Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

The growing chance that the corporate income tax rate could remain untouched in the new budget bill helped lift the S&P 500 last week. Additionally, quarterly earnings reports have surfaced showing that companies are finding ways to navigate their prevalent supply chain challenges. Companies are reporting results that are now exceeding their hampered expectations. Rate markets, however, have not been so kind. The 10-year Treasury yield hit 1.7% at one point last week, up a substantial 40 bps from a month ago and 52 bps from July. Rates markets now include a considerable probability of a Fed rate hike in the first half of the year – before tapering is scheduled to be completed.

Whereas just one month ago they didn’t expect any, rate markets are now priced for approximately two rate hikes by the end of next year. We believe many participants are looking beyond the tapering process to what the next rate hike cycle might look like and, more importantly, how high policy rates could rise this time around. In 2018, the Fed’s view of the long-run policy rate and the 10-year Treasury yield converged at 3.0%. The question is whether the final number will settle at 2.5%, 2.0%, or even somewhere higher or lower.

Fed tapering is starting soon (almost surely in November), and it will wrap up in mid-2022. Importantly, however, labor force participation is still being held back by Covid. The Fed’s conditions for rate hikes require an inclusive recovery of labor force participation. That is unlikely to happen by the middle of next year, despite it being priced in by the markets. For now, the Fed fully expects participation to recover and says it will wait before hiking rates. Hence, we have reason to believe that although rates have risen substantially over the past month, they might not have that much further to go. The Fed may blink on inflation, however it is more likely they eventually lose patience with their labor force viewpoint and decide participation among some groups will never recover. That evolution of thinking, however, generally takes years, not months, and in our view rate markets are getting a little ahead of themselves.

This week we await personal income, spending, PCE inflation, and likely of most importance the first estimate of Q3 GDP.

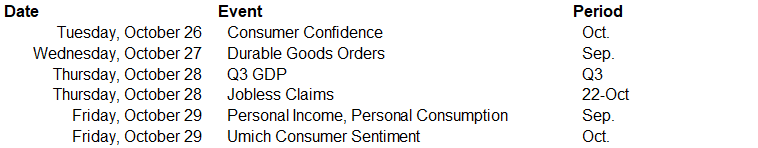

Data deck for October 23–October 29: