Welcome to “A Piece of the Puzzle," where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming month.

In this new series we want to highlight the latest in investment thoughts in an informative and entertaining format.

In today’s article, we’ll take first take a look at 2023 and then use those insights into positioning for the rest of 2024.

There Was No Lack of Bad News in 2023

Instead of covering the good news initially, going over the bad news first may provide better context.

A year ago, numerous challenging headlines cropped up, causing many to wonder if 2023 would be just as bad as 2022, including the following:

- Federal Funds Rate Increases: The Federal Reserve raised rates during four consecutive meetings between February and July, resulting in an aggregate 100 basis point rise.

- Multiple Bank Failures: During five days in March, three small- to mid-sized U.S. banks failed, including Silicon Valley Bank, when a bank run was triggered after it sold its Treasury bond portfolio at a large loss, and Silvergate & Signature Banks, both with significant exposure to cryptocurrency.

- Downgrading of U.S. Government Credit Rating: In August, Ratings agency Fitch downgraded the U.S. long-term debt rating from its sterling AAA level by one notch to AA+, after the prolonged debt ceiling stalemate in June.

- Fixed-Rate Mortgages Hit Multi-Decade Highs: In October, the average Annual Percentage Rate (APR) on 30-Year Fixed-Rate Mortgages hit 8%. Ten-Year U.S. Treasury Note yields, by which mortgage rates track, reached 5%.

- Debt Levels reached Record Highs: Uncle Sam’s debt level reached $33 Trillion, while Student Debt reached $1.6 Trillion.

Markets and the Economy Were Nevertheless Resilient

Despite the negative news above, markets in 2023 still rallied and economic metrics improved dramatically[1]:

- U.S. Stocks Rallied Back after a Tough Year: After declining over 19% in 2022, U.S. Large Caps increased over 26%. U.S. Small Caps declined 20% in 2022 yet increased 17% last year.

- U.S. Bonds Performed Admirably: After falling 13% in 2022, U.S. investment grade bonds performed moderately-well with a return of over 5%.

- Non-U.S. Stocks Rallied as Well: International stocks declined over 14% in 2022, but increased almost 17% in 2023, its best performance since 2019.

- Inflation Moderated Significantly: After reaching a 30-year high level of 9.1% annualized in June 2022, inflation (as measured by the Consumer Price Index) fell to 3.1% annualized by the end of 2023.

- Employment Remained at Historical High Levels: The unemployment rate finished the year at 3.7%, at near historical lows.[2]

Discipline Paid Off Handsomely in 2023

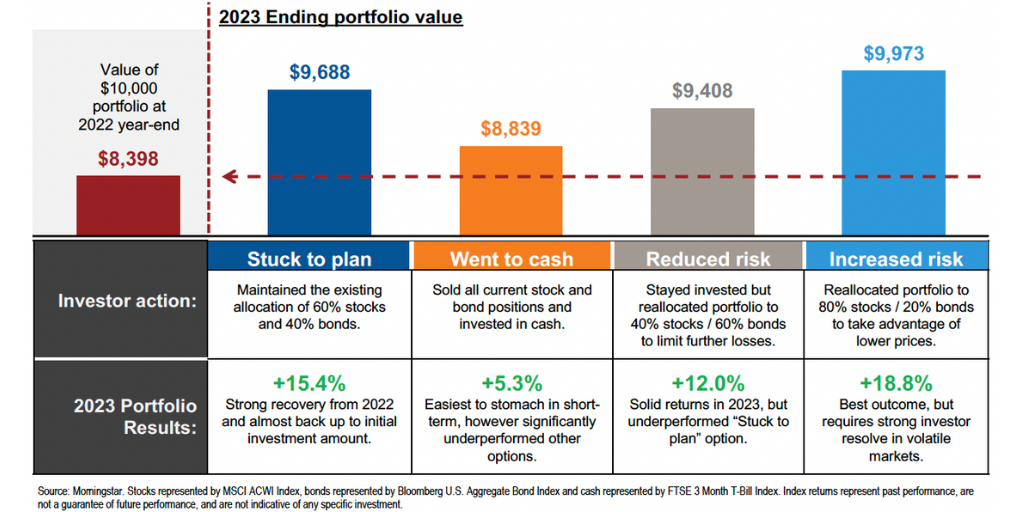

At the end of 2022, many investors were understandably shaken with the standard “60/40” portfolio (i.e., 60% Globally-Diversified Equities & 40% U.S. Investment Grade Bonds) having declined about 16 percentage points during that year[3].

After the Federal Reserve had hiked interest rates significantly throughout 2022 – with more increases yet to come in 2023 – the temptation to move to cash was certainly a large one. Doing so, however, would have been very expensive, at a cost of over ten percentage points in return.

As an illustration, in 2022, a $10,000 beginning-of-year 60/40 portfolio shrank to just under $8,400 by year-end. The following year, investors who had gone to all cash would have been behind some $850, or roughly nine percentage points, behind the investor who remained in the 60/40 portfolio.

Of note: Investors with the ability to withstand higher risk and allocate even more to Equities (i.e., “buy (even more) low, sell high”) were nearly able to break even from the beginning of 2022 through the end of 2023:

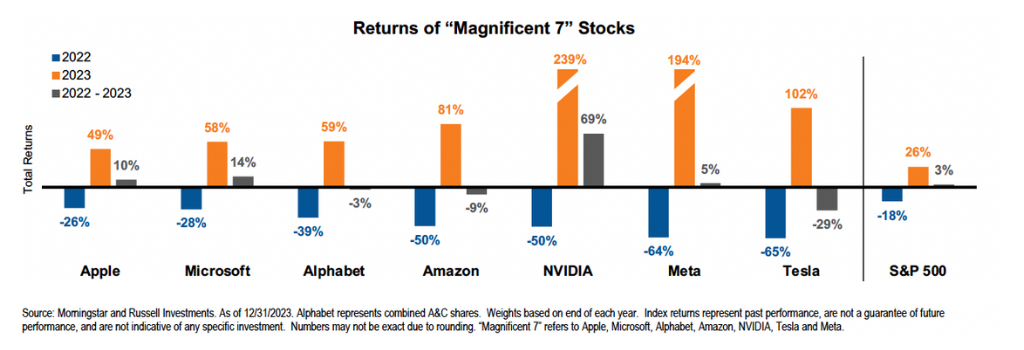

The Strength of the Magnificent Seven and the Ramifications for the S&P 500 Index

One of the recurring major headlines in 2023 was the performance of seven high-flying technology stocks, known as the “Magnificent Seven”:

- Alphabet (Parent Company of Google)

- Amazon

- Apple

- Meta (Parent company of Facebook)

- Microsoft

- NVIDIA

- Tesla

The “Magnificent Seven” stocks led the way in 2023, bouncing back after a particularly challenging 2022.

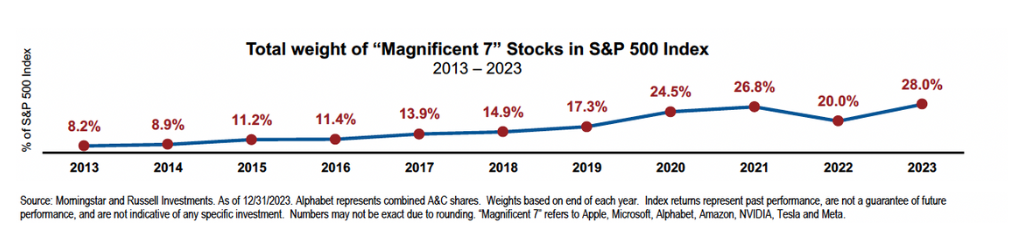

While the performance of these seven companies is strong, the weighting of these stocks in the S&P 500 index reached a historical high, at 28% of the index. Put another way, the Magnificent Seven is overly represented by approximately 30 times compared to the average company in the index.

Major Questions for 2024

Three questions to ponder for the rest of the year:

- Cash play a significant role in portfolios?

- Political risk affect portfolio positioning?

- Alternative Investments play a role in allocations?

Should Cash Continue to be a Core Component of Portfolios?

To many investors, the idea of earning a nearly-completely-liquid, risk-free return in excess of 5% is very enticing, to the point that shifting more of one's portfolio to cash becomes natural after having experienced many years of zero-interest rate policy.[4].

So why would an investor not want to shift to a higher percentage in cash? Several reasons come to mind.

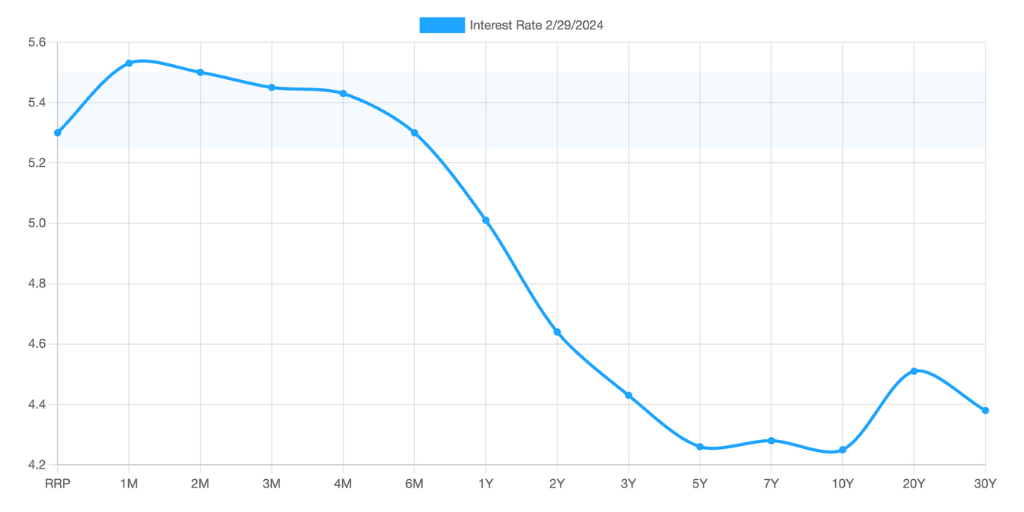

First off, the idea of parking one’s money into cash presumes that short-term rates will continue to stay high. There are several reasons to believe this isn’t likely to be the case, but perhaps the biggest reason is that the term structure of interest rates – that is, what longer-term bonds will pay – is well below 5.4%. For instance, the benchmark 10-Year Treasury Yield is about 4.2%, a precursor to where cash will be paying.

U.S. Treasury Yield Curve (February 29, 2024)

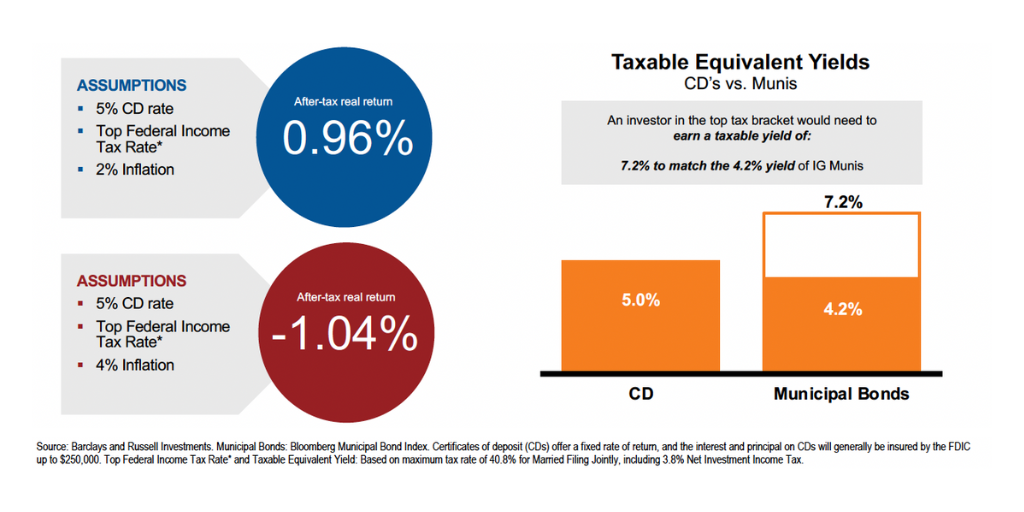

Second, in a taxable portfolio, one must always be cognizant of post-tax returns. Consider a Certificate of Deposit that pays an advertised yield of 5%. This assumed rate is not going to be true in practice if one is in a high tax bracket and this is even before considering inflation. Municipal Bonds may be a better place to be in than cash for these investors.[5]

Lastly, inflation, while tamer now, has not gone away completely. With CPI still above 3%, Cash paying 5% does not provide much cushion in case inflation comes back. Being in more inflation-protected asset classes – such as Equities or TIPS – may be a better place to be than in cash.

Should Political Risk Affect Portfolio Positioning?

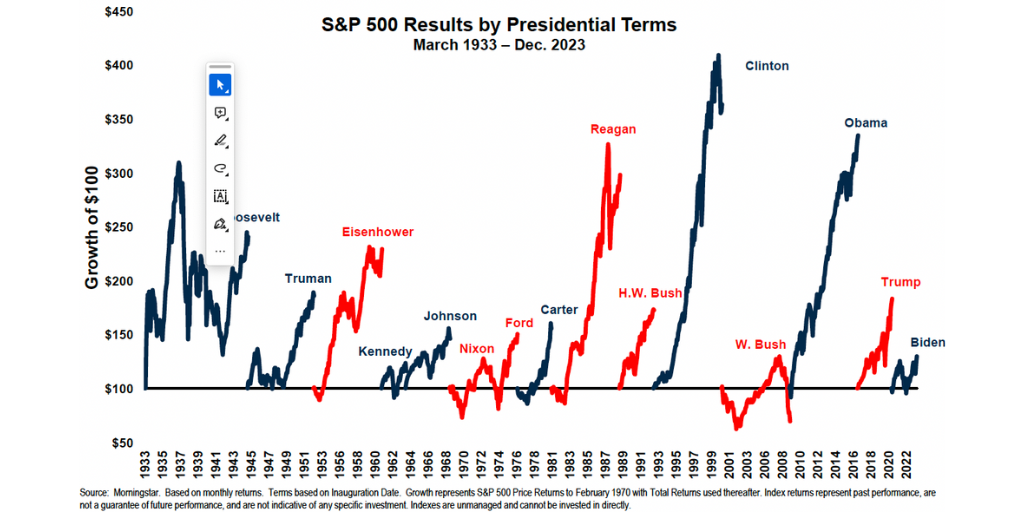

The traditional viewpoint is that the Republican Party is better for business and hence may portend better performance in the stocks markets. Is this really true in practice, though?

As one can see in the chart below, both Republican presidents and Democratic presidents have experienced overwhelmingly positive stock market performance. In fact, since the inception of the S&P 500 index 91 years ago, the two presidents with negative stock performance after having left office were from the Republican party:

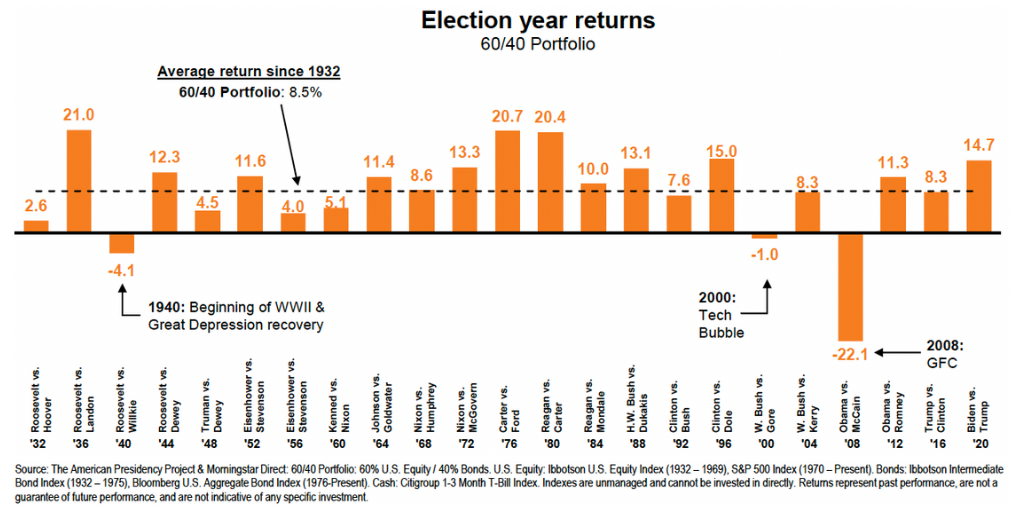

Perhaps another way of looking at portfolio positioning during an Election Year is to see how actual portfolios would have done in past election cycles. Once again, the evidence is clear that “staying the course” has worked out well.

During election years, a “60/40” portfolio has delivered an average annual return of +8.5%, with 87% of those years having had a positive return. Only three years experienced negative occurrences; each of those were macroeconomic related:

Should Alternative Investments Play a Role in Allocations?

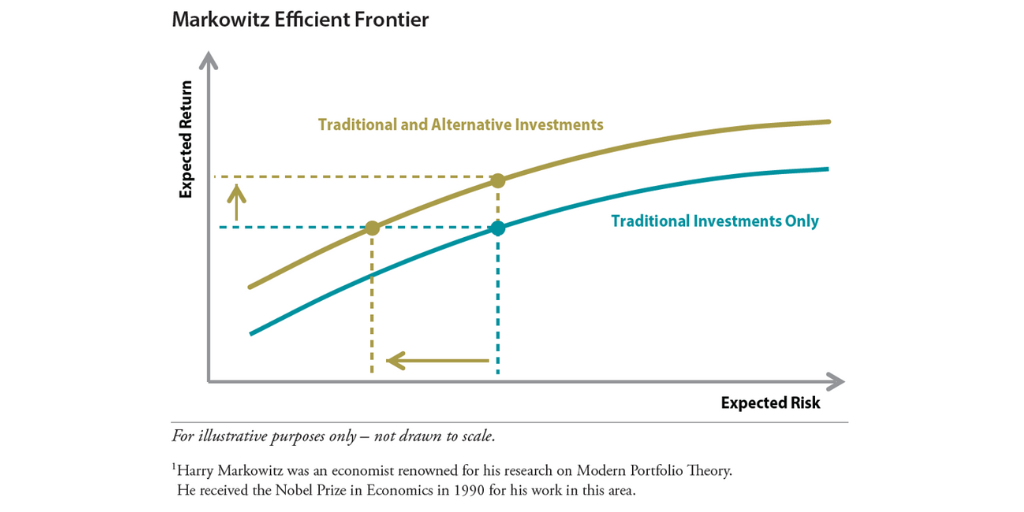

Much of the narrative in today’s discussion has focused purely on the traditional assets of stocks and bonds. While such assets should form the bedrock of most investors’ portfolio allocations, employing non-traditional, or Alternative Investments, is a way to enhance an investment strategy, whether in 2024 or in any other year.

In a nutshell, an Alternative Investment is any financial asset that does not fall into one of the conventional investment categories (e.g., stocks and bonds). Alternative Investments can include Real Estate, Private Credit or Equity, Energy, Commodities, among other types of assets.

Why can adding Alternative Investments improve the characteristics of a portfolio? This is due to the idea that such investments may either increase returns for a given level of risk, or maintain returns while decreasing risk, as shown to the left.

Suffice it to say that we have just scratched the surface of the world of Alternative Investments. We’ll have much more to discuss in the months ahead.

Conclusion

Although we have covered many topics, perhaps the unifying takeaway is that continuing to maintain one’s long-term strategic approach to investing, with perhaps some small adjustments at the margins, is likely to be the best outcome in 2024, despite the unique interest rate and political environment under which we are currently experiencing.

[1] Sources: U.S. Large Cap: Russell 1000 Index; U.S. Small Cap: Russell 2000 Index; U.S. Investment Grade Bonds: Bloomberg U.S. Aggregate Bond Index; Non-U.S. Stocks: MSCI EAFE Index.

[2] Source: U.S. Bureau of Labor Statistics.

[3] “60/40” portfolio is represented by 60% in the MSCI ACWI and 40% in Bloomberg U.S. Aggregate Bond Index. One cannot invest directly in an index.

[4] As of 2/29/2023, the yield on the 3-Month U.S. Treasury Bill ("T-Bill") was 5.45% (Source: Treasury Department). While a 3-Month T-Bill is not considered to be strictly equivalent to cash (unlike an FDIC-insured bank deposit or Money Market Fund), investment professionals consider a 3-Month T-Bill to be substantially similar to cash given that it has a very short-duration and an implicit repayment backed by the full faith and credit of the United States government.

[5] Source: Barclays and Russell Investments. Municipal Bonds: Bloomberg Municipal Bond Index.