Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Despite the coronavirus outbreak being increasingly acknowledged and addressed by businesses as a lingering issue, the U.S. stock market notched new highs during the week, with the S&P 500 gaining around 1.5% over the last 5 days and the NASDAQ up 11 of the last 13 trading days. With equities bouncing back to higher levels than the pre-virus sell-off, it is worthwhile to note the narrowness of the gains: half of the NASDAQ gain year-to-date has come from 4 companies, while the largest 5 companies now account for over 19% of S&P 500 market cap.

While equity markets seem to have set aside concerns over the coronavirus' impact and resumed their resilient run, global rates are now repricing to near-zero, which would historically imply a cyclical slowdown. U.S. Treasuries have been high in demand, with memories of the recession fears that plagued the markets last summer driving investors to the safety of government bonds. Interest rates are now the lowest they have been in all of human history going back 5,000 years, and the market is pricing in further potential cuts to provide support for global stocks should they stumble.

Essentially, there exists strong confidence that central banks will act as a safety net for markets and investors have been conditioned to treat shocks as “containable, temporary and reversible” said Mohamed El-Erian, chief economic adviser to Allianz. The implication has been to think of everything in the U.S. as a "safe haven." Treasuries, Stocks, and even High Yield Credit have all seemed to benefit amidst the coronavirus uncertainty, as the expectation of substantial monetary injections has continued to fuel sentiment and optimism.

While this "safe haven" sentiment is unlikely to dissipate anytime soon considering the headwinds other major economies are facing, how long before some of the other unknowns intensify investor angst (phase 2, elections, stretched valuations)? How much longer before central banks worry about continued excessive reliance on monetary policy? It's hard to say, but as divergences and weak spots have become apparent in global economic data, caution is warranted – even in “safe haven” U.S assets.

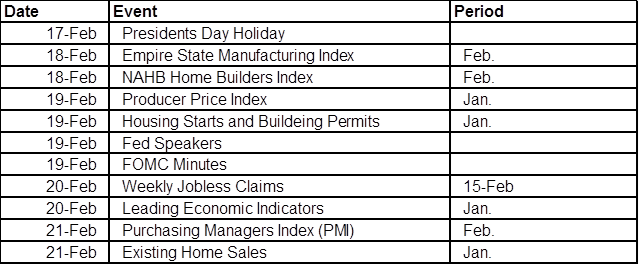

This week features a relatively light economic calendar and much of the focus will be on the index of economic indicators; last month's reading was the worst since 2016. We will also get a report on producer prices - measuring inflation pressures before they reach consumers, some housing market updates with reports on January housing starts and existing homes sales, and the Federal Reserve minutes from its January meeting.

Data deck for February 17–February 21: