Even the Romans had a name for this type of market. Investor anxiety, it seems, is an ancient phenomenon.

Cogito ergo sum. Habeas corpus. Carpe diem. Bona fide. Caveat emptor. Semper fidelis. Redit levitas. All famous Latin phrases. Wait…redit levitas? OK, so maybe that one isn’t among the most recognizable Latin phrases. But I suspect had you been an investor during the Roman Empire, you would certainly be familiar with it. It means “volatility returns.” After the unprecedented calm of 2017, the much-anticipated volatility has finally arrived – and with a vengeance! Investor behavior has suddenly become anxious, agitated, and erratic. The stock market has become tumultuous. Like an airplane in a storm, the market has hit some serious air pockets, plummeting suddenly, only to subsequently regain altitude. The chart of the VIX – the volatility index – looks like a Michael Flynn polygraph. Remarkably, the stock market has experienced two 10% corrections already this year – and it’s only April! What’s going on? Why the sudden shift in sentiment? Is this renewed bout of volatility a cause for concern?

Not fun…but normal

First, we should point out that volatility is a normal characteristic of bull markets. It’s definitely not fun. It’s unsettling, to say the least. But, as most investors know, it comes with the territory. The statistics tell the story. We’ve mentioned them before, but they bear repeating. On average, there are at least three 5% pullbacks per year, even in years when the market ends the year higher. And, on average, there is at least one 10% correction – again, even in years when the market ends higher.

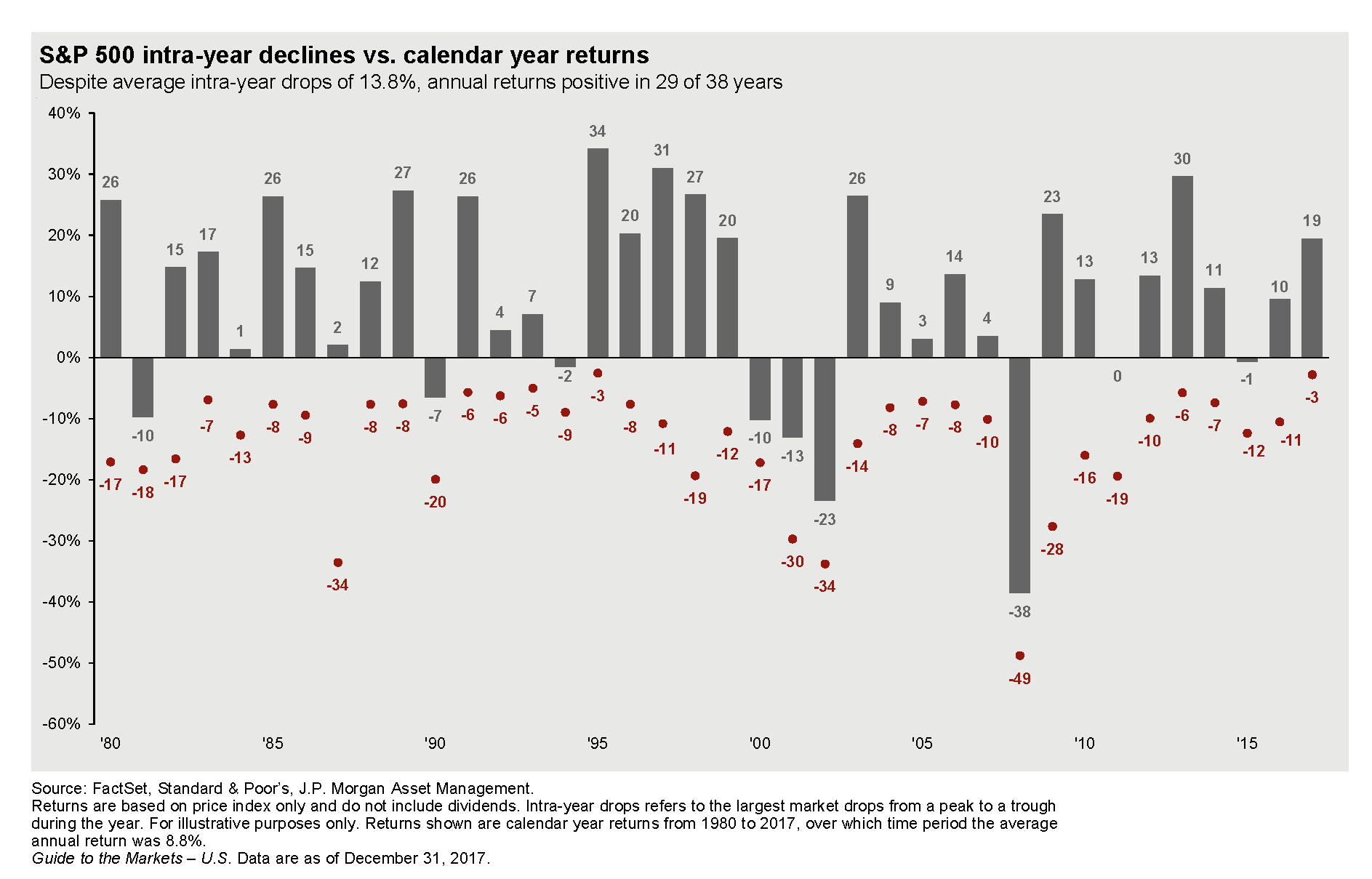

Figure 1.

Figure 1 illustrates how common stock market gyrations are. It shows the annual returns and intra-year declines for the S&P 500 historically. What you’ll notice is that for every year that the stock market ended the year higher, it typically had an intra-year decline of at least 5%, and often a much larger decline, frequently in the double digits. Last year was a notable exception, as was 1995. In both of those years, the market ended the year with a gain, while the intra-year decline was less than 5%. But take, for example, 2009, 2010, 2011, 2012, 2015, and 2016. In each of those years, the market declined by 10% or more before finally ending in positive territory by year-end. As you can see, 10% corrections are not unusual. They’re not fun, but they’re normal.

Like taking medicine

One thing that makes the corrections we’ve had this year unusual is how quickly they have occurred, and how quickly the market has subsequently rebounded. Market corrections, and the recoveries that follow, are typically drawn-out affairs. They happen not over days and weeks, but rather over months. This time, with gut-wrenching drops of as much as 1,500 points for the Dow Jones Industrial Average and quick recoveries – sometimes even in the same day – the stock market has been on a wild roller-coaster ride. I’m not sure what’s worse – a quick correction and recovery, with nausea-inducing intra-day volatility, or a somewhat longer and drawn-out correction and recovery. Maybe corrections are like taking medicine – better to get it over with quickly, even if it’s an unpleasant experience.

Investors on edge

Investors seem nervous, edgy, even agitated. What’s behind the sudden change in market psychology? Such a shift seems strange when the economy still looks like it’s in great shape. For example, GDP growth in the fourth quarter was revised upward to 2.9%. First-quarter GDP growth is expected to moderate somewhat to 2.3%, but most economists expect it to accelerate during the year, driven by consumer and investment spending from the tax cuts, resulting in even stronger GDP growth of 3.0% for 2018. The labor market remains healthy, with still-strong job growth and an unusually low unemployment rate of 4.1%. Not only is the U.S. economy hitting on all cylinders in its recovery from the financial crisis and Great Recession, but virtually every economy around the world is expanding as well. We’re experiencing what economists call a global synchronized expansion, which simply means that every region around the world – from the U.S. to Europe to Japan to Latin America to Asia – is growing. With such a favorable economic backdrop, what could possibly be causing anxiety among investors? The shift in investor psychology can be attributed to essentially two things: worries about the possibility of accelerating inflation (and hence rising interest rates) and the potential for a global trade war. Let’s explore these issues in greater depth, starting with inflation.

The last piece of the puzzle

Inflation remains subdued, with core CPI in March running at 2.0%. The Personal Consumption Expenditures (PCE) Price Index is tracking at 1.8%, below the Fed’s target of 2.0%. What rattled investors initially, triggering the first 10% correction back in February, was a better-than-expected wage growth figure. Why was this one figure so significant that it caused a market rout? Wage growth has been the missing piece – the final piece – of the recovery puzzle. Virtually every other economic indicator has recovered – from GDP growth to jobless claims to the PMI to durable goods orders to personal income to consumer spending to retail sales to…well, you name it…except wage growth. Corporate profits have recovered nicely since the downturn as companies have focused on cost-cutting, which has driven margin expansion, as well as stock buybacks and dividend increases. Companies have been able to get by with producing earnings growth by simply tightening their belts and engaging in financial engineering. But now, with the labor market having recovered, and tight labor market conditions with very low unemployment, wage growth is beginning to move up as companies have to compete to hire and retain workers. Rising wage growth was a signal to some investors that the final piece of the puzzle was in place – and hence the recovery was complete. Now, with rising wages, investors are worried that previously subdued inflation might suddenly heat up. We might even see runaway inflation. And runaway inflation means the Federal Reserve is behind the curve. It would have to raise interest rates at a much-faster-than-expected clip, which is bad for bonds and other income assets – and even risk assets in general, including stocks. At least that was the thinking back in February…

Welcome to the new market environment

A 10% correction in the span of a few weeks seems awfully drastic for a single, slightly better-than-expected wage growth figure. As it turns out, there is more to the story. The wage growth figure was the catalyst for the initial selling, but the selling pressure was exacerbated by what you might call “structural factors” characterizing the market. With volatility at historic lows last year, a number of investors had taken a “short volatility” position, by owning so-called inverse volatility exchange-traded funds (ETFs) and exchange-traded notes (ETNs). When volatility finally showed up, initially triggered by the better-than-expected wage growth number, it caused these investors to redeem their positions in the ETFs and ETNs. This, in turn, caused additional selling pressure, leading to a self-fulfilling downward spiral.

Investors in these funds were hit hard by the reversal in volatility. Consider the VelocityShares Daily Inverse Short-Term ETN sponsored by Credit Suisse. A day after the VIX had its largest one-day increase of 115.6%, Credit Suisse announced it would be shutting down the fund. The fund, which had nearly $2 billion in assets, declined 96% in a single day, prompting the issuer to redeem the fund earlier than scheduled. Similarly, the ProShares Short VIX Short-Term Futures ETF, which had $2.2 billion in assets, suffered a decline of 96.1% the same day, although its sponsor, ProShares, announced it would keep the fund open, despite the sharp decline. Just to be clear, we didn’t own either of these funds, nor have we invested in any short volatility strategies like them.

The unwinding of these short volatility ETFs and ETNs, combined with the short volatility strategies of other investors – quantitative investors, algorithmic traders, momentum investors, commodity trading advisors (CTAs), managed futures funds, and risk parity funds – further exacerbated the selling pressure. This is how a legitimate concern about a single, modestly negative economic indicator can translate into a 10% correction in a very short time. This is likely why the market has gyrated so wildly, with such large intra-day swings. Once the dust settled and all the short volatility investors had exited their positions, the market was able to finally find an equilibrium, and eventually we saw a rebound as investors realized the selling was overdone and out of proportion to the economic fundamentals. Welcome to the new market environment, where complex derivatives-based ETFs and ETNs, and other complex quantitative investment strategies, can exacerbate price swings well beyond what’s justified by the economic data.

This new environment is a bit unsettling, to be sure, and requires some getting used to. This is not your father’s stock market anymore. Our suggestion is to be aware of these new structural factors that are impacting the market, be prepared for more volatility than usual (rather than less, like we saw in 2017), and settle in for what could be a bit of a wild ride at times. We would encourage you to do what we do: Focus on what really matters – the economic data, not the price swings, which are often a reflection of these structural factors rather than the true economic fundamentals.

But what about the economic data? Are rising wages indicative of potential runaway inflation and interest rates? We think not. In our view, the modest increase in wages is merely a sign of an economy that has finally recovered and is now healthy. We expect wage growth and inflation overall to continue to rise, though gradually and modestly. And, as a result, we expect interest rates to continue to rise as well, though also gradually and modestly. There is no question the labor market is tightening and wages are bound to go up somewhat. But we think there are enough deflationary forces in the world – including globalization, the economic slowdown in China and other emerging markets, demographics (the aging population in the developed world), and technology – to keep inflation in check. We have positioned our clients’ portfolios for rising inflation and interest rates, even though we expect both to rise only gradually and modestly. And, rest assured, we will be watching carefully for signs that inflation is heating up. Although we don’t think runaway inflation is likely, it’s a scenario we include in our planning process.

Bellum artis

Speaking of the Romans, international trade was a common feature of the Roman Empire. The Romans crisscrossed the Mediterranean, trading with Spain, France, the Middle East, India, and Africa. They exported cereals, wine, and olive oil and imported precious metals, marble, and spices. Although the Romans were largely free traders, portorium – customs duties and tariffs – were levied on imported goods. Bellum artis – a trade war – was a relatively uncommon phenomenon in the time of the Roman Empire. Basically, when the Romans sought to expand their empire, they simply engaged in outright war rather than a trade war. Why slap a tariff on imports when you can just conquer your trading partner instead?

Today, tariffs and trade policy are on everyone’s minds. President Trump’s announcement of the imposition of tariffs has stock market investors rattled. In March, Trump initially announced tariffs of 25% on steel and 10% on aluminum, while promptly exempting Canada, Mexico, and Australia. He later announced tariffs on an additional $50 billion worth of goods. This was followed by a tit-for-tat announcement by China that it would levy 25% tariffs on 106 U.S. exports worth $50 billion. Trump upped the stakes further by instructing his U.S. trade representative to consider an additional $100 billion in tariffs on Chinese goods. While these numbers seem high – $50-$100 billion – they’re actually relatively small compared with the size of the overall economies of the U.S. and China. As a result, the impact of the announced tariffs on the overall economy, at least so far, is likely to be relatively minor. What has investors so worried is not the announced tariffs per se, but rather that they could possibly lead to a global trade war.

A global trade war would likely have a significant impact on the U.S. economy, with some estimates indicating that, in an extreme scenario, it could lower economic growth by 25% per year and raise inflation by nearly 50%. This means that if the economy is growing at 3%, it would slow to 2.25%. If economic growth moderates to 2.5%, a global trade war could cause a further slowing to 1.8%. It seems safe to say that a global trade war would easily wipe out any benefit from the tax cuts. And with inflation running at around 2%, a global trade war would potentially increase it to 3%. Suddenly inflation becomes a more serious threat. The biggest loser in a global trade war is the U.S. consumer. With consumer spending representing close to 70% of U.S. GDP, a global trade war would have a significant impact on the main driver of U.S. economic growth.

While these extreme scenarios seem dire, we think a global trade war is unlikely. We think President Trump’s protectionist stance on trade is merely a negotiating strategy, designed to bring the parties – namely China, but other trading partners as well – to the bargaining table, and to extract as much benefit from trade negotiations as possible. We think China, as a rational actor that wants to prevent its economy from slowing further, is likely to make some concessions, thereby avoiding the outbreak of a global trade war. The U.S. is reportedly already engaged in behind-the-scenes talks with China on trade policy, which is a good sign. In short, we think the turmoil surrounding trade policy will get settled eventually, and we may end up with healthier trade relationships with our trading partners, especially China. However, in the meantime, we expect trade tensions to continue to contribute to market volatility.

We think the recent market volatility is more about investor psychology than about economic reality. Inflation seems certain to rise as the economy continues to recover, but we think it will rise gradually and modestly. Trump’s protectionist stance is worrisome in that it could trigger a global trade war, which would have a significant impact on economic growth and inflation, but ultimately we think the parties will work things out at the negotiating table. However, in the meantime, expect continued market gyrations as investors grapple with news headlines related to both inflation and trade policy.

Stocks are no longer expensive

One bright spot in all this is that stocks are no longer expensive. At the end of last year, the S&P 500 traded at a price-to-earnings ratio of 18x, above its 25-year average. Today, after the market swoon, the S&P 500 trades at 16x, which is right in line with its 25-year average. Stocks are not cheap, but they’re no longer expensive. And assuming we avoid a global trade war and the benefit of the tax cuts kicks in over time, we think an acceleration in GDP growth and corporate profits will lead to a higher stock market by year-end. We expect and are prepared for more volatility in the near term, but we think the market will likely move higher over time, driven by accelerating economic growth and rising earnings.

International stocks still attractive

As we have mentioned on several occasions, we think international stocks represent a compelling opportunity. As the economic recovery expands beyond the U.S., international stocks should continue to benefit. Although international stocks rose sharply last year, they have not risen at the same pace as U.S. stocks since the end of the financial crisis. And unlike U.S. stocks, which are above their 2007 peak now, international stocks remain below their 2007 peak. As a result, we think international stocks have plenty of room for further gains. They’re also cheaper than U.S. stocks. Emerging-market stocks look especially attractive. We have initiated a position in emerging-market stocks in our asset allocation strategies and are looking to increase our allocation further over time.

Bonds face a headwind

Our view on bonds hasn’t changed much in recent months. With the expectation of rising interest rates, bonds clearly face a headwind. But with rates expected to rise only gradually and modestly, this is an environment that we feel we can successfully navigate. We continue to focus on segments of the bond market that offer attractive yields yet provide some insulation from the effects of rising rates. These include short-duration strategies, floating-rate bank loans, asset-backed securities, inflation-protected strategies, short-term high-yield municipal bonds, and other categories that share these same features.

As the Romans say, “Redit levitas!” “Volatility returns!” Times like these are not fun, but they’re normal. With the prospect of an accelerating economy, rising corporate profits driven by the tax cuts, modestly rising inflation and interest rates, and the likelihood that we will avoid a global trade war, we expect the stock market to head higher over time. But in the near term, we expect volatility to continue as investors deal with headlines related to inflation and trade policy. There are plenty of global macro issues – from the political chaos in Washington to the upcoming meeting between President Trump and North Korea’s Kim Jong-un to a possible escalation of the situation in Syria – that could contribute to market volatility as well. Rest assured that we will be carefully watching all these things and positioning our clients’ portfolios accordingly. We are guided by the twin principles of risk control: endeavoring to preserve and protect our clients’ hard-earned capital while growing it to help them achieve their goals and vision of the future.

Raising a goblet of fine Roman wine, we say, “Iubentium! (‘Cheers!’) Here’s to a hopefully calmer and prosperous rest of 2018!”

As always, we appreciate your trust in us as stewards of your wealth, and we thank you for your business. Should you have any questions, we invite you to call or schedule a meeting with your First Foundation Wealth Advisor.