Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Recently, my wife and I decided to have lunch at a local taco stand. Despite it being well before noon, there was already a line of people – suggesting we weren’t the only ones trying to beat the crowd. The manager was running around making sure every detail was being handled as things were already beyond capacity; and this was before the lunch rush had even started! As we waited in line, I noticed a help wanted sign prominently displayed in the window. While everyone was doing their best and running things efficiently, it occurred to me that this was a microcosm of today’s economy.

Through most of the economic expansion, the U.S. economy had been growing at a moderate, steady pace, even feeling somewhat sluggish at times. This pace of growth placed very little pressure on wages as companies had plenty of qualified workers to hire. However, the recent tax cuts have added a strong dose of stimulus to the economy, boosting economic growth late in the economic cycle. Data are showing wages increasing at an accelerating pace (2.7%), which has provided the incentive for workers to move back into the labor market. This is why oftentimes we see an uptick in the unemployment rate after a strong jobs report similar to the one we saw in June. Eventually, as the economic expansion continues to accelerate, productivity increases as companies find ways of using their existing workforce more efficiently. These economic forces are playing out both at Hugo’s Tacos in Glendale, CA and in the U.S. economy at large.

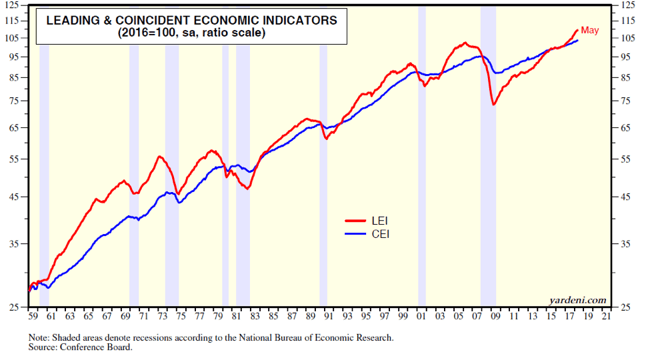

This Thursday we will be looking forward to seeing the Leading Economic Indicators (LEI) report, which uses 10 key economic indicators to predict future economic activity. The LEI is up by 6.1% over the past 12 months to yet another new record high during May. The LEI certainly isn’t sounding a recession alarm and, indeed, the economy is expanding nicely. Many economists are predicting GDP growth for 2018 to exceed 3%, which is even more support of a growing economy. Unfortunately, this probably means more stressful days to come for the proprietor of my local taco stand.

Data deck for July 16 - July 20:

|

Date |

Indicator |

Period |

|

July 16 |

Retail sales |

June |

|

July 16 |

Retail sales ex-autos |

June |

|

July 16 |

Empire state index |

July |

|

July 16 |

Business inventories |

May |

|

July 17 |

Industrial production |

June |

|

July 17 |

Capacity utilization |

June |

|

July 17 |

Jerome Powell testimony |

--- |

|

July 17 |

Home builders' index |

July |

|

July 18 |

Housing starts |

June |

|

July 18 |

Building permits |

June |

|

July 18 |

Jerome Powell testimony |

--- |

|

July 18 |

Beige book |

--- |

|

July 19 |

Weekly jobless claims |

7/14 |

|

July 19 |

Philly Fed |

July |

|

July 19 |

Leading economic indicators (LEI) |

June |