Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Equities were up over 2.5% last week amid a softer-than-expected inflation report. In the report, annualized growth in U.S. CPI slowed to 3.0% in June, an entire percentage point below the previous month’s pace, suggesting we might be nearing the end of the road for Fed tightening. Unfettered, however, several Fed officials have highlighted that they expect the Fed to continue with a hike next week and implied that markets should expect another hike later this year.

We see little reason not to heed Fed official commentary and to discount what the market is currently pricing. With wage inflation still growing well above 4%, we believe markets may be too quick to anticipate a pause after the projected 25bps hike next week. For instance, last week, Fed Governor Waller said he supports the Fed delivering two additional rate hikes this year, consistent with the FOMC dot-plot published in June. Notably, he implied that the second hike could come as soon as the September meeting.

Why would a Fed governor go to such lengths about prospects for raising rates when recent inflations reports show it is slowing considerably, and the economy has yet to feel the full effect of the hikes made so far? In our view, we observe mixed messages embedded in the employment data, in which data recently indicated that payrolls have declined, but the growth in average hourly earnings has not. Seemingly, the second part of the Fed’s dual mandate is starting to take the wheel, and employment has become more important than inflation, in what may at some point portend a duel of mandates.

This week will be dominated by earnings releases, with a second-order focus on the data front, where we await retail sales, industrial production, and several housing statistics (NAHB, housing starts, building permits, and existing home sales). While very early into the earning release calendar, the earning beat ratio is already tracking relatively high, with over 80% of firms beating EPS estimates and about two-thirds beating revenue estimates. Tellingly, that doesn’t appear to be enough to really move the associated stocks.

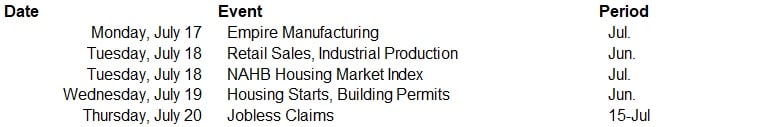

Data deck for July 15 - July 21: