Due to lower tax rates and the recently passed SECURE Act, those nearing retirement should consider a Roth Conversion.

For those nearing retirement, taking the right planning steps is even more important given the narrowing time frame to retirement. This current year brings forth planning opportunities which can help you achieve your retirement goals that may not be available next year since there may be an increase in the income tax rates, especially given the amount of stimulus paid for the various COVID- 19 relief packages.

One possible strategy to look at, given generally lower tax rates and recent changes to laws governing retirement plans, is converting your current pre-tax retirement accounts to a Roth.

Taking Advantage of Lower Tax Rates and the Benefits of a Roth Conversion

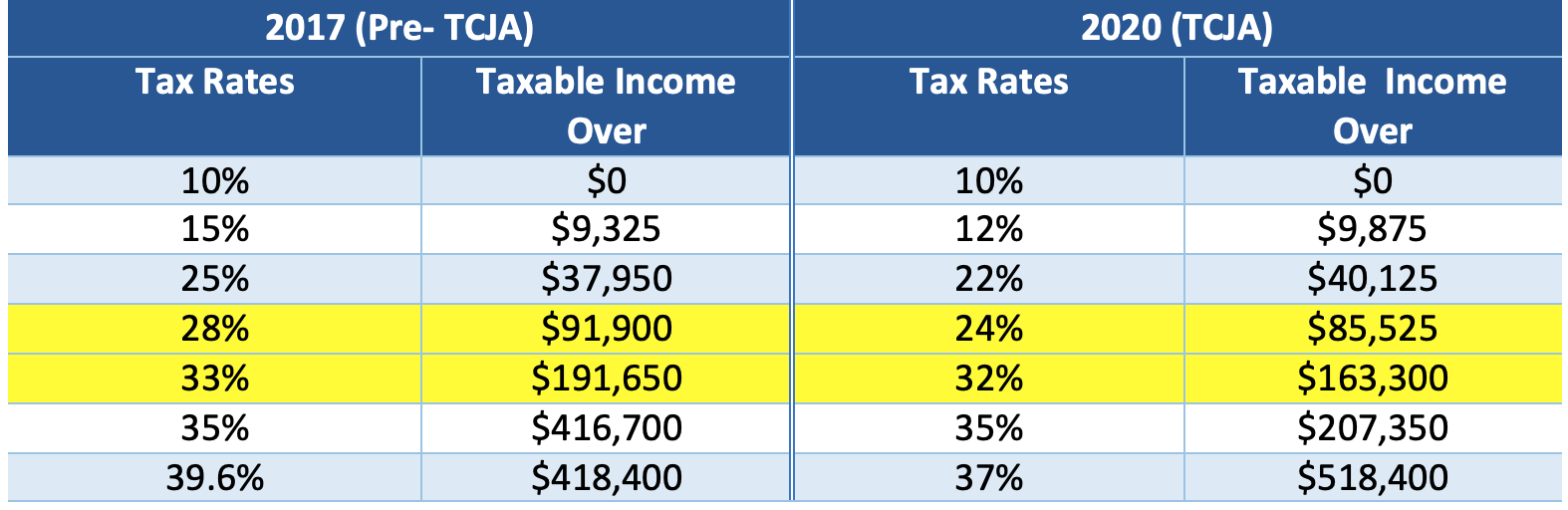

The Tax Cuts and Jobs Act (TCJA), which was signed into law at the end of 2017, generally resulted in lower tax rates for most (one exception are single filers who had taxable income between $91,900 to $163,300 of income who would have a higher top tax rate of 28% vs the current 24%). Below is a comparison of 2017 tax rates (pre-TCJA) and the tax rates that took effect in 2018 under the TCJA.

Tax Rates Comparison: 2017 vs 2020 Under TCJA – Single Filers

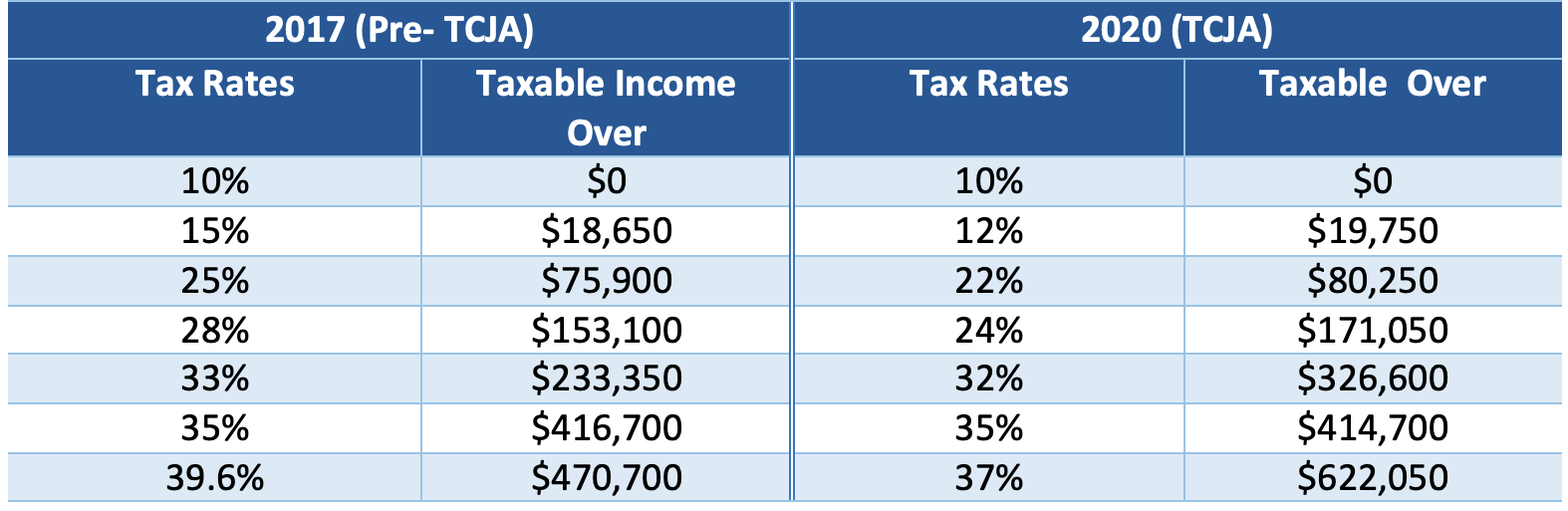

Tax Rates Comparison: 2017 (Pre- TCJA) vs. 2020 Under TCJA – Married Filing Jointly

How can you take advantage of these lower rates? As you near retirement, your income may be less than it was in previous years, resulting in less income taxes due to both lower tax rates and less income. Even if that is not the case, and you are making as much if not more now, you may still pay less taxes because of the reduced tax rates. If this is the case, you may want to consider strategies that may incur more income to accomplish certain goals. It may seem counterintuitive to incur more taxes, but doing so may make sense – especially since this is an election year and one never knows when tax rates will be increased.

One way to take advantage of these tax rates is converting current pre-tax retirement accounts to a Roth IRA. Since funds contributed have not been taxed (they are contributed pre-tax), generally all funds withdrawn from them are subject to ordinary income taxes. This tax consequence could further reduce a retiree’s spending power and deplete savings amounts. For example, let’s assume a retiree, Liz, age 65, needs $50,000 for living expenses from her pre-tax IRA account, and that is her only income for the year. Her federal taxes would be about $4,288, which would leave her with $45,627 after taxes. If she wants to net $50,000 after taxes, she would need to withdraw an additional $5,100, or a total withdraw of $55,100. This example only reflects the federal tax impact, and the tax impact would be worse if she lived in a state with a substantial state income tax.

With these tax concerns, utilizing a Roth conversion could make a lot of sense, especially given the current lower tax rates. The conversion from a Traditional IRA to a Roth IRA will result in an immediate tax liability, since any pre-tax amount converted will be included as income – but then regardless of how much a Roth account grows, withdrawals from these accounts are generally tax free (especially if the Roth IRA was set up 5 years before withdrawals are made and the participant is over 59 ½). If, like in our previous examples, an individual needed $50,000 for living expenses, he or she would only need to withdraw that amount, and not a greater amount to account for taxes.

Who are good candidates for a Roth conversion strategy?

Although Roth IRA conversions can benefit a broad range of people, it should be most strongly considered by the following individuals:

- Those who are in their 60s and are retired or nearing retirement, and

- Those who have the funds (other than from the IRA or another pre-tax retirement account) to pay the taxes resulting from the conversion.

The earlier one can conduct the conversion, the longer they can “stretch out” the taxes incurred from them – which can help avoid the possible substantial tax impact from receiving large RMDs. With RMDs now being pushed out to age 72 (under the SECURE Art), participants also have almost two more years to maximize benefits of a conversion strategy.

The advantage of doing the conversion with the current tax rates is illustrated by the following example. Let’s assume a couple whose filing status is married filing jointly (MFJ) have current taxable income of $180,000, which would mean their highest tax rate under current tax law is 24%. If their taxable income were to increase to over $326,600, their top rate would jump considerably by 8%, to a top rate of 32%. Another way to look at it is that this couple can increase their income by almost $146,000 and still be in the 24% bracket. If this couple decides to convert $100,000 of their IRA account to a Roth IRA, their total taxable income would be $280,000, with their top tax rate remaining at 24%. Compare this to if the couple did this conversion in 2017 (under the previous tax law), their top tax rate would have been 33%, or 9% more than what their top tax rate would be in 2020.

What about inherited IRAs?

Another reason for considering a Roth conversion is the negative change resulting from the SECURE Act in how inherited IRAs or retirement accounts are to be distributed. Under previous law, if an IRA owner passed away and they designated a non-spouse beneficiary to receive these accounts, even though the beneficiary was required to take taxable distributions, they could “stretch” these distributions over his or her life expectancy.

The SECURE Act changed this by requiring that beneficiaries who receive an inherited IRA from 2020 on to completely withdraw these accounts by December 31 of the year that contains tenth anniversary of the original IRA participant’s date of death. This results in making an already tax inefficient item even more inefficient by accelerating taxable withdrawals within a 10-year window. If a 40-year-old individual inherited an IRA, previously they would be able to take withdrawals over his or her life expectancy, which would be over 40 years. Under the new law, distributions are now accelerated to a 10-year time span. A Roth conversion will minimize the impact of the now required 10-year withdrawal of retirement plans, since tax-free withdrawals from an Inherited Roth IRA will also extend to the participant’s children.

Roth Conversion Opportunity Created by the CARES Act

In response to the COVID-19 pandemic, the CARES Act was signed into law March of this year. One of the Act’s major provisions was the suspension of Required Minimum Distributions (RMDs) for the 2020 tax year from certain retirement accounts (i.e., defined contribution plans and IRAs). This suspension allows IRA owners to avoid taking RMD distributions this year to help IRAs (or other retirement accounts) recover values lost due to the adverse market conditions caused by the current pandemic. This suspension of RMDs provides a unique opportunity to exercise a Roth conversion.

During years when RMDs are required, if you want to convert a portion of your IRA to a Roth, you must satisfy the RMD before amounts can be converted. The Roth conversion needs to be carefully planned since it results in a large withdrawal amount (RMD and amount to be converted) and significant income taxes, since this additional income could potentially place an individual in a higher income tax bracket. This year though, since RMDs are suspended, an individual can immediately convert an amount to a Roth IRA without satisfying an RMD requirement. So let’s assume an individual’s normal annual RMD is $50,000. This year, because of the CARES Act suspension of RMDs, she can take what would normally be a required withdrawal of $50,000 and convert that amount to a Roth conversion.

How to get started on a Roth Conversion

If you want to determine if a Roth conversion would be beneficial, the first step would be to contact your Wealth Advisor. He or she can help you determine if doing a conversion is appropriate given your current wealth planning and long-term goals.