Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Despite taking a slight breather last week, U.S. equity markets have started 2021 much like they finished 2020, posting gains as investors overlook rising Covid-19 infections and instead focus on an anticipated economic rebound and additional fiscal stimulus.

The stimulus plan laid out by President-Elect Biden last Thursday had all the pieces expected: a round of $1,400 for individuals, a $400 per-week unemployment insurance boost through the end of September, and an increase in the federal minimum wage to $15 per hour. The proposal also extends the eviction and foreclosure moratorium until the end of September. It provides $350 billion in state and local government aid, $170 billion for education, and $70 billion for COVID testing and vaccination. The proposal is furthermore said to be the first phase of a two-part strategy, with a broader program focused on infrastructure and climate change to be unveiled in the coming weeks. Additional fiscal support will go a long way toward breathing new life into the economy. With control over both chambers of Congress, a new Treasury Secretary, and a President and Vice President who know how to work Congress, we’d expect most of this stimulus plan to get passed.

A unified government and prospects for further fiscal aid have also boosted the inflation outlook recently. However, despite some Fed governors’ comments to the contrary, the intensified focus on inflation won’t cause the Fed to dial back its accommodative policy. Fed Chair Powell brushed aside concerns about higher inflation last week and reiterated the Fed’s commitment to maintaining an accommodating monetary policy stance until the economic recovery is complete. Jay Powell noted, “Now is not the time to be talking about an exit.” With elevated unemployment levels and a full economic recovery still years away, we do not see any Fed policy changes on the horizon.

As we launch into 2021, we think it is worth highlighting that every single balance sheet – government, household, corporate – will be spending at the same time and have plenty of money to spend; this is extremely rare after a ‘credit shock.’ The promise of sustained stimulus (both fiscal and monetary), low rates, and an expected sharp bounce back in corporate earnings suggest that despite elevated valuations, equity markets have more room to run from here.

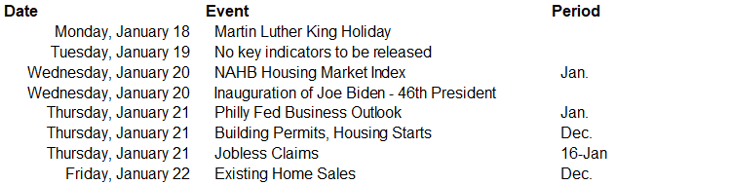

This week’s economic calendar is light, which means most of the focus will remain on the next fiscal package’s timing and size, and whether people will spend the money quickly or save it. Investors will also turn their attention to corporate earnings as U.S. markets reopen following Martin Luther King Jr. Day. Financial names will make up the bulk of the reports, with regional banks reporting alongside national institutions. Of the economic reports to be released this week, of greatest interest will be the Philly Fed survey for a glimpse on business sentiment and the updates on the state of the housing market.

Data deck for January 16–January 22: