Preserving and Transitioning Your Wealth – Most Common Wealth Planning Concerns and Strategies

One of the most common planning questions we get asked, especially from clients with sizable IRAs or pre-tax retirement accounts, is whether they should convert some of those amounts to a Roth IRA. Since such conversions would require paying income taxes on the amount converted, the question is whether doing such a conversion makes any sense. Given new tax law changes which have pushed back ages for required minimum distributions and possible future tax rate increases, a Roth Conversion could make sense for certain clients.

Pre-tax retirement plans or IRAs can increase retirement savings due to the ability to contribute pre-tax dollars and the funds in IRA accounts generally grow tax free. The negatives though are that because pre-tax funds are contributed, every dollar taken out of these accounts are subject to ordinary income taxes, and these accounts also require minimum distributions to be taken when a participant reaches a certain age. Previously that age was 70 ½ but given recent tax law changes, those ages are now 73 or 75 depending on the year the participant was born. This forced distribution could result in increased taxes during retirement. Compare that result to a Roth IRA, in which after tax dollars are contributed, but the amount withdrawn is generally tax free (withdrawals are tax free if taken after age 59 ½ and if Roth IRA is at least 5 years old). There is also no required minimum distribution. Although a person may be able to save more in a Traditional IRA than a Roth, these amounts should be adjusted for the taxes that will need to be paid when amounts are withdrawn.

Given that taxes will need to be paid on any conversions from a Traditional IRA to a Roth, are benefits of doing a conversion substantial enough to outweigh this immediate need to pay taxes? The first possible benefit is that it allows the account owner to spread the taxes on the withdraws from a traditional IRA over a longer period. Even though the account owner does not need to withdraw from their IRA until they must take required minimum distributions (RMDs), waiting until then could result in the need to take substantial withdrawals which could push them into higher tax brackets especially if they have substantial amounts in their IRA. Whether or not this makes sense to do depends on their current tax situation. If they currently have low or no income it could be a great time to consider a conversion. It is also important that they have funds outside of their retirement accounts to pay the income tax liability that will result from the conversion. Conversion is less appealing if additional funds are needed to be withdrawn from the retirement account to pay the tax liability. These additional withdrawals will increase the overall taxes due and make the conversion less attractive.

The following scenario is what a typical client nearing retirement may experience. It illustrates the benefits and the factors that should be considered in determining whether to undergo a Roth conversion(s).

-

Client is 67 and is in his first year of full retirement (no income or wages).

-

He is married and has substantial amounts saved in his IRA (over $3 million) and has a taxable joint account with his wife of about $1.3 million.

-

Given recent tax law changes the age he needs to take requirement minimum distribution (RMD) is age 73, at that time estimated RMD will be about $205,000 which would push his effective federal tax rate to 24%, the year before the RMD year, his effective tax rate was 12%.

When analyzing the above facts, there were many favorable factors for the client to conduct Roth conversions. With our help, the client decided to convert $100,000 this year, and plans to do the same amount until he reaches his RMD age of 73 in 2029. First, since the client is fully retired and not earning any income, their current taxes are very low. Even with the additional $100,000 of income from the conversion, they will still be in the 22% tax bracket. Also, by spreading out the withdraws by in essence starting early, the estimated RMD will go down to $170,000 in 2029, down from $205,000 estimated RMD without any conversion, which means he would recognize approximately $40,000 less income a year. Additionally, since RMDs cannot be converted to a Roth, the tax law changes that pushed back RMD age from 70 ½ to 73 helps them by providing 2 more years to be able to do Roth conversions.

Secondly, the clients taxable joint account provides them the funds to pay the taxes for the conversion, without the need of taking additional withdrawals from their IRAs. Although liquidating assets in a taxable account could result in additional taxes, this is still more favorable in most cases than making withdraws from an IRA, since taxes will be only paid on any gains (you get to recover your cost basis first or what you paid for the asset) and they will be taxed at lower capital gains rates, rather than ordinary income tax rates. Withdrawals to pay taxes will result in a reducing of their joint account value but that is balanced out by amounts that are being converted to a Roth. Since a Roth is a retirement account, unlike their taxable account, investments will grow tax free with withdrawals from these accounts being tax free as well.

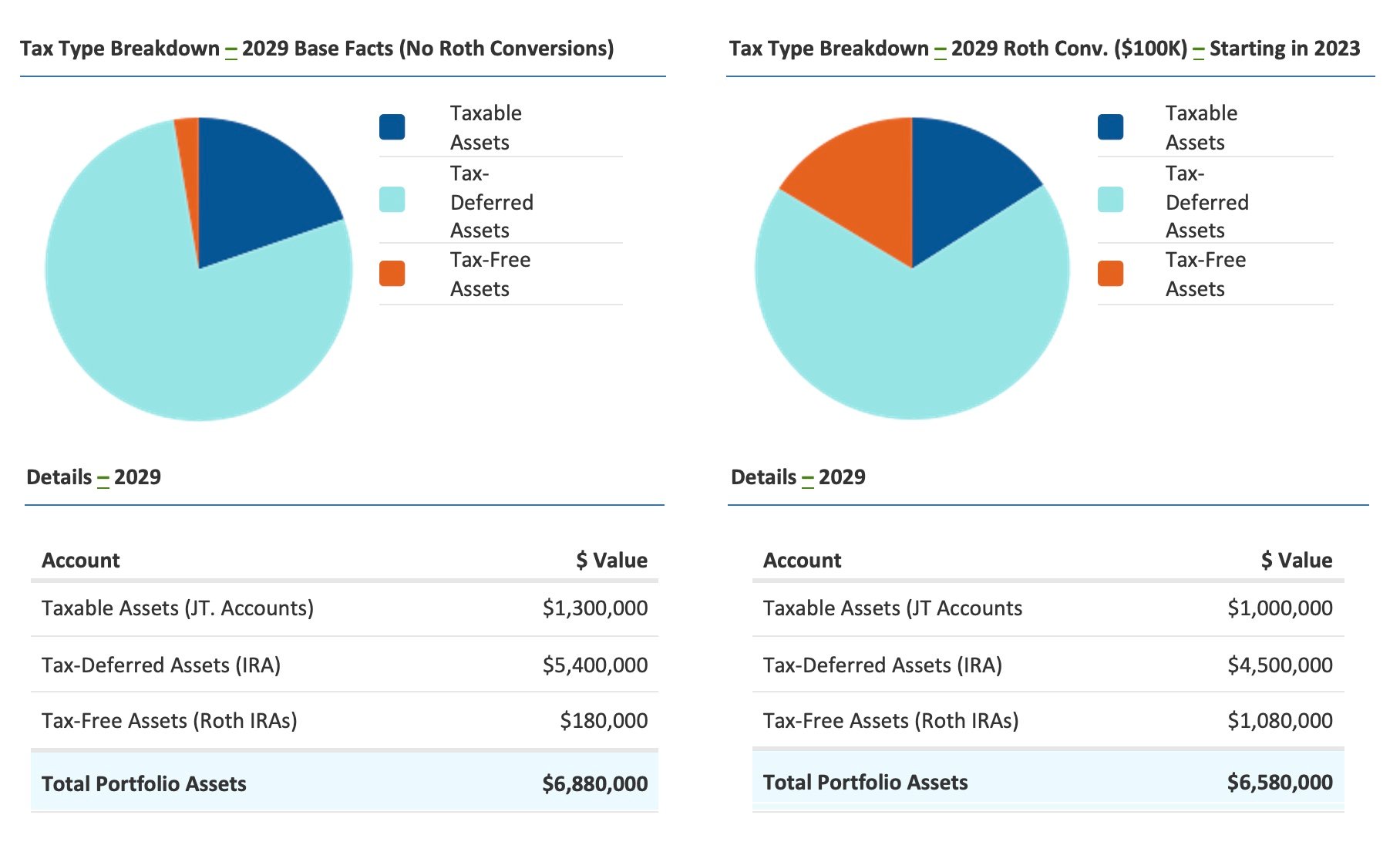

With an annual $100,000 conversion, for this scenario the account balances are projected to be as follows in 2029, when client turns 73:

Although total portfolio assets are projected to be less after the conversions, if you consider taxes that need to be paid on withdraws from an IRA, on a net basis clients are better off with the conversions. Also, since Roth IRAs also grow tax free and do not have RMDs, they will get to a point with time when total portfolio assets with conversions will exceed total portfolio assets with no conversions.

To help our clients determine if a Roth conversion made sense for them, we used a cash flow analysis that we previously created for their retirement plan (which provided projections that we discussed) and provided tax projections (which they then reviewed with their CPA), so they were able to see projected tax liability on different annual conversion amounts. It was with this data and information that they then decided on annual $100,000 conversions. If you have a similar situation, we can also help you determine if Roth conversions are beneficial for you by running the same analysis.

Our goal is to help our clients preserve, protect, and transition their wealth. What was mentioned in this article are some of the ways that we can help clients with their wealth planning to help them achieve this goal. If you are interested in exploring these strategies or if you have any other wealth planning issues or questions, please let your Relationship Manager know and they can set up a meeting with the Wealth Planning team.

We hope you found this illustration to be informative. If you would like to learn more about how we approach developing your financial plan, please contact us. Or read more insights on life and wealth planning from our team here.