Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Last week began where the previous week finished, as stocks remained under pressure. The technology-heavy Nasdaq Composite Index fared the worst, ending the week down more than 10% from the all-time high it reached at the beginning of September. Unusual activity in Options markets, increased pressure from politicians on tech sector giants, and improvements in the U.S. economic data were just some of the potential reasons given for the sell-off as investors paused to examine the risks.

While Congress continues to debate another package, small businesses continue to take the brunt of the impact and continue to see outsized job losses. According to the Small Business Administration, in 2019, nearly half of all private-sector employees (about 60 million) held jobs at small businesses. With more than 29 million people seeking some form of unemployment benefits, the outlook for the consumer and the holiday shopping season looks tenuous in the absence of more stimulus.

We believe the absence of additional stimulus and the potential for chaos regarding the election are likely to fuel market volatility over the next few months. These are the risks at play heading into the fall. While economic data is recovering, we believe a meaningful recovery in job growth is unlikely until there is a readily available vaccine.

Next week, the Fed will be back in the spotlight with the FOMC meeting to determine any warranted changes in monetary policy. After last month's announcement that the Fed would allow inflation to "run hot" in order to support the labor market, we are not expecting much in the way of new announcements this week. Among other updates we will get this week, jobs, retail sales, and preliminary readings on consumer sentiment are likely to be of interest.

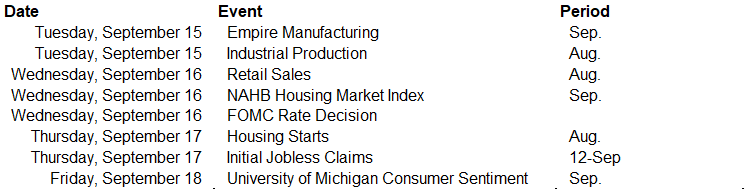

Data deck for September 12–September 18: