Welcome to our financial education resource, covering key topics in financial services, including terminology, trends, and strategies shaping the investment and banking industries. We have developed this resource to empower you to make informed decisions about your finances and be better prepared when working with your advisor and/or banker.

During the global financial crisis in 2008 and 2009, central bankers made significant efforts to limit the impact of the ensuing Great Recession. The Federal Reserve (“Fed”) instituted policies to promote stability, some of which were expected, and others that were unique if not unconventional. By many observations, the recovery that followed has been slow, but nonetheless has persisted. We now enter a phase where it is necessary to unwind some of the strategies that had been implemented. Much of the focus of this unwinding process is, and will be, on the Fed reducing its overly accommodative monetary policy.

Let’s First Address… What Exactly Is Quantitative Easing?

The Federal Reserve functions to promote the effective operation of the U.S. economy, to foster maximum employment, stable prices, and moderate long-term interest rates.[i] In order to accomplish that goal, the Fed primarily influences the raising or lowering of the federal funds rate – the rate where banks lend overnight funds to other banks. Following the U.S. financial crisis, the Board of Governors of the Federal Reserve lowered the fed funds rate to promote stability and ease tight conditions. In 2007, the fed funds rate began the year at 5.25%; however, by the end of 2008, the rate was zero.[ii] Despite this effort, the U.S. economic recovery at that point remained tenuous. Concerned that deflationary expectations and significant contractions in credit would diminish a recovery, the Fed needed another way to signal to the markets that it wanted to hold rates down and allow economic growth. The signal the Fed chose was to direct the FOMC to pursue what has been referred to as quantitative easing (“QE”).[iii] Technically speaking, quantitative easing is when a central bank goes from targeting interest rates to targeting the quantity of currency in the banking system.[iv] In late 2008, in order to lower borrowing costs and ease credit conditions in the housing market, the Fed embarked on a program of large-scale asset purchasing (“LSAP”), or targeting increased currency supplies instead of solely interest rates.

How Large Was the Asset Purchasing Program?

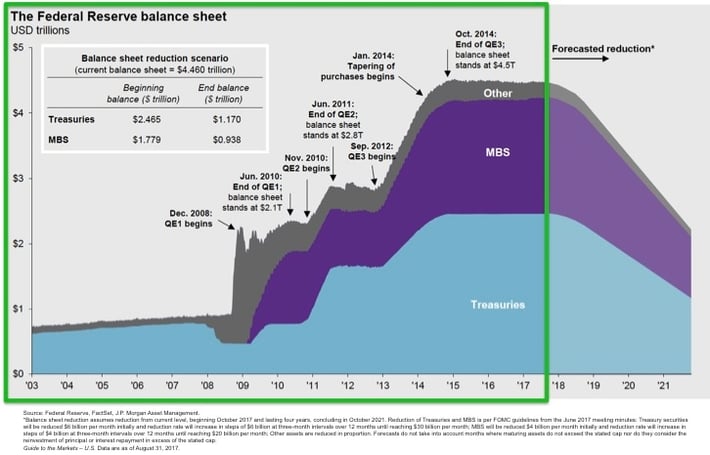

In the beginning of 2008, the Federal Reserve’s balance of assets was near $900 billion.[v] However, in late 2008, the Fed began purchasing on a large scale (hence the term LSAP) both Treasuries and Mortgage Backed Securities (“MBS”), dubbed QE (in hindsight, QE1). This was followed by another buying program in November 2010, not surprisingly called QE2. Finally, in late 2012 and on into 2013, the Fed directed a third round of significant asset purchases, or QE3. By purchasing Treasuries and MBS, the Fed’s balance sheet increased substantially, placing more cash “in the system”. This effectively held longer-term interest rates lower with the goal of supporting economic activity, growth, and overall confidence. The aggregate of the three rounds of QE increased the Fed’s balance sheet to approximately $4.5 trillion (see Figure 1); four times what it was in 2008.[vi]

Figure 1.

Normalization of Rates and the Balance Sheet

According to many, the buying program supported the recovery and helped to avoid a depression.[vii] Other observers have questioned the impact of the Fed’s measures on the economy. But, whatever the actual impact of QE, now with the economic recovery fully buoyed, there are risks of overextending the buying program. The risks could be twofold: 1) risk assets, including stocks and real estate, could continue to appreciate and overheat, and 2) the Fed might not have the ability to stimulate the economy during the next economic downturn. This brings us to the point of “monetary policy normalization” (the term used for raising the fed funds rate and lowering the assets the Fed holds).

The Fed is already underway to normalization in terms of raising the fed funds rate. It hiked the rate for the first time in seven years in December of 2015. It has increased rates three times since, and it (the target rate) now stands between 1.0% and 1.25%.[viii] The next stage will be decreasing the balance sheet, which has been hinted at for some time, but first formally announced in June of this year.[ix] At the most recent Fed meeting on September 20, 2017, the Federal Reserve announced that effective this October, it plans to gradually reduce its securities holdings.[x] Holdings will be reduced by purchasing at lower levels than before. For Treasury securities, the Fed will lower purchases by $6 billion per month initially and gradually increase in steps of $6 billion until reaching $30 billion per month. As for MBS, the cap will be $4 billion per month initially and will increase in steps of $4 billion until reaching $20 billion per month.[xi] (See Figure 2). Since the Fed will still be buying securities, just in lesser quantities, one market watcher has suggested the approach is like “cutting back from three desserts to just two”.[xii]

The FOMC believes this lower level of purchase/repurchase will remain in place until things are back to “normal”. In their view, this means holding “no more securities than necessary to implement monetary policy efficiently and effectively.”[xiii] Presumably “efficiently and effectively” means the ability to raise or lower rates given underlying economic conditions, as well as asset purchases or sales to influence reserves. Also note that this is being labeled a period of “normalization”, versus the language of tightening, even though the process is similar.[xiv]

Figure 2.

The Impact of Normalization

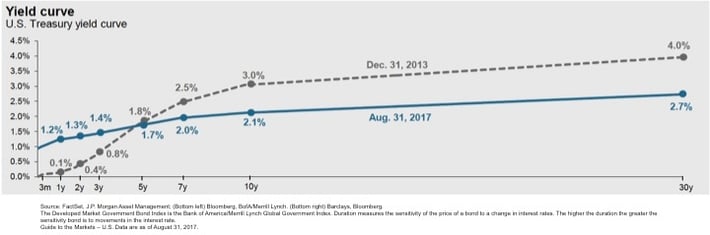

As was mentioned earlier, the Fed is both raising rates and beginning to end QE. The tapering of the QE programs essentially serves to make monetary policy less accommodative. The yield curve represents the yields on various maturities, in this case, of Treasury securities. The curve changes due to many variables, one of them being the fed raising rates. In addition, the various rounds of QE had the effect of holding longer-term rates down by about 1%.[xv] As shown in Figure 3, since 2013, shorter maturities have increased in yield, while the longer maturities have actually decreased.[xvi]

Figure 3.

We expect that as the Fed continues to raise rates, shorter term yields will continue to rise. Also, as the Fed lowers its purchasing levels of Treasuries (and MBS), the longer dated maturities will have greater supply and less demand. This could have the potential to place upward pressure on yields. Keep in mind, that while this would be good news for income investors, it isn’t as positive for total return, as yields tend to move in the opposite direction of prices (in this case, down). There are many other potential factors that could influence the yield curve, such as foreign demand given that international rates are even lower than our own.

We will continue to monitor the implications to the market and investment portfolios surrounding the actions of the Fed. One key will be how well they continue to communicate and “telegraph” their actions and intentions. Thus far, the Fed has been transparent in the process they will take to unwind the QE program. But any uncertainty, perceived or real, could have the potential to increase volatility in Treasuries and the fixed income market as a whole. Cutting back from three desserts to two is one thing; cutting out desserts altogether is quite another.

Feel free to reach out to your First Foundation Advisor if you have any questions about how to best plan for upcoming market and economic events.

[i] https://www.federalreserve.gov/aboutthefed/files/pf_1.pdf

[ii] http://www.fedprimerate.com/fedfundsrate/federal_funds_rate_history.htm

[iii] “Quantitative Easing: Lessons We’ve Learned”. Fawley, Brett W. and Juvenal, Luciana. The Regional Economist, July 2012

[iv] Id.

[v] Pan, Lance, CFA. Capital Advisors Group. “Fed Balance Sheet Normalization”, June 2017.

[vi] https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

[vii] https://www.stlouisfed.org/publications/regional-economist/january-2014/the-rise-and-eventual-fall-in-the-feds-balance-sheet

[viii] https://www.thebalance.com/fed-funds-rate-history-highs-lows-3306135

[ix] https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm

[x] https://www.federalreserve.gov/newsevents/pressreleases/monetary20170920a1.htm

[xi] https://www.federalreserve.gov/monetarypolicy/policy-normalization.htm

[xii] https://www.pimco.com/en-us/insights/economic-and-market-commentary/global-central-bank-focus/the-fed-balance-sheet-and-the-taper-tantrum-that-aint-yet

[xiii] Id.

[xiv] https://www.nuveen.com/Home/Documents/Default.aspx?fileId=52960

[xv] “Quantitative Easing: Lessons We’ve Learned”. Fawley, Brett W. and Juvenal, Luciana. The Regional Economist, July 2012.

[xvi] FactSet, J.P. Morgan Asset Management