Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

The resilience of the US stock market should be acknowledged. The S&P 500 is, again, nearing the year’s highs, despite numerous layoffs in many industries, two 25bps rate hikes by the Fed, and a seemingly nascent banking crisis. Companies have blamed an uncertain economy with rising interest rates for a string of layoffs that have reached the tens of thousands. Yet, this earnings season has painted a reasonably constructive picture, as 76% of S&P 500 companies (88) that have reported their earnings have above consensus estimates. Alas, there is a distinct disconnect between what people’ feel’ is happening to the economy and, by extension, the markets and what is ‘actually’ happening and being reported

S&P 500 revenue growth is slowing to the low single-digits from a year ago. It sported double-digit gains through 2021 and most of 2022. There are some signs of cracks, however. With the banking turmoil only recently unfolding, the impact the resulting tighter lending standards will have on businesses and the economy is still uncertain. Aside from economic and company earnings, we note that not a single Fed speaker last week opened the door for rate cuts in 2023, likely cementing market expectations for another 25bp rate hike at the May FOMC meeting. Among the FOMC participants, we noted some disagreement regarding the policy outlook beyond May, mainly predicated on: (1) how much progress has been made on inflation and (2) how policymakers should incorporate the impact of tighter credit conditions in the banking sector.

We believe the recent banking crisis has demonstrated the unintended consequences of a swift move to tighter monetary policy conditions. Hence, we expect central bank rates to reach their peak policy rates in the coming months and believe we are close to the end of this monetary cycle. We also think the market is ahead of itself in the timing of rate cuts. The market is currently pricing in just under two cuts in ’23; we doubt we will see any in ’23. Those disparities in viewpoints make markets, so only time will tell what comes to fruition.

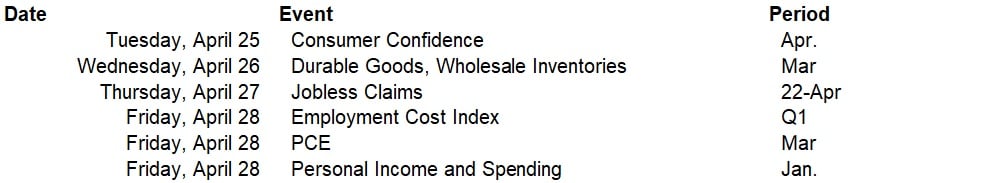

This week, we get the typical end-of-the-month data, including - durable goods orders, new home sales, personal income, spending, and a PCE (Personal Consumption Expenditures) inflation report. The primary focus for the week, though, is likely to be on the Employment Cost Index (ECI), as it will likely be a critical point in the Fed’s concerns over inflation. In addition to the economic data releases, this week is also a huge week for 1st Quarter earnings season, with 170 companies in the S&P 500 scheduled to report, including some of the index’s most significant companies: AMZN, GOOG, MSFT, META, V, XOM, LLY, MA, CVX, MRK, ABBV, and KO.

Data deck for April 22 - April 28: