016 to 53.0 in March 2017. The most recent figure, as of June 2017, stands at 52.6. The U.S. PMI has improved from 51.3 in June 2016 to 53.3 in March 2017. The most recent figure for the U.S., as of June 2017, is now 52.0. This is the first time that the global PMI, at 52.6, is ahead of the U.S. PMI, at 52.0. Again, the U.S. is no longer the best house on the block.

GDP growth around the world is not only synchronized, but also improving. According to the IMF’s latest economic report, global growth is expected to be 3.5% for 2017 and 3.6% for 2018.

Dust off the passport?

We had already positioned our portfolios with exposure to international stocks some time ago, in anticipation of an eventual economic recovery and corresponding stock market rally. We’ve been writing about the unfolding economic recovery in Europe and the attractive valuations of international stocks for some time. In October 2015, for example, when European economies were struggling, our commentary was titled “Is Europe the Next Japan?” The answer was an unequivocal “No.” We predicted Europe would avoid recession and eventually produce a sustainable recovery. That thesis is now playing out, just as we expected. So we don’t need to dust off our passports. Our passports have already been in use for some time. They’ve been stamped many times at border control. We’re participating in this rally in international stocks already. However, given the strong gains this year, with developed markets up 14% and emerging markets up 18%, the question naturally arises: Is there still opportunity?

Since the market trough on March 9, 2009, the S&P 500 Index has risen 258%. The MSCI ACWI Ex-US Index, a measure of international stock markets, on the other hand, is up only 106%. Even with their recent strong gains, international stocks have underperformed U.S. stocks by 150%. International markets have largely moved sideways and have been range-bound for years. If U.S. stocks can escape going sideways and being range-bound, so too can international stocks, especially now that international economies look as though they’re finally on a sustainable growth path.

What about valuations? Aren’t stocks expensive?

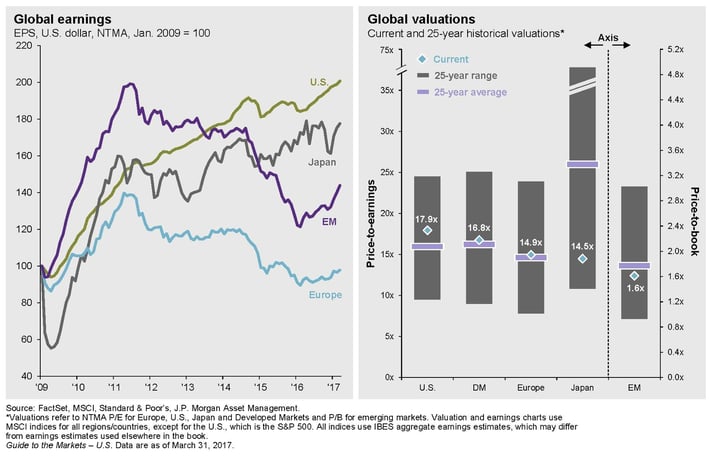

Figure 2. International equity earnings and valuations

Figure 2 shows international earnings and valuations. From the chart on the left-hand side of Figure 2, we see that earnings for every region around the world – including the U.S., Japan, Europe and the emerging markets – have turned and are now growing. Once again, the U.S. is no longer the best house on the block. And although the U.S. market has performed exceptionally well, it’s no longer cheap. The S&P 500 price-earnings ratio on forward earnings currently stands at 17.5x, above its 25-year average. That doesn’t necessarily mean it’s headed for a freefall anytime soon. Earnings are expected to continue to grow, and should elements of the Trump administration’s policy agenda – especially tax cuts – eventually get implemented, albeit later than expected, economic growth and earnings could power even higher. But the fact is, U.S. stocks are expensive, and thus some caution is warranted. We have had remarkably little volatility, and we expect that we could get some volatility at any time. A 5% pullback or even a 10% correction is certainly possible. Pullbacks and corrections of that magnitude are common in bull markets like this and shouldn’t come as a surprise.

The U.S. may have been the best house on the block, but no longer – and it’s certainly not the cheapest house on the block. International stocks, on the other hand, have been upgraded to the best house on the block. And they’re definitely cheaper than U.S. stocks, even with the substantial gains we’ve seen year-to-date. From the chart on the right-hand side of Figure 2, we see that developed market stocks are just slightly above their 25-year average, European stocks are at about their 25-year average (though remember, Europe has an earnings recovery story that is just beginning to unfold, unlike the U.S., where the earnings recovery has been underway for quite some time). Japan and the emerging markets trade at valuations below their 25-year average.

What about bonds?

We have focused this piece primarily on international stocks since that’s an area where we’ve seen a striking change in market leadership this year. But we can’t forget about bonds, of course, which remain an integral part of most of our investors’ portfolios. One way to frame the discussion about bonds is to note that it’s been 36 years since interest rates peaked. Rates have been on a downward slope over that time period, driving strong returns in bonds. That trend, we think, has finally come to an end. The yield on the 10-year Treasury hit a record low of 1.37% last year. We think that marks the low for the foreseeable future. The Fed has signaled its intention to raise interest rates and begin the process of reducing its balance sheet. Even Mario Draghi, the head of the European Central Bank (ECB), has signaled recently that the ECB’s accommodative monetary policy may be coming to an end. This is a sign that the global recovery since the financial crisis has finally taken hold and the expansion continues.

We think inflation and interest rates will rise, though we expect both will move up only gradually. Caution is in order. Now is the time to be particularly selective. That’s exactly what we’ve done with the positioning of our fixed income portfolios. We are focused on credit exposure over duration exposure. And we’re focused on inflation protection and strategies that are relatively insulated from rising interest rates. Apart from core municipal bonds, which typically are a component of our taxable portfolios, we favor a select group of fixed income asset classes including certain types of residential mortgage-backed securities, commercial mortgage-backed securities, asset-backed securities, floating rate bank loans, inflation-protected strategies, short-duration high-yield municipal bonds and short-duration bonds in general. We have de-emphasized U.S. Treasuries and corporate bonds. We had a meaningful exposure to high yield over the past few years, and with the recovery of the credit markets in 2016 and 2017, we have benefited from that exposure. However, as credit spreads have tightened, and the valuation of high yield bonds has become less attractive, we have pared our exposure to this area significantly. We expect to continue to reduce our exposure further over time, taking gains and reducing risk in the process.

No longer a lonely planet

When the U.S. was doing well and other regions weren’t doing as well, you might say it was a lonely planet. But now, with every region doing well – indeed, with a global synchronized expansion underway, the first one since 2010 – it’s no longer a lonely planet. So dust off your passport, get out your guidebook and get out there! If you happen to find yourself sipping an espresso in a café in Rome on a hot summer day, try the cannoli – they look fabulous!

As always, we thank you for your continued confidence and trust in us as stewards of your capital. We appreciate your business. If you have any questions or comments, we invite you to reach out to your Wealth Advisor.