A slew of risks from rising interest rates, slowing international growth, and a ratcheting up of trade tensions have left investors suddenly feeling vulnerable. In this edition, we discuss these challenges and how to cope with them.

A man and a woman, total strangers meeting for the first time – completely naked – are dropped into some of the world’s most extreme environments. They’re tasked with surviving for 21 days with no food, water, or clothes. If this sounds like the making of a reality TV show, it is. It’s called “Naked and Afraid.” If you haven’t seen it yet, I would encourage you to check it out. It’s pretty wild (pun intended). Imagine being transported from your comfortable life in the city or the suburbs, complete with all of today’s modern amenities, and suddenly being dropped into an extreme, hostile environment – say, a remote jungle somewhere in South America or a deserted isle in the Indian Ocean – encountering deadly animals and numerous physical challenges as you seek out shelter, forage for food, and find water. You’ve got nothing to rely on but your survival instincts and whatever skills you’ve managed to acquire over time – oh, and the help of your new partner, who, like you, is also naked and afraid. What makes the show so fascinating is that while some of the contestants manage to survive for 21 days, as you might imagine, many others don’t. And while sometimes it’s the physical challenges that prove to be insurmountable, more often than not it’s the mental challenges that ultimately do them in. The show illustrates that when it comes to survival, mental fortitude is every bit as necessary, perhaps even more so, as physical strength, stamina, or skill.

Like the contestants on “Naked and Afraid,” investors are suddenly feeling vulnerable and scared. U.S. stocks have pulled back sharply in recent days as interest rates have spiked higher. The yield on the 10-year U.S. Treasury note rose from 3.06% to 3.23% in just two days, before backing off slightly. That’s a big move in such a short period of time. The yield is up from 2.81% in late August and 2.41% since the beginning of the year. An 80 basis point move in nine months is bound to make investors a little unsettled. Based on strong economic data, including most recently a strong jobs report and a decline in the unemployment rate to its lowest level since 1969, along with other positive economic data, investors are realizing that economic growth might be faster and more sustainable than previously thought. The concern is that this could eventually lead to higher inflation, causing the Fed to continue its path of raising short-term interest rates even more aggressively and indefinitely. Other investors, who think the current economic strength is likely to be temporary and will soon moderate, are worried that the Fed may overshoot by raising rates too far, too fast. Indeed, Fed Chairman Jerome Powell’s comment that the Fed may go past the neutral rate is a cause for concern for these investors. President Trump is solidly in this camp, even going so far as to call Powell “loco” and saying he thinks he’s “making a mistake” and he’s “disappointed” by him.

The rise in bond yields has caused investors to worry about risk assets in general, causing the sharp sell-off in stocks. The Dow Jones Industrial Average plummeted 832 points on October 10, and then skidded another 699 points at the session low the following day before rebounding somewhat by the close, down 545 points. The S&P 500 is on track for its worst month since September 2011. Growth stocks, especially the high-flying FANG stocks – which have led the market over the past year – were some of the hardest hit during the initial downturn. Amazon and Netflix, two of the best performers this year, have declined 15% so far in October.

“Only when the tide goes out do you discover who’s been swimming naked.”

– Warren Buffett

The current turmoil is set against the backdrop of the withdrawal of liquidity from the economy as the Fed reduces its $4.5 trillion balance sheet that it built up by buying government debt and mortgage-backed securities during three rounds of quantitative easing over the past several years. Other central banks, including the ECB and Bank of Japan, are poised to do the same. This grand experiment has never been done before, and it’s not entirely clear how it will all go. It seemed to be going fine as the Fed executed a very gradual reduction and carefully telegraphed its steps along the way. But investors are worried that it may not always go smoothly. As liquidity is withdrawn from the global economy, it’s like the tide going out. As Warren Buffett famously quipped, “Only when the tide goes out do you discover who’s been swimming naked.” Some investors will likely be left standing on the shoreline, naked and afraid. Switching metaphors, if a rising tide lifts all boats, logic would suggest that a receding tide could present some serious challenges.

A reset

Our view is that interest rates, which were at low levels in part due to structural reasons (demand from foreign investors who viewed the low yields as attractive vis-à-vis the even lower yields of their own government bonds), were probably due for a reset at some point. This reset came in the form of a sharp and sudden spike, which has caught many investors off guard. However, we don’t expect interest rates to continue to spike aggressively higher and rise indefinitely. Rather, we expect them to continue to climb gradually and modestly, eventually plateauing. We’re not concerned about aggressively rising interest rates for two reasons. First, while U.S. economic growth is strong currently, much of that strength is attributable to the tax cuts. We think the impact of the tax cuts will likely fade over time, causing growth to moderate eventually. Second, inflation, while rising gradually, remains relatively well-controlled, near the Fed’s target level of 2%. Wage growth, measured by average hourly earnings, while increasing, remains below the 2009 post-recession level. We are seeing some anecdotal evidence of rising wages, and wage growth is likely to pick up over time, but not enough to cause runaway inflation. While some inflationary pressures are building up as the recovery has gained steam, there are plenty of deflationary forces in the world – from demographics to technology – that are likely to keep inflation from spiraling out of control. Some inflation is healthy; it’s simply a sign that the economy has finally recovered from the financial crisis and Great Recession.

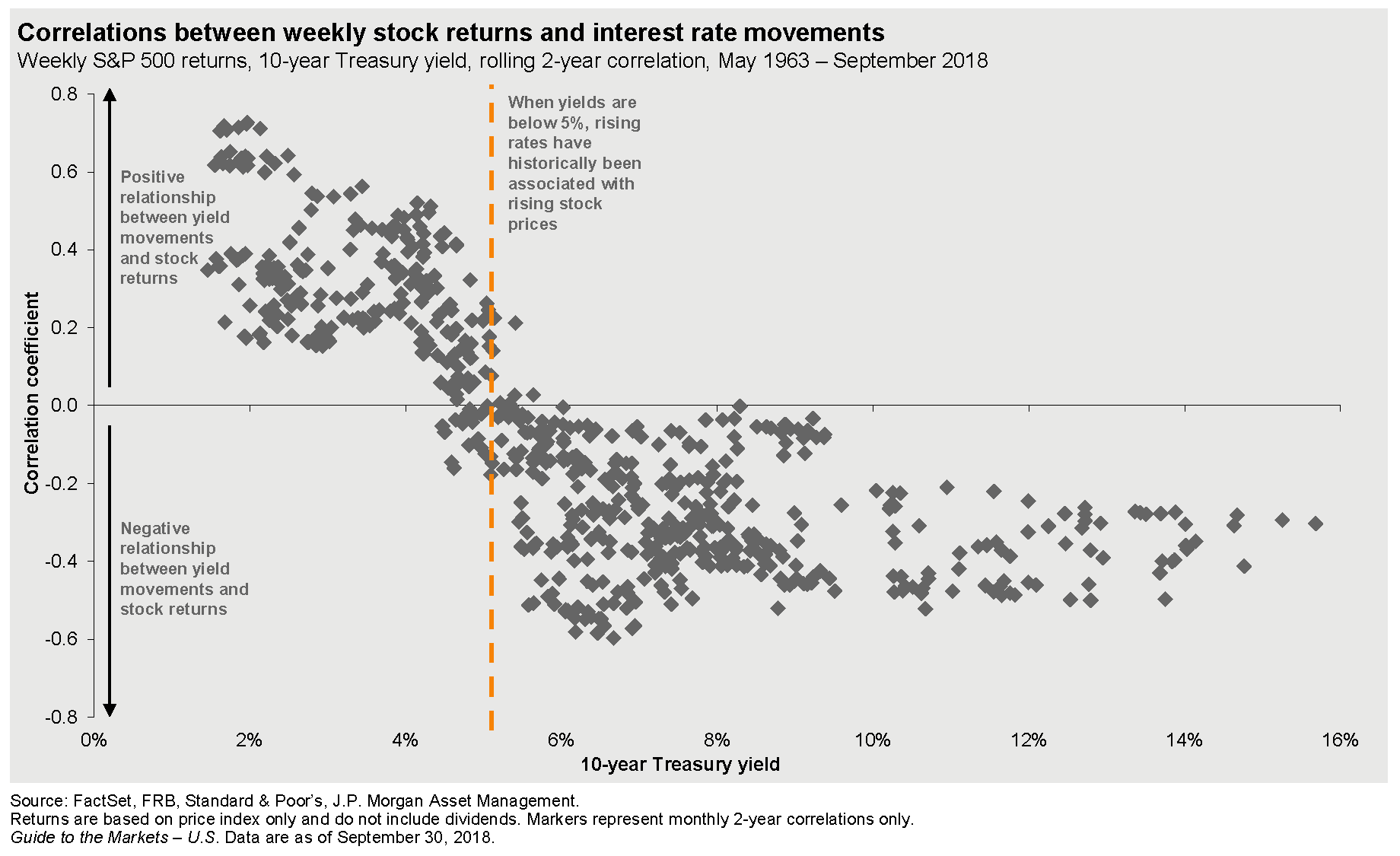

While a reset of interest rates, especially sudden spikes as we’ve seen recently, can spook investors and cause a sell-off in stocks in the short term, the current level of rates is not likely to derail the stock market for long. As you can see from Figure 1 below, when the 10-year U.S. Treasury yield is below 5%, rising rates have historically been associated with positive stock market returns. At a yield of 3.18% currently, we have a long way to go before hitting that 5% threshold level where negative stock market returns are more likely (and we don’t expect yields to reach that level).

Figure 1: Interest Rates and Stock Market Returns

With good, though moderating, economic growth, even in the face of gradually rising interest rates, we think the U.S. stock market can continue to climb higher over time. However, in the near term, investors should be prepared for a continuation of the current pullback – even a possible correction – as expectations for growth and interest rates are recalibrated.

The global trade war: A game of hardball

Besides the sharp spike in interest rates, investors remain worried about rising trade tensions between the U.S. and China. The Trump administration has imposed tariffs, starting at 10% and then rising to 25% by year-end on $250 billion in Chinese goods. Escalating the situation even further, Trump has threatened to impose tariffs on another $250 billion in Chinese goods. The Chinese, in turn, have retaliated by imposing tariffs on U.S. goods. As negotiations have broken down and hopes of a quick resolution at the bargaining table have faded, investors are now worried that we may be entering a protracted trade war. We have already experienced a decline in international stocks this year – and even a full-blown bear market (a decline of 20% or more) in emerging market stocks. Investors are realizing that the longer the trade dispute goes on, the more likely it is that the U.S. market, which has remained relatively immune from the trade dispute so far, can’t remain insulated indefinitely. The gap between the strong performance of the U.S. market and the poor performance of international markets can’t hold. Rising tariffs, inflation ticking higher, and disruption in global supply chains, as corporations begin to shift production away from China to other geographies, could crimp profit margins and slow profit growth here in the U.S. This scenario could contribute to a further market sell-off in the near term. However, as we discussed at length in our previous commentary (“Entering Parts Unknown”), we expect the trade issue to eventually be resolved, and thus a market sell-off will ultimately prove to be temporary. We view Trump’s trade policy as a negotiating tactic designed to extract concessions from our trading partners with the goal of ultimately resetting the terms of trade globally. Trump’s aggressive stance on trade appears to reflect the philosophy of advisors such as Peter Navarro, the Director of the White House National Trade Council, and Robert Lighthizer, the U.S. Trade Representative. Both have been long-time critics of China. But one thing we know about Trump, if we know anything at all, is that he fashions himself as a dealmaker. The latest news, as of this writing, is that he may meet with China’s President Xi Jinping at the upcoming G20 meeting in Argentina. If this proves to be the case, this is an encouraging sign that the parties may be returning to the bargaining table.

The strategy comes into focus

As a recent article in the New York Times pointed out, while the Trump administration’s trade policy initially looked somewhat chaotic, with no apparent coherent strategy, a clear strategy finally appears to be emerging. As the Times article describes it, the strategy is to essentially attack our traditional allies – Canada, Mexico, the EU, Japan, and South Korea – by publicly assailing them, implementing tariffs on steel and aluminum, and threatening their auto industries – with the goal of softening them up in order to extract moderate concessions that bolster America’s interests. A trade deal was successfully negotiated with South Korea back in September. Next was a deal with Mexico, which was then used as leverage to coerce Canada to come into the fold, which resulted in the recent USMCA deal (The United States-Mexico-Canada Agreement). Following this playbook, we expect deals with Japan and the EU to follow shortly.

It’s all about China (or, rather, mostly about China)

Drawing again on the Times’ reporting, the strategy apparently is to show that the administration can successfully get deals done with our close allies, and then seek a concerted effort among them to isolate China, thereby compelling China to make changes. The ultimate goal is to reset the economic relationship between China and the rest of the world. In short, it’s all about China (or, rather, mostly about China). Again, Navarro and Lighthizer are believed to be the architects of the strategy, while Trump is the executor. The administration is engaged in a multi-step process to attain greater leverage, through a combination of pressure and negotiations designed to extract concessions from China. As evidence of the administration’s goal of using our allies to help isolate China, the USMCA was designed to essentially give the U.S. veto power over any unilateral deals that Mexico and Canada might seek with China. White House Economic Advisor Larry Kudlow referred to the strategy as “a trade coalition of the willing” to confront China. Critics suggested the strategy was more akin to “a coalition of the coerced.” But, whatever the case, the administration believes it has greater negotiating leverage with a series of bilateral agreements than a multilateral agreement (such as NAFTA or the TPP). As the Times article pointed out, the important takeaway here is that Trump is not looking to blow things up (well, that’s a relief!). The message seems to be: So long as negotiators can claim victory for American interests, there are deals to be had.

The strategy appears to be working

The success that the administration has had in negotiating deals with South Korea, Mexico and Canada suggests that the strategy is working, and thus we think it’s only a matter of time before other trading partners come to the bargaining table and strike deals too. It’s in no one’s interest to have a global trade war. Neither President Trump nor President Xi want to see economic growth slow. Both may be playing hardball now, with aggressive rhetoric and the imposition of tariffs in a tit-for-tat fashion, which creates uncertainly and hence volatility in the near term, but we are confident that the situation will ultimately get resolved. Keep in mind, the Chinese have already shown a willingness to sit down at the bargaining table and make concessions. They did so previously. Trump rejected their offer, choosing instead to up the ante. The Chinese are playing hardball back. But we think they will ultimately make concessions again. We envision a scenario where Trump holds a Rose Garden ceremony to announce a deal, claiming victory for America (much like he did with the recent USMCA deal), playing to the American audience, while President Xi does something similar, claiming the deal he struck supports China’s interests. In this scenario, everyone saves face and is able to claim victory to their respective constituencies (even if the truth lies somewhere in the middle).

A coiled spring

Once the trade issue gets resolved, we expect international and emerging market stocks to rebound. We liken them to a coiled spring, about to uncoil at any moment. In the meantime, don’t be surprised if we also see some further volatility in the U.S. market as investors realize our economy is not immune from the trade dispute. Although the current volatility is causing fear among investors, which is understandable since a global trade war would undoubtedly be bad for the global economy, we would encourage them to hang in there during this difficult time. We see light at the end of the tunnel. Those who do, we think, will ultimately be rewarded. Recall one of the lessons of “Naked and Afraid” is that survival depends not just on physical prowess and skill, but mental fortitude as well. We are maintaining our exposure to international and emerging market stocks and even assessing whether to add to our position at some point.

Stay diversified

For investors feeling vulnerable, perhaps even fearful – maybe even naked and afraid – our advice for coping with the current set of challenges is, first and foremost, to rely on diversification. A balanced portfolio consisting of multiple asset classes has historically proven to be the best way to weather different market environments. This is one of the best tools in your survivalist toolkit. When suddenly facing a hostile market environment, one of the best ways to mitigate the threat is to stay diversified. Diversification doesn’t always work in the short term. In fact, lately, U.S. stocks have been the best place to be, while international stocks are down due to the brewing trade war. And bonds are suffering too from the headwinds of rising interest rates. But this situation won’t always be the case. As strong U.S. growth moderates, interest rates begin to plateau, and the trade war gets resolved, U.S. stocks may no longer be the best house on the block. The gap between the strong performance of U.S. stocks and the poor performance of international stocks – and the corresponding gap in their valuations (with U.S. stocks more expensive and international stocks much cheaper) – will likely close.

Not all bonds are created equal

Similarly, while bonds seem unattractive in a rising rate environment, should we get a pullback in the stock market, you will likely be thankful that you have some bonds in your portfolio to cushion the blow. Moreover, not all bonds are created equal. Our fixed income portfolios and the fixed income component of our balanced portfolios are positioned to try to insulate investors from the ill effects of rising rates by investing in shorter-term bonds and focusing on floating rate bonds and other selected bond categories that provide a degree of protection from rising rates. Collecting coupon income over time can generate reasonable returns, offsetting any possible price declines from rising rates in the interim.

Overall positioning

A summary of our views on the major asset classes and our overall portfolio positioning is as follows:

· U.S. Stocks – While we could be in for more selling pressure near term, as investors grapple with the effects of rising rates and the trade dispute lingers, we think U.S. stocks will eventually move higher over time. At average valuations relative to their long-term history, they’re neither cheap nor expensive. With a good economy driving corporate profit growth, even if that growth moderates over time, stocks have room to climb higher. We should note that the performance of the U.S. market has been driven by a very narrow group of stocks – about 10 growth-oriented stocks, primarily in the technology and consumer discretionary space (including the so-called FANG stocks: Facebook, Amazon, Netflix, and Google). We would caution investors that while many of these are great companies with favorable long-term outlooks, we may see a leadership change in the market at some point as the strong performance of this category cools and other stocks begin to do well. Those investors focused solely on this narrow group may be in for a rude awakening when they wake up one day and find out that these once high flyers are no longer flying so high. Remember Warren Buffett’s quote, “Only when the tides goes out do you discover who’s been swimming naked.” Don’t get caught swimming naked!

· International and Emerging Market Stocks – As mentioned earlier, both international and emerging markets stocks are down year-to-date, owing to a number of factors including the strong U.S. dollar, a moderation of global growth, concern over possible contagion from some troubled economies around the world (e.g., Turkey, Italy, Argentina), and, most notably, fears associated with the trade tensions between the U.S. and its trading partners, especially China. Taking these concerns one by one, we see the U.S. dollar moderating over time as growth slows and interest rates begin to plateau. We view the troubles in Turkey, Italy, and Argentina as isolated and not likely to trigger a widespread contagion effect. And, as discussed at length earlier, we see the trade war eventually getting resolved. All of this is likely to result in a rebound in international stocks, closing the gap in performance between the U.S. and overseas markets. Importantly, international and emerging market stocks are much cheaper than U.S. stocks, making them a compelling buy at these levels.

· Fixed Income – Bonds clearly face the challenge of rising interest rates. Rising rates act as a headwind for bonds. But, as mentioned earlier, we don’t see rates continuing to spike aggressively and rise indefinitely. Rather, we expect a gradual and modest increase over time. Moreover, there are ways to protect against rising rates by staying short term and focusing on certain categories of bonds – those that provide some insulation from rising rates. Collecting coupon income over time should help offset any potential price declines in the near term. As rates rise, bonds become more attractive given their higher yields, suddenly providing a compelling alternative to other assets.

· Real Estate – Real estate is attractive on a selected basis. However, we continue to be cautious, focusing on specific property types (e.g., industrial, triple net-lease retail) and selected geographies.

· Alternative Investments – Alternative investments comprise several different categories and thus present a mixed set of opportunities. We have generally avoided equity-oriented hedge funds since, in general, they don’t do as well as long-only equity strategies in rising markets. However, as markets have climbed higher over time, equity hedge funds are an area to consider since they generally provide some protection against market declines while still offering upside appreciation potential. With the increase in merger activity, we view merger arbitrage favorably and have an allocation to this strategy. We own credit hedge funds in selected client accounts, but we are becoming more cautious in this area going forward as more capital has entered the space, yields have come down, and credit risks are rising. We view private equity as unattractive with the view that there is too much capital chasing too few deals, although we view secondary private equity funds as an opportunity.

Investors’ fears are understandable, but largely overblown

As usual, there are lots of things to worry about. Lately, rising interest rates, slowing global growth, and trade tensions have left many investors feeling naked and afraid. While these issues certainly deserve carefully monitoring, we think investors’ fears, while understandable, are largely overblown. The U.S. economy is in good shape. We are expecting neither a recession on the one hand, nor accelerating growth leading to runaway inflation and aggressively rising interest rates on the other. Rather, we see a continuation of good, solid economic growth. We expect the current strength to moderate as the effects of the tax cuts wear off. We expect the global trade war to eventually get resolved, and when that happens, international and emerging market stocks are poised for a rebound as investors realize that things are not as bad overseas as they feared. In the meantime, the U.S. market may continue to experience volatility, even a sharp pullback or correction, as investors realize our economy is not immune to the forces buffeting the global economy. We would advise our clients to stay patient as these crosscurrents get sorted out. As usual, stay diversified since today’s winning and losing asset classes (and sectors) may take turns over time. Diversification hasn’t been the best strategy lately – the best strategy has been U.S. stocks, and moreover, a very narrow group of stocks (essentially 10 tech stocks) – but diversification is almost always the best strategy over the long haul. As the tide recedes, don’t get caught standing on the shoreline, naked and afraid. Stay confident. Be prepared … with a diversified portfolio … a sturdy swimsuit … and maybe a piña colada in hand!

As always, we appreciate your confidence and trust in us. Should you have any questions, please don’t hesitate to reach out to your Wealth Advisor.