After a long bull market and a recent bout of volatility, the stock market has reached a crossroads. We’ve entered a time of great uncertainty regarding the economy and geopolitical events. We’re sitting on the brink of a possible global trade war. To borrow the name of the CNN series of the late celebrity chef Anthony Bourdain, we’ve entered “parts unknown.” The critical question on investors’ minds is, what now? Should investors pull back or stay the course?

There were lots of surprises last quarter: A historic summit between a U.S. president and the leader of North Korea. Ongoing concerns over rising inflation and interest rates. A flattening of the yield curve signaling a maturing of the economic cycle. The continued rise of populism in Europe with the emergence of two anti-establishment, Eurosceptic parties in Italy. Renewed turmoil in Turkey, Argentina, and Brazil. A controversial immigration policy enacted by the Trump administration. The announced retirement of Supreme Court Justice Anthony Kennedy, which is likely to dramatically reshape the Court. And, most notably, the aggressive trade policy stance by the Trump administration and the threat it poses for a possible global trade war.

Like a punch in the gut

For me personally, however, the most surprising event of the quarter wasn’t any of these. The real shocker was the tragic loss of the ultra-cool, Persol-wearing, Brazilian jiu-jitsu-trained, former bad-boy chef turned father, gastronome, and intrepid traveler – the iconic and incomparable Anthony Bourdain. Of course, the death of fashion icon and entrepreneur Kate Spade was equally tragic. But I didn’t feel the same personal connection with her that I did with Bourdain, whose globe-trotting epicurean lifestyle I aspired to emulate. His departure left me stunned, like a punch in the gut. Tony, as he was known, was a master storyteller. His great gift was his ability to make the world feel like a smaller place – an utterly fascinating place, at once both beautiful and gritty – through travel, food, and learning about other cultures. He did so through the simple act of sharing a meal with others. By entering “parts unknown,” traveling the globe and trying foods that were unfamiliar to many Americans, he made the exotic – whether location, food, or cultural custom – feel somehow familiar and comfortable (and, if nothing else, interesting and fun). Whether it was sushi in Tokyo, a spleen sandwich in Sicily, spicy vegetarian flatbread in Punjab, live octopus in Molokai, street food in Bangkok, freshly killed pig in Borneo, Turkish breakfast in Istanbul, goat stew on a hilltop in Oman, pecan waffles at a Waffle House in Charleston, or grilled pork and rice noodles in Hanoi with President Obama, somehow Bourdain made unfamiliar experiences feel familiar. It was typically just him and the locals, sometimes with a friend tagging along, sitting down to share a meal, and in the process connecting as humans, despite whatever cultural differences we may have. What could be more common across cultures than the bond created through sharing a meal?

An inexorable process

What relevance does this have to investing? As we sit here now, with trade tension dramatically heating up, on the brink of a global trade war (some would say we’re already in a global trade war), Bourdain has plenty to teach us. One key theme of his work should be obvious – we live in a globalized world, and that world is shrinking. We’re in this together, no matter what. There may be a rise in populism and a backlash against globalization occurring right now around the world, and perhaps for good reason – the downsides of globalization are many – and while we would do well to address those downsides, globalization (hopefully a healthier version of it) is an inexorable process. There’s no turning back the clock. Tariffs or no tariffs, investors need to invest globally. We can’t simply isolate ourselves, hiding out in domestic investments.

Our shrinking world

Consider, for example, that in 1960, the U.S. accounted for 40% of global GDP. Today, the U.S. accounts for only 22% of global GDP. With foreign economies representing almost 80% of global GDP, they’re simply too big to ignore. Emerging market economies (e.g., China, India, Brazil, Indonesia) are now bigger than the U.S. and European economies. Emerging markets are expected to represent 50% of global GDP by 2020. Think about that for a minute. That’s only a year and a half away. More than 95% of the world’s population lives outside the U.S., and 60% of the world’s population lives in the emerging markets. The two most populous countries in the world are China, with 1.4 billion people, and India, with 1.3 billion people. The U.S., by contrast, is the third most populous country, but with only 327 million people.

The greatest growth story ever

With China and India both growing faster than the U.S., it’s only a matter of time before their economies catch up and overtake ours in size. China is projected to overtake the U.S. as the country with the largest middle class by 2020. India will overtake the U.S. in 2021 and then overtake China in 2024. Emerging markets overall are growing 2.5 times faster than the developed markets, with GDP growth of 4.8% versus 1.8%, and six times faster than Japan. Ed Kerschner, chief portfolio strategist at Columbia Threadneedle Investments, a 40-year veteran of Wall Street, referring to the opportunity in emerging markets, says, “This is the greatest growth story I have ever seen!” Kerschner notes that it’s similar to the U.S. baby boom that drove post-war growth – only that was 100 million people, and this is 3 billion people!

Home country bias

In terms of market capitalization, the U.S. represents approximately 36% of the world market capitalization. Almost two-thirds of the world’s companies by market capitalization reside outside the U.S. Investors would be foolish to ignore two-thirds of the world. And yet despite the fact that the U.S. has less than 5% of the world’s population, only 22% of global GDP, and only 36% of global market capitalization, U.S. investors have 85% of their investments in U.S. assets. This is called the “home country bias.” And it’s not just a U.S. phenomenon; it’s common around the world. Japanese investors have most of their investments in Japanese assets. European investors have most of their investments in Europe. And so on, for virtually every region around the world. The reason the home country bias exists is simply unfamiliarity. The first lesson of Anthony Bourdain, then, is this: Get comfortable with the unfamiliar. Be willing to enter “parts unknown.”

Is the international investing story over?

We have long been proponents of international investing and have had exposure to international investments for quite some time. Last year, we benefited nicely from that exposure as international stocks rose sharply, with the MSCI ACWI ex-USA Index up nearly 28% on a total return basis. Last year was the first time since 2010 that international stocks outperformed U.S. stocks. In the wake of the financial crisis, the U.S. had been the best house on the block – one of the first to embark on an economic recovery from the Great Recession, driven by the Federal Reserve’s aggressively accommodative monetary policy. The rest of the world lagged the U.S. in recovering, but it’s now finally catching up. The world had entered a global synchronized expansion: a period when every region around the world was growing. But now that thesis is being called into question – due to rising interest rates in the U.S.; a rising dollar; a flattening of the yield curve; softness in Europe (e.g., U.K., France), the rise of populism in Italy; slowing growth in China; market turmoil in Italy, Turkey, Argentina, and Brazil; and especially, now, escalating trade tensions and the increasing possibility of a global trade war. A global trade war – which would likely impact business and consumer confidence and cause a severe falloff in demand, as well as disruptions in supply chains around the world – could bring the global synchronized expansion to a halt. This has investors worried. After last year’s strong gains, international stocks have experienced a pullback this year as investors grapple with these issues.

Our take

While these issues are real, and we’re monitoring them carefully, we don’t think they are likely to derail the case for investing in international stocks in the longer term. Inflation and interest rates are likely to continue to rise gradually and modestly, but at some point we expect this trend to moderate. And while the dollar has been rising lately, we think it could top out at some point and reverse course, experiencing some softness again, as was the case last year. The dollar lost 10% of its value against the euro last year; thus, this year it’s merely gaining back some of those losses. As the ECB and other central banks begin to remove their accommodative stance, the dollar is likely to become less attractive. Right now, the dollar is benefiting from its status as a safe haven, given the turmoil over trade policy. This is sort of ironic, since the U.S. is responsible for the turmoil, but nevertheless the dollar is perceived as a safe haven in times of global uneasiness. However, should trade tensions subside, the dollar will begin to lose its safe haven status, especially as investors begin to focus on the rising fiscal deficit associated with the tax cuts.

A reminder: Why we like international stocks

As we’ve noted in several past commentaries, one of the reasons we like international stocks is that they are cheaper than U.S. stocks. And with the recent pullback, they’ve become even cheaper. U.S. stocks currently trade at a price-to-earnings ratio of 16x forward earnings, in line with their 25-year historical average. They’re not overly expensive, but they’re certainly not cheap. By contrast, international developed market stocks (e.g., U.K., Germany, France, Japan) are much cheaper than U.S. stocks, trading at a P/E ratio of only 13x. Emerging market stocks are even cheaper, trading at a P/E ratio of only 10x. And if we exclude the high-flying Chinese Internet stocks, which trade at 20-30x earnings, that means the rest of the emerging market stocks are trading at single-digit P/Es.

On the brink of a global trade war

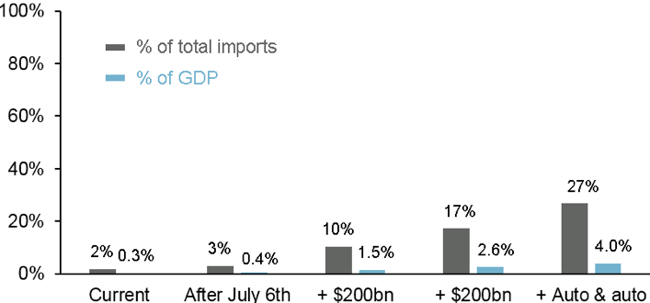

But what about that looming global trade war? By the way, some say we’re already in a global trade war. Others disagree. Peter Navarro, the director of the White House National Trade Council, who helped craft the administration’s trade policy, doesn’t like the term “trade war.” He prefers to call it a “trade dispute.” He cheekily says the U.S. lost the trade war long ago. He may be right. But, for our purposes, let’s consider the possibility that the current trade tensions might escalate, with multiple rounds of retaliation, leading to something much worse, which we’ll call a global trade war. Could a trade war bring the global synchronized expansion to a crashing halt? In assessing the implications of tariffs on the global economy, it’s important to separate out tariffs that have actually been implemented and those that have merely been proposed but are still under discussion. The administration has implemented tariffs on imports of steel and aluminum (with exemptions for certain countries) as well as lumber, washing machines, and solar cells and modules. Together, these account for $54 billion of goods, which represents only 2% of all U.S. imports of goods and services and only 0.3% of GDP. These numbers are quite small and should not have a material impact on U.S. economic growth. However, on July 6th, 25% tariffs were implemented on an additional $32 billion of Chinese imports, targeting 800 different items including industrial machinery, medical devices, and auto parts. Beijing responded within minutes, implementing tariffs on a similar amount of U.S. exports including beef, seafood, and SUVs. An additional $16 billion in imports is under review by the Trump administration, and tariffs on those goods could be implemented in a few weeks. The administration has proposed another 10% tariff on an additional $200 billion in Chinese imports, and another $200 billion after that, should China retaliate. Trump continues to turn up the heat, threatening to slap tariffs on $500 billion of Chinese goods. The numbers are starting to get very large, very quickly. But these figures are far from being firm. The Commerce Department has also begun an investigation into whether imports of autos and auto parts represent a threat to national security and are subject to tariffs. This could represent an additional $275 billion in goods and services. In a worst-case scenario, we could see as much as 27% of U.S. imports affected, representing 4% of U.S. GDP. Figure 1 below shows the scale of proposed tariffs on imports by the U.S. under different scenarios.

While the amount of imports affected by the tariffs implemented so far is not material in terms of total imports and GDP, the amount of additional goods that would be affected by proposed tariffs would be material. However, even under the worst-case scenario, only 4% of U.S. GDP would be affected. While certainly material, the direct impact of these tariffs on our economy is still likely to be small.

A game of tit for tat

But what about further retaliation by the Chinese and our other trading partners? So far, in response to the steel and aluminum tariffs, we have seen 25% tariffs imposed by the E.U. on $3.2 billion in U.S. exports; 15-25% tariffs imposed by China on $3 billion in U.S. exports, with additional 25% tariffs on $50 billion in U.S. exports; 25% tariffs imposed by Canada on $13 billion in U.S. exports; and 15-25% tariffs imposed by Mexico on $3 billion in U.S. exports. Together, this amounts to a total of more than $72 billion in U.S. exports, which at this point is still very small relative to total U.S. exports of $2.3 trillion. However, the Chinese have threatened to impose additional tariffs based on an escalation of tariffs from the U.S. Similarly, the E.U. and other trading partners have threatened to impose more tariffs on U.S. exports in response to any tariffs on autos and auto parts.

The real concern, of course, is not the direct impact of the tariffs implemented so far, or even those proposed so far, but rather the likelihood of an ongoing escalation of trade tensions with multiple rounds of retaliation – in a tit-for-tat fashion – leading to a full-blown global trade war and the effects that would have on global economic growth and inflation.

When the dragon sneezes

The impact on growth would likely be more severe for China than for the U.S., since the $450 billion in Chinese imports that could face tariffs represents 3.2% of China’s GDP. This explains why China’s stock market has dropped 22% year-to-date. The U.S. exports only $130 billion in goods to China, which is less than 1% of U.S. GDP. However, there are other ways that China can retaliate besides tariffs, such as restricting U.S. business operations in China. But it’s no consolation that China may be hit harder than the U.S.; with its fast-growing economy, China is a key driver of the global synchronized expansion, which benefits everyone, including the U.S. We used to say, “When Uncle Sam sneezes, the rest of the world catches a cold.” Now, the more accurate phrase might be, “When the dragon sneezes, the rest of the world – including Uncle Sam – catches a cold.” Of course, China is not our only trading partner, and retaliation from it and our other trading partners overall would likely offset the recent fiscal stimulus from the tax cuts, impact business and consumer confidence, and materially impact U.S. economic growth. Moreover, if the cost of the tariffs is passed on to consumers, inflation could accelerate, which has implications for interest rates and Fed policy.

How severe a cold?

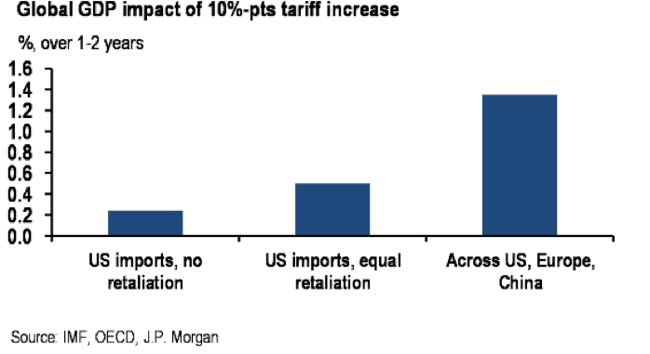

Quantifying the impact of a trade battle on the global economy is a difficult task, but J.P. Morgan has taken a stab at it. Figure 2 below shows three scenarios: tariffs on U.S. imports with no retaliation, tariffs on U.S. imports with equal retaliation, and the entire world raises tariffs (a global trade war).

Scenario one seems unrealistic – in fact, we’re now past that point already. Under scenario two, equal retaliation, the impact on global growth is estimated to be 0.4%, which is significant. The IMF estimates that global economic growth in 2018 will be 3.9%, so a reduction of 0.4% would cause growth to decline to 3.5%. Under scenario three, the worst-case scenario – an outright global trade war – global growth would be reduced by 1.4%, from 3.9% to 2.5%. That would be a bad cold indeed.

The art of the deal

While a global trade war would clearly be bad, and despite escalating tensions at the moment, we think a trade war will ultimately be avoided. We view President Trump’s stance as a negotiating tactic. Trump and his advisors argue that tariffs are necessary to pressure China into abandoning unfair trade practices, especially the theft of intellectual property and requiring American companies to hand over technology. It’s clear that negotiations have not worked so far. After three rounds of negotiations between the two sides, which included a Chinese pledge to significantly increase purchases of American products, Trump decided to go ahead with the tariffs anyway. For Trump, this is the “art of the deal” – a show of strength to drive a hard bargain. But we think a deal will ultimately be struck. It’s encouraging that the Chinese are willing to negotiate and have shown a willingness to make some concessions. As the economic pain intensifies for both sides, and the political fallout of a trade war becomes clear, we think the parties will eventually return to the negotiating table and an agreement will be hashed out. In the meantime, the art of the deal is likely to continue to roil global markets until the dust finally settles. But when it does, we expect the global synchronized expansion to continue. With U.S. GDP growth likely to accelerate from the tax cuts, and global GDP growth approaching 4%, driving strong corporate profit growth, we should see both U.S. and international stocks head higher over time.

Fixed income positioning: A shift to quality

Shifting gears, let’s touch on the fixed income markets and our positioning there, especially in this environment of rising inflation and interest rates, a flattening yield curve, and a decline in the bond market year-to-date. Our fixed income strategies – with a shorter duration than the bond market, an orientation toward credit-oriented strategies, and some exposure to below-investment-grade securities (e.g., floating-rate bank loans) – have fared well versus the market year-to-date. With the rise in short-term yields making short-term Treasury notes suddenly more attractive, for our non-taxable strategies, we are shifting some of our exposure in that direction by buying two-year Treasury notes. Also, with increasing flows into bank loans and collateralized loan obligations driving up prices and driving down yields, coupled with a reduction in credit metrics (e.g., an increase in covenant-lite loans and loan-only companies), we have decided that now is a good time to increase the credit quality and liquidity of our fixed income strategies by shifting out of funds that own bank loans and into funds that own floating-rate investment-grade corporate bonds and other higher quality securities such as variable rate demand notes and other short duration securities.

Crisis = danger + opportunity

Shifting back to the topic of a looming global trade war and its impact on the global economy and stock market, while we expect more volatility in the short term, due to the escalation of trade tensions, we think things will eventually calm down as the trade issue is ultimately resolved. Once that resolution occurs, we expect global stocks to resume their march higher over time, driven by continued solid global growth. Accordingly, we are sticking with our international investments for now, and may even add to them opportunistically on weakness. We’re the first to admit that sitting on the brink of a global trade war, we’ve entered “parts unknown.” But, as many observers have noted, the Chinese character for “crisis” is said to be composed of two characters: “danger” and “opportunity.” On the other hand, some expert sinologists reject this claim, noting that this is an inaccurate characterization that has become common in the world of business and pop psychology. Whatever the case, we think this looming crisis, while posing some danger for sure, may also contain the seeds of opportunity, and we will seek to take advantage of that opportunity should it unfold.

Bun cha in Hanoi

In assessing the escalating trade tensions and the possibility of a trade war, the natural tendency would seem to be to pull in your horns – stay local, don’t invest abroad, and avoid the unfamiliar and exotic. We think this is the wrong strategy. Remember, 95% of the world’s population lives outside the U.S. Remember, two-thirds of the world’s companies by market capitalization exist outside the U.S. Remember, the emerging market economies are growing much faster than ours. Remember, the “greatest growth story ever” – the rise of the middle class in China and India – is already unfolding. Remember Anthony Bourdain, who brought the world closer together and made the unfamiliar feel familiar. I’ll be thinking of him as I embark on a vacation to Vietnam this summer. I plan to visit a small café in Hanoi – the same café that Bourdain and Obama visited – to try “bun cha,” the quintessential Hanoi dish of grilled pork over rice noodles with fish sauce. I will have definitely entered “parts unknown.” But thanks to Tony, it will already feel familiar.

As always, we appreciate your trust in us as stewards of your wealth, and we thank you for your business. Should you have any questions, we invite you to call or schedule a meeting with your First Foundation Wealth Advisor.