Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Last week, the S&P 500 fell 4.5%. The early week testimony of Fed Chair Powell, which shifted market expectations towards a 50bp rate hike at next week’s March FOMC meeting and pushed up terminal rate pricing, seemed like old news as the developments at Silvergate and Silicon Valley Bank (SIVB) unfolded later in the week. Whiffs of 2008? Perhaps, though unlikely.

A liquidity problem rapidly morphed into a solvency issue when SIVB sold its Available For Sale (AFS) securities at a loss. This should not be a problem as banks can keep these securities on their books until maturity. However, with the surge in interest rates and many of the bank’s clients moving deposits out of banks and into higher-yielding alternatives - 5% Treasuries come to mind - a severe asset/liability funding mismatch was created. A failed capital raise late in the week foreshadowed the bank’s fate. SIVB, while not small, was not Too Big To Fail, and they are not unique in that sense. However, banks are not the only walking wounded, as much of last year’s tightening has yet to be fully digested by the economy.

Small business formations exploded in recent years, given access to cheap capital. Despite headlines focused on large businesses that have already retrenched from hiring, small businesses have been slower to pull back meaningfully. Small businesses are often capitalized with bank loans and lines of credit, and the average rate that small businesses pay on bank loans has increased from roughly 5% to 7.6% last year. That rate is likely to rise to about 9.5% by mid-year. Based on Powell’s comments earlier this week, elevated loan rates will likely remain for an extended period. This creates significant pressure on small businesses and, in many cases, their lenders, who are now more dependent on small business cash flows and solvency that they underwrote in an environment of lower expenses.

The latest unemployment report showed that the number of people collecting benefits rose by 69k in the last week of February, the largest increase since November 2021. This occurred in a week when initial claims dropped, which implies that those who were already unemployed are having a more challenging time finding new jobs. Data indicate job losses are spreading from tech companies to manufacturing, transportation, and warehousing companies. Unless something changes, we believe they will also broaden from large to small businesses.

All in, this past week surfaced that the cumulative tightening delivered by the Fed thus far is finally starting to put the breaks on activity, and cracks are emerging. Financial stress and recession risks have again entered the spotlight, and there’s likely more pain in that pipeline. Small banks and other financial institutions with less sophisticated funding operations benefited from Quantitative Easing (QE) but, under a tightening policy, will continue to be vulnerable as they compete for deposits in more expensive funding markets. As small banks were not the only beneficiaries of QE, similar beneficiaries should also be on alert.

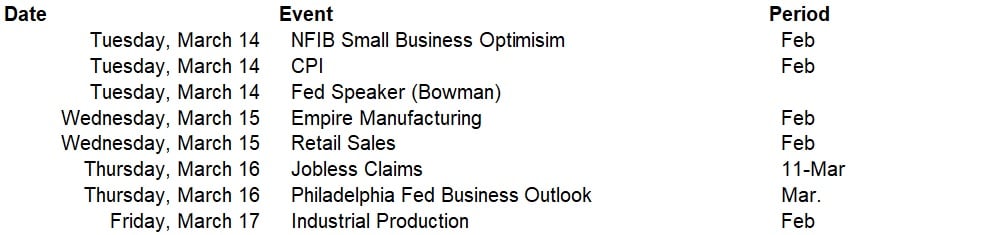

This week, the key economic data release will be the CPI report on Tuesday. We will also get the retail sales report on Wednesday and the Philadelphia Fed manufacturing index on Thursday before all eyes turn to next week and the March FOMC meeting.

Data deck for March 11 - March 17: