4 minute read

A new year brings new opportunities to take advantage of to enhance your future financial success. In that regard, we want to share five quick planning ideas to kick off the new year.

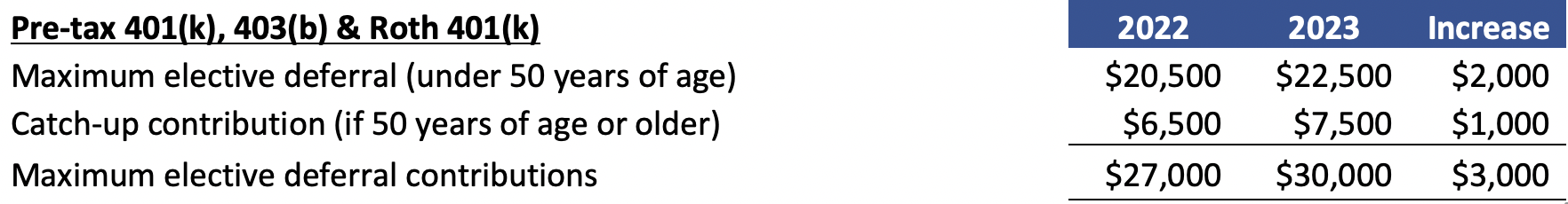

Increase your 401(k) contribution rate

Contributions to retirement accounts have increased significantly in 2023 due to inflation adjustments. Make sure to review your payroll contribution percentage now and adjust if you intend to contribute the maximum you are eligible for. The sooner you adjust your contribution percentage, the less you will have to contribute from each paycheck. The contribution maximums are as follows:

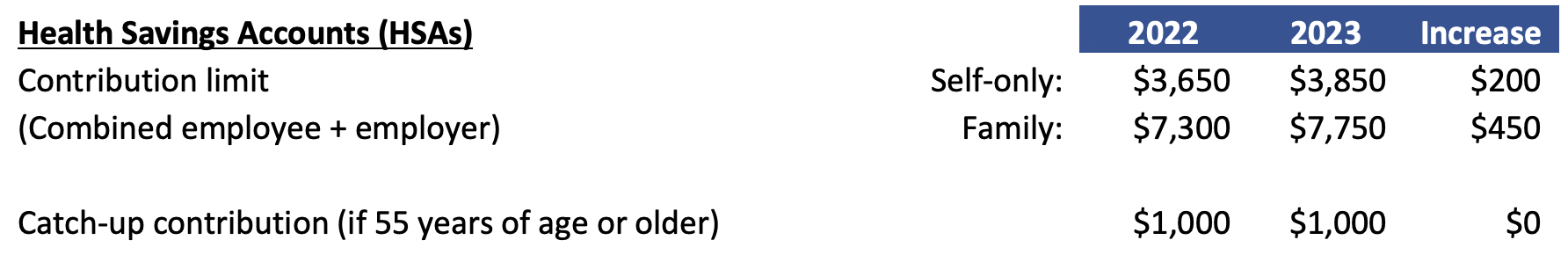

Adjust your Health Savings Account contribution amount

Similar to 401k’s the Health Savings Account (HSA) contribution limit was also increased due to inflation. Again, the sooner you adjust your contribution percentage, the less you will have to contribute from each paycheck. Don’t forget that these pre-tax contributions lower your taxable income. The contribution amounts as follows:

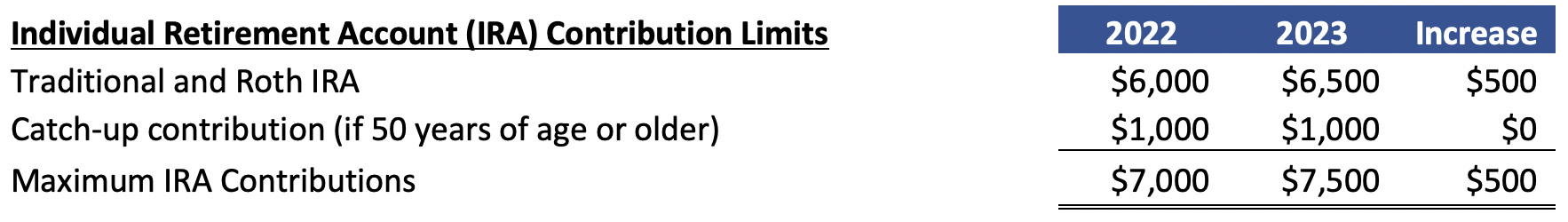

Make IRA contributions

You don’t need to wait until April 18th to make your deductible IRA contributions (or non-deductible IRA contributions if participating in another qualified plan). Making the contribution now (for example while the market is temporarily depressed), will theoretically allow those funds to earn more in that tax-sheltered environment. The contribution maximums are as follows:

Make annual exclusion gifts

The annual exclusion gift has increased this year from $16,000 to $17,000. This means that you can give heirs up to $17,000 each in a single year without incurring a taxable gift ($34,000 for spouses that split gifts). Making gifts now of assets that have dropped in value, will allow future appreciation to take place in the hands of your heirs. This may also help lower your taxable income for the year by shifting any income from those assets to your heirs which will hopefully be taxed at their lower tax rates.

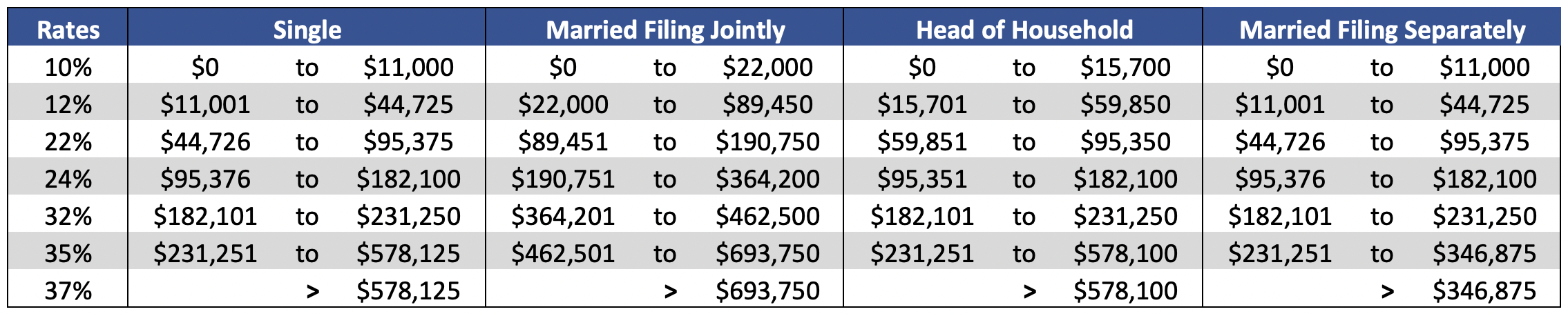

Check your withholding

Always a good idea to check on your withholding at the beginning of the year (especially if you’ve gotten a raise, or are incorporating the adjusted pre-tax contribution amounts described previously). Inflation may give you a slight tax break this year. Federal income tax brackets have been adjusted for inflation by approximately 7%. This means that if you were slightly into the next highest bracket in 2022, you could actually fall into a lower marginal tax bracket in 2023. For example, if you were married, filing a joint return in 2022 with $364,200 of taxable income, then you were in the 32% marginal tax bracket. In 2023, with the same amount of taxable income, you would now be at the top of the 24% tax bracket. So, not only would you drop into the next lowest bracket, but you would also get a reduction due to the inflation effect on the lower brackets as well. In this example, the total reduction in tax would be about $2,800! The revised 2023 tax brackets are as follows:

Note: Keep these inflation adjusted brackets in mind for later in the year if undertaking Roth IRA Conversion Planning. The implication from the increase in brackets means that you may be able to convert more dollars while staying in the same marginal tax bracket. For example, the top of the 24% tax bracket for married taxpayers filing jointly increased by $24,100. This increase allows you to convert an additional $24,100 without increasing your marginal tax bracket and subjecting this income to tax at the next highest tax bracket (which jumps to 32%).

If you would like to discuss these planning ideas further, please do not hesitate to contact us or your tax professional. After discussing your situation with us, there may be other planning ideas we can undertake early in the year as well. Here is to a prosperous year ahead!