Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

At the halfway mark of 2021, life is almost back to normal, and equity markets have experienced the second-best first-half year performance since 1998 (behind 2019) for the S&P. Not too shabby. However, the consequences of COVID are still with us. The Fed’s stimulus and bond-buying programs are barely different from a year ago, even though markets have more than recovered. We continue to believe that equity markets have further room to run due to a substantial economic and corporate earnings environment and ongoing stimulus programs. However, the remainder of the year will be a transition period as the Fed has already signaled it plans to shift towards less accommodative policies, and with transition comes volatility.

As we move through the second half of the year, the Fed will be transitioning from a crisis level of accommodation. Additionally, the pace of economic recovery is likely to be appreciably slower. The slowdown in economically sensitive sectors (Financials, Industrials, Materials, and Energy) and the decline in U.S. Treasury yields conveys that markets are already starting to discount this transition. During the previous incidence of tapering, equity markets initially had difficulty interpreting the Fed’s communication and stumbled. This time around, we think the Fed has more effectively prepared the markets for tapering; however, we would not be surprised by a 7-12% pullback. In our view, if markets are well-informed in advance about the tapering of Fed asset purchases and have clarity over future tax measures and programs, market disturbances related to the transition will be short-lived and should serve as an opportunity for apprehensive investors to more confidently scale into the markets.

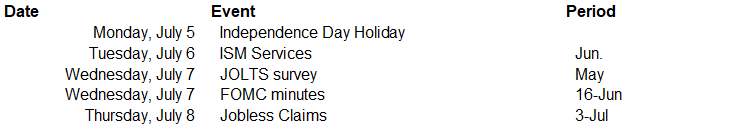

This week, only a few data releases are lined up, and much of the focus will be on the minutes of the June FOMC meeting. We expect the main focus will be centered on details about the discussion on tapering. The services ISM is expected to worsen in June, but remain quite elevated, consistent with strong growth as re-opening continues.

Data deck for July 3–July 9: