Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

A debt ceiling resolution, remarks from FOMC members, and a stronger-than-anticipated employment report paved the way for a nice week in equities last week, with the S&P 500 up 1.8%. The FOMC talk is perhaps the most interesting. Talk of a Fed “skip” at the next FOMC meeting has been permeating since the last FOMC meeting in May. However, comments from Fed Governor Jefferson and Philadelphia Fed Harker last week suggest the move has gained traction. Chairman Powell opened the door at the May meeting and made a case for pausing at the June meeting. Still, Dallas Fed President Lorie Logan, who favors raising rates in June, was the first participant to suggest she would entertain the possibility of skipping a meeting rather than pausing outright. With markets already expecting a pause in June and a 25bps rate hike in July, hints that the Fed could “skip” the June meeting and reassess the situation upon incoming data in July are in increasing abundance ahead of the Jun 14 FOMC meeting.

The idea is to wait to tighten in July because there will be more information about the banking environment and tightening credit conditions then. Even though Harker thinks more restraint will be necessary, tightening at every other meeting reduces the risk of overshooting. It gives the FOMC time to recognize its error and reverse course if it does overshoot. The idea has legs as policy works with a lag effect, and US economic data has continued to print surprisingly strongly. Last week’s most notable data point was the payroll release, which reported well over 300,000 new jobs last month, well ahead of expectations. That helped offset the reported weakness in the ISM manufacturing release, where new orders declined to the low 40s. The payroll data, while positive for the economy, exacerbates the tension that continues to exist in this market. The more resilient the economy, the more the Fed is likely to act to slow it down. Market pricing of future Fed policy has moved meaningfully higher in the past few weeks. At some point, that re-pricing of rate expectations represents a problem.

This week’s economic calendar is light. The highlights are the S&P Global PMIs and the ISM Services PMI, all on Monday. There will be no Fed chatter until the Jun 14 FOMC meeting.

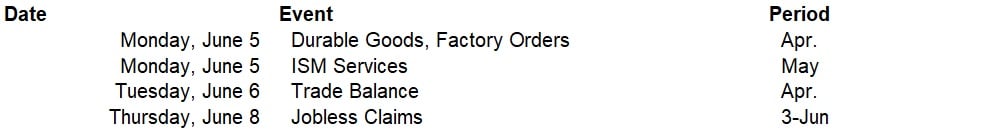

Data deck for June 3 - June 9: