Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Equity markets fluctuated near all-time highs this past week as investors assessed the last critical data point ahead of the upcoming FOMC policy decision. However, the primary dynamic at play has been the decline in the 10-year Treasury, which fell below 1.5%, the lowest since early March. The consensus seems to be that market expectations for inflation have eased as participants seem to have conceded that the Fed’s transitory view might be right after all. We believe other factors at play have affected rates markets – banks holding unprecedented reserves and reverse repo operations skyrocketing come to mind. We believe these other factors are temporary and continue to expect that inflation above 2% should beget higher bond yields.

In our view, the latest couple of nonfarm payroll prints haven’t been strong enough to challenge the Fed’s view of a weak labor market. Recent data has shown 9 million job openings, which by far is an all-time high. A Dallas Fed survey shows that the share of people laid off and say that they won’t return to the same job and pay has increased every month this year and is now as high as 31%. Thus, it seems people are leaving their jobs either believing they can get a higher paid one or maybe searching for a better quality of life. Whatever the reason, we believe this is an additional something that market participants are only beginning to consider.

The only times we have seen core inflation rise above 2% has been when job openings are rising. At present, the number of job openings in the U.S exceeds the amount of unemployed by a small margin. In addition, the percentage of openings vs. the total labor force is higher than the unemployed + discouraged as well. This type of dynamic is rare and consistent with periods of wage growth, which should allow for inflation to become more persistent, and allow the Fed to achieve their new inflation target that averages 2% over time. With higher wage income a likely prerequisite for sustained upward inflation, we believe recent data is unlikely to lead to monetary policy shifts in the immediate future.

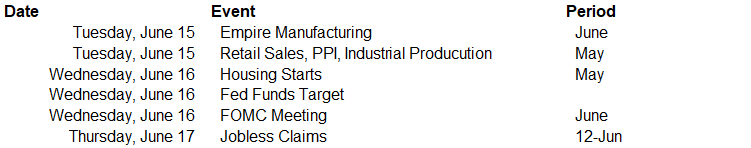

This week the focus will be on the FOMC meeting. While no change to the current level of monetary stimulus is expected, market participants will closely watch the post-meeting press conference for clues concerning the timing of tapering asset purchases. Other economic releases hitting this week include the empire manufacturing survey, industrial production, business inventories, and weekly unemployment claims.

Data deck for June 12–June 18: