Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Equity markets are currently in the most challenging part of the calendar year from a historical perspective, as September has been the ‘worst month of the year’ for stocks over the last 20 years. After hitting all-time highs 54 times this year, the S&P 500 took a pause last week and fell for five consecutive days, ending the week down 1.7%. It has played out this way in each of the previous three years.

Bloomberg’s Economic Surprise Index, which measures data flow versus expectations, has also turned negative for the first time since the pandemic started. Still, the market has shown minimal sign of concern, much less distress, at the prospect of Fed tapering and a slow withdrawal of accommodation by numerous central banks.

Recent Fed commentary suggests the pace of withdrawal could occur faster than markets currently contemplate. In particular, several FOMC participants have suggested completing the tapering process by mid-2022. Just this past week, New York Fed President Williams noted that the pace of tapering could occur faster than previously assumed, with asset purchases or tapering being adjusted on a per month instead of per meeting basis.

Despite these subtle changes in commentary, we believe the main focus remains on the labor market’s health. Demand for workers is exceptionally high, but it seems that workers are still not ready to come back to work. Job openings have reached the highest level ever, with 1.26 jobs offered per unemployed person.

In our view, the end of the fiscal subsidies to households and the decline in Delta variant infection rates are likely to trigger adjustments in the labor market. Either job openings will get filled, or companies will pay up to compensate and incentivize workers back into the workplace. Both scenarios result in a tighter labor market, which the Fed is looking for before becoming more steadfast with their tapering plans.

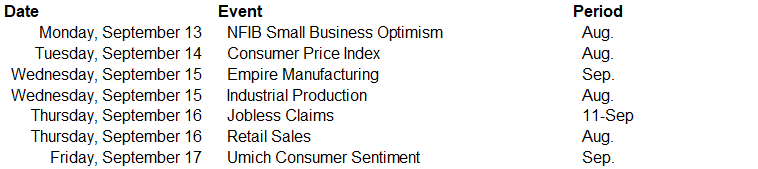

This week, the main event will be the CPI report. We also get new regional business sentiment surveys from the Empire and the Philly Fed, plus an NFIB Small Business index and a consumer sentiment survey from the University of Michigan. On the hard data front, we get a look at Industrial Production and Retail Sales for a well-rounded snapshot of last month’s economic activity.

Data deck for September 11–September 17: