Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

“Navigating the Decade Ahead” is the broad theme for this year’s Fed Economic Policy Symposium, traditionally held at Jackson Hole, Wyoming. This meeting has been of significant interest because many times it has been used as THE venue for presenting new monetary policy initiatives. The likelihood of a similar market-moving meeting, however, has likely decreased after the recent release of the July FOMC minutes this week.

While we’ve probably learned most of what we need to already regarding the Fed’s view on negative rates, inflation targets, and yield curve control, any commentary focused on asset purchases, additional lending, and/or liquidity programs could be of importance. For the past few months, the key discussion point for the Fed has been the importance of fiscal policy in holding up spending, investment, and the labor market until a vaccine or effective treatment is found. We expect this week’s symposium will be much the same.

As this past week saw economic data moderate globally, with disappointing PMIs in Europe and a higher than expected U.S. initial jobless claims report, the U.S housing market continues to exceed expectations. Existing home sales are now 8% above January levels while new housing starts are 7% below the pre-pandemic peak. With a shift toward remote work and historically low mortgage rates, there has been a healthy influx of prospective buyers in suburban areas. Looking ahead, however, the housing outlook depends on the labor market recovery. Bank lending standards for mortgage loans have tightened significantly, and the labor market recovery appears to be losing steam. People will need verifiable income to take the plunge into homeownership, and a weak labor market is likely to start cutting into the substantial gains we have thus far seen in housing.

All said, to navigate what’s ahead, the playbook seems to be a similar redux to that of the previous decade. The onus will be on policymakers to provide support to households and businesses that are struggling. A caveat is that, this decade, the liquidity and fiscal stimulus needed to turn things around have been many times greater than in the previous crisis, which seems to portend that global economies are not all that healthy as they continually need steadily increasing injections of stimulus to remain somewhat stable. As we have stated previously, we do not believe Equity markets represent what we see in global economies.

This week, we expect all eyes to be centered on the Fed symposium. Of the data to be released this week, consumer spending reports and jobless claims are of interest. Expectations are that spending likely slowed after huge gains in May and June, and that jobless claims are likely to show the effects of the Paycheck Protection Program (PPP) expiration.

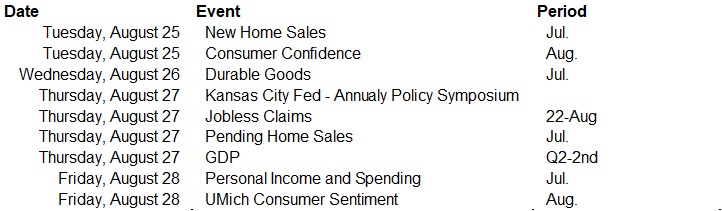

Data deck for August 22–August 28: