Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Last week, equities struggled to find direction, posting gains one day only to be wiped out the next. By the time all was done, the S&P 500 finished the week up 0.8%, marking the first increase in the past four weeks. Fixed income markets were much the same, with US 10-year yields flirting near 4.3% multiple times only to close the week at 4.23%, 2bps lower than where it closed the previous week.

Much of last week was spent anticipating Fed Chair Jay Powell’s speech at the Jackson Hole Symposium. The speech did not evoke the fireworks some participants were angling for. Nothing new was mentioned, while the Fed Chair essentially reiterated earlier Fed talking points, retained maximum policy optionality, and stressed the uncertainty about the path ahead. It did not bring much comfort to either market; however, in our view, it delivered. Overall, the key takeaway is that the Fed appears to be fully committed to its 2% inflation target (pouring cold water on those suggesting a 3% target should be adopted), and, in the pursuit of 2% inflation, they are prepared to tighten policy further if needed. Powell also noted that while two months of good inflation data is a welcome development, more is required to build confidence that inflation is returning to target. He welcomed the slower pace of price gains amid tighter financial conditions and easing supply constraints.

Powell ended his speech with a statement and analogy that we think illustrates and underscores the current environment: “As is often the case, we are navigating by the stars under cloudy skies, we will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.” A similar framework was used in his 2018 speech, in which he voiced that navigating by the stars, while straightforward in principle, in practice, was quite challenging because one’s assessment of the location of the stars could change significantly. In our opinion, this is a subtle reference to the notion that current data is important until they are subsumed by other data points deemed more critical. What comes next remains unclear and will depend on the economic data ahead.

This week, we get a trio of important data points, including the July PCE inflation release, a fresh ISM Manufacturing Index, and the August nonfarm payrolls report. We believe payrolls and wages will be important gauges in assessing the data-dependent path for the FOMC’s September 20th rate decision, along with other data points on inflation, like the July PCE and August CPI inflation reports.

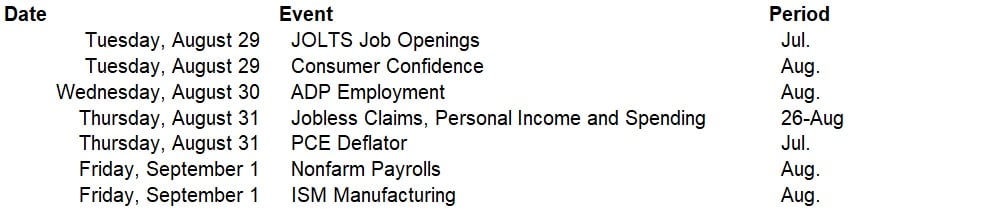

Data deck for August 26 - September 1: