Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Markets endured a volatile stretch last week, reacting to coronavirus fears, central bank intervention, and the resurgence of Joe Biden. As stocks toggled between sharp rallies and steep retreats, the heightened uncertainty has fueled a sharp rally in perceived safe-haven assets; 10-year UST yields below 1% and gold at nearly a seven-year high. A rare intra-meeting surprise rate cut from the Federal Reserve – the first time the Fed took action outside of a scheduled meeting since 2008, failed to stem equity volatility as market participants question just how deeply the economic repercussion will weigh on global growth.

Despite the afflictions of last week, this market experience is not new or novel. Fear and uncertainty are the greatest enemies of the market, and most markets tend to struggle when there is concern over contractions in the U.S. economy. Since the current expansion cycle began in 2009, there have been four growth scares; 2010, 2011, 2015-2016, and the second half of 2018. The declines during these growth scares ranged from 14.2% to 19.8% - Covid-19 coronavirus has so far led to a 12.8% fall in the S&P 500). Concerns around the coronavirus outbreak will probably continue to suppress investor sentiment for some months to come as the knock-on effects on global sales and earnings will be a long time coming. Additionally, the outbreak will likely push some weak companies to the brink. As U.K. airline Flybe learned this week, they should not expect to be bailed out; it is not the job of taxpayers to underwrite bad businesses and management teams.

We think there is more market volatility in store. However, we see this as an opportunity. Unlike the 2008 financial crisis, which saw a breakdown of the financial system, this epidemic is likely to have only a transitory impact on the global economy. Right now, virtually every company is curtailing travel and spending in some way. Almost everyone agrees that in all likelihood, these steps are an overreaction. Additionally, during the week of February 24th-28th, approximately $3.6 trillion in equity market value evaporated. For perspective, nearly $6 trillion in market value was added in the whole of 2019, the most in history. A year where equity markets gained approximately 30%.

Just a month ago, most market participants thought the macro outlook was uniformly favorable, and they had trouble envisioning a negative catalyst that could materialize. We believe there are valuable lessons to impart from this lookback. First, the catalyst for a market correction isn’t always foreseeable - it can seemingly appear out of thin air. And second, the effect of an unforeseeable catalyst is more significant when it collides with a market priced for perfection.

As the weather turns warmer in the northern hemisphere, we expect the immediate coronavirus concern will dissipate. This, if true, means there will be a window of opportunity if the number of reported cases of the virus takes off in North America in the next few weeks. Should another round of panic selling of equities ensue, be prepared.

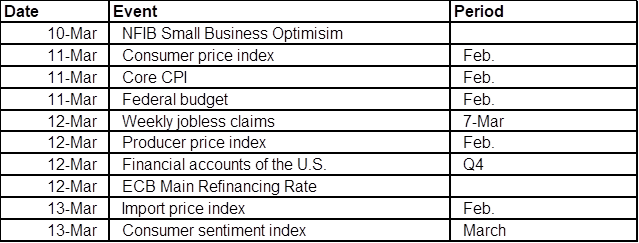

This week will offer a relatively light economic calendar, with the most notable releases being updates on inflation. Other releases include the NFIB small business optimism survey and the University of Michigan's gauge of consumer sentiment. In central bank news, the European Central Bank is widely expected to cut rates by 0.10% on Thursday, despite its benchmark rate currently in negative territory at -0.50%. In our view, rate cuts and QE will not do much to help at this juncture, but will likely increase the odds that we see a more substantial recovery once we are through the peak of the coronavirus.

Data deck for March 7–March 13: