Many of you might remember a time when credit card and ATM receipts were processed with a “knuckle buster” machine that produced a carbon copy by-product of your receipt. These carbon copies usually found their way into the trash and were easily accessed by thieves seeking to steal your identity.

The by-product of these machines became such a common security concern for anyone using plastic to pay for goods at retailers or meals at restaurants, that the card industry along with retailers would remind you to rip up your receipts.

And this malicious activity continued for years, but was deemed to be over when the card industry went digital. Gone were the knuckle buster machines and gone were the carbon copies of your receipts. But as the industry evolved, so did the criminals. Their new preferred method of heist has to do with recording your transaction using a device called a “card skimmer.”

Anywhere a credit or debit card is accepted, a card skimmer can be installed. And buyer beware: those fancy EMV chips that have made their way into cards lately do not protect the card; rather they provide another place of storage for your information – more data the criminals can steal. EMV chips and magnetic strips contain the same information and can be read by a device made to look like a part of an ATM or gas pump.

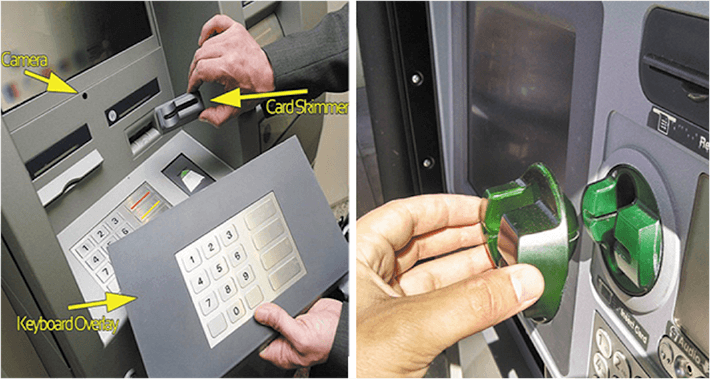

Given that the goal is to get your card information and PIN, a video camera or keyboard-recording device is installed to record your PIN or zip code. These devices are tough to spot for untrained eyes, so below are a few tips, and photos, to ensure you can identify a compromised machine.

How do you spot a skimmer and reduce your risk of card fraud?

- Look at the card slot carefully; skimmers are meant to blend in but can be identified if you look carefully enough.

- Touch the card reader; the skimmer is not securely fastened to the device and can be pulled off – give a tug!

- Check the keyboard; fake keyboards, like card skimmers are not securely fastened.

- Use fuel pumps and ATMS in safe places and avoid dark areas with little traffic.

- Cover the keyboard with your hand when entering your PIN or zip code.

Fraudsters take advantage of low traffic, secluded locations which provide them the best chance of installing a card skimmer and camera or keyboard reader. Your best protection is to be aware of the device you are about use and the immediate surroundings, and possibly use cash if applicable.

Besides a card skimmer, cameras and keyboards may be installed to get your PIN.

ATMs and gas pumps are the common targets for card skimmer attempts but grocery store checkouts have been victims.

All this card skimming activity has made national headlines, so there are now a plenty of resources available to help keep you informed. Also, it is interesting to note that the Wall Street Journal published an article a few years ago about the return of the once-ubiquitous “knuckle buster.” Read more about it here.

Hopefully this cyber security tip keeps you and your financial information safe from the criminals.