Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

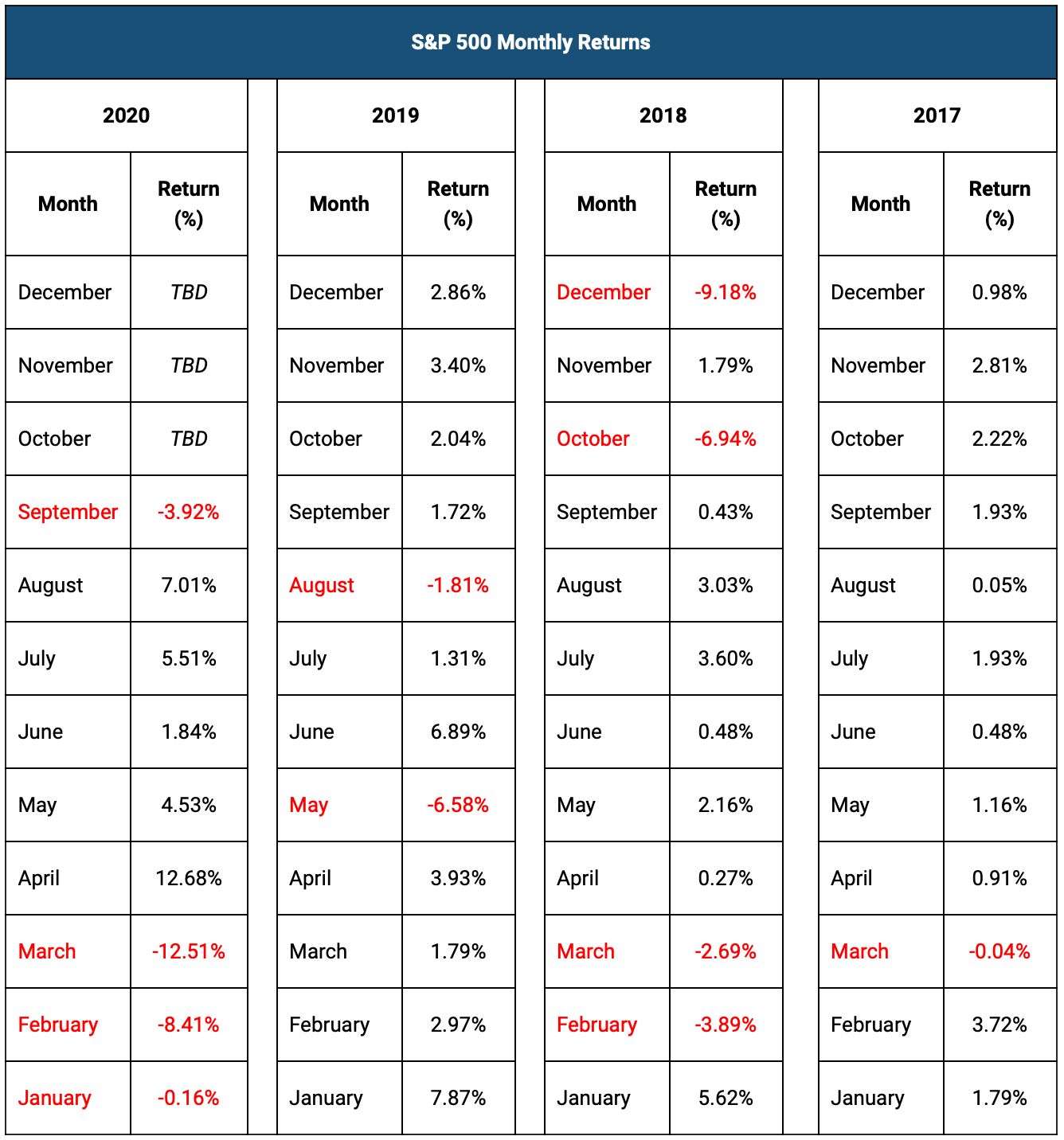

What’s with the month of March? Many investors famously remember March 6, 2009 as the day the S&P 500 index briefly touched 666 intraday as investors faced the edge of the abyss during the Great Financial Crisis. Flash forward to 2020 and I think many of us will remember a few dates. March 13, the day President Trump proclaimed Covid-19 to be a national emergency. March 19, the day California Governor Newsom issued the “Stay at Home Order” for the entire state. And of course March 23, 2020. The day the S&P 500 touched 2,191 intraday, collapsing 34% over a five-week period. As equity markets have rebounded (hitting new highs in early September), investors have asked themselves as the regular flu season begins, will we see another economic shutdown and, if so, will we see another massive correction in equity markets?

What really occurred in March of this year was a corporate liquidity crunch as fixed income investors were fearful that companies in disrupted sectors would become insolvent. Another round of widespread pressure on corporate liquidity, similar to what we saw in March, seems unlikely, as many firms (even those in distressed sectors such as airlines, travel, and leisure) have taken advantage of attractive debt funding costs (low interest rates) and strong investor demand (central bank purchases). Per the International Monetary Fund, governments and central banks have taken forceful measures to ensure the credit markets, companies, small businesses, and unemployed workers to the due of $12 trillion globally. Looking at the Fed and ECB, on a combined basis they have expanded their balance sheets 64% year-over-year to a staggering $15 trillion.

Since 1932, the average four-year forward annualized return of the S&P 500 after an election has been 9.3%. Only three presidential elections (out of 22) have resulted in a negative forward result. 1937-1940 (Great Depression), 2001-2004 (Tech Wreck), and 2005-2009 (Great Financial Recession). While we have about 2.5 months left in this current four-year cycle, the S&P 500 is currently running at about a 14.5% annualized rate.

This week, we will get an update from the Fed with the latest “Beige Book” being released on Wednesday. It’ll be good insight on the current economic conditions across the 12 Federal Reserve Districts and is always an easier read than most economic data releases, as it is more qualitative than quantitative. With a little over two weeks to go before the Presidential election, investors will continue to look for clarity on if the election will be a contested one or not. To further expand on our thoughts last week regarding the much anticipated stimulus relief bill which has driven markets higher more recently, if President Trump is re-elected expectations are for a stimulus relief bill to be passed before the end of the year. However, if former Vice President Biden is elected, the time frame could be between the end of the year and into early next year.

Data deck for October 17–October 23

|

Date |

Indicator |

Period |

|

October 19 |

NAHB Housing Market Index |

October |

|

October 20 |

Building Permits & Housing Starts |

September |

|

October 21 |

FOMC Beige Book |

---- |

|

October 22 |

Initial Jobless Claims |

---- |

|

October 22 |

Existing Home Sales |

September |

|

October 22 |

Leading Indicators |

September |

|

October 23 |

Markit Manufacturing PMI |

October |

|

October 23 |

Market Services PMI |

October |