3 minute read

Smart insight and clear visuals that matter – what we’re watching now and how intention and conviction shape our portfolios.

Markets

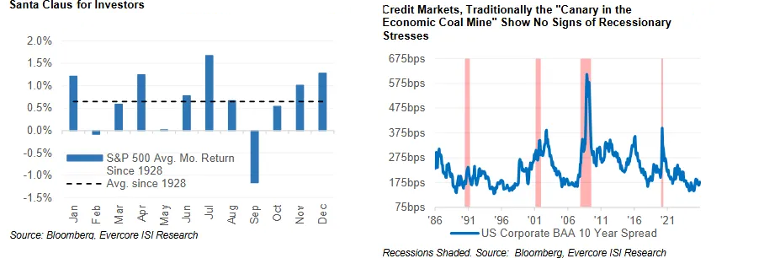

Stocks extended their rebound, led by Tech and Small Caps. We observe sentiment has swung back positively in front of catalyst ahead. ♫It’s the most wonderful time of the year ♫ and with more expected Stimulus (Fiscal and Monetary) ahead and credit markets signaling “No Recession in 2026,” the Market has further to run in 2026.

Small Cap

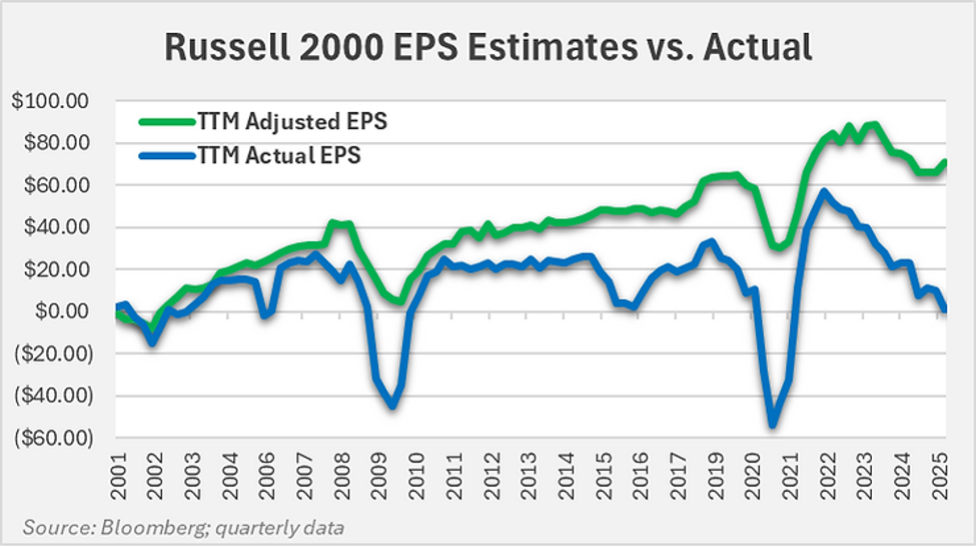

It has been a strange year in small cap (companies with approx. $250 million to $2 billion market capitalization) with the Russell 2000 up now 15% year-to-date as of Tuesday, which improved as the week went on. But we believe signals are all over the place as the write-downs on the smallest stocks are now swallowing up all earnings produced. And while profitable companies in the index are up 10%, unprofitable stocks in the index are up 45%!

Gold

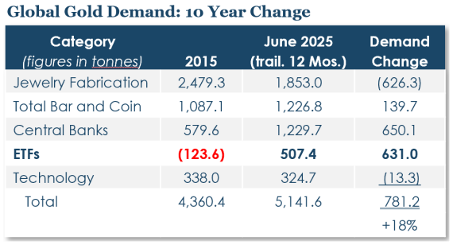

Global gold demand rose 18% over the past decade, driven by a surge in central bank (+650.1) and ETF (+631) buying, while jewelry demand fell sharply. Structural shift signals gold’s evolving role from adornment to financial hedge.

Source: Horizon Kinetics

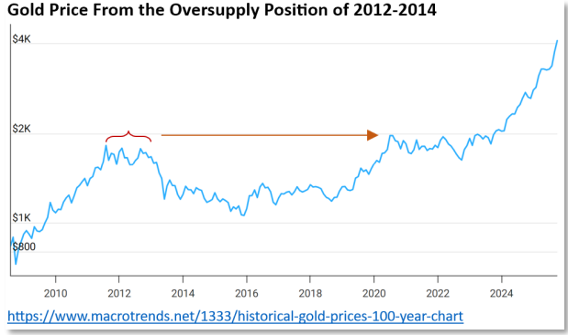

Having endured a period of overproduction and excess supply a decade ago (2012–2014) that caused Gold to drop 40-odd percent from its peak price in 2012, mining companies could no longer get an adequate return on their capital. It took Newmont Mining, the largest U.S. gold producer, until 2016 to reduce its sustaining capital expenditures (those necessary to maintain current gold production from existing projects) by almost 60%. Total capital expenditures in the five years to 2017 were reduced by over 70%. This, along with the patience for the oversupply issue to correct itself, we now see a rise in gold prices and miners motivated to control supply. Additionally, with demand coming from ETFs and central banks, miners are even more hesitant to increase supply for financially motivated demand. The combination of these positions makes an argument for gold prices to sustain at these levels.

Real Estate

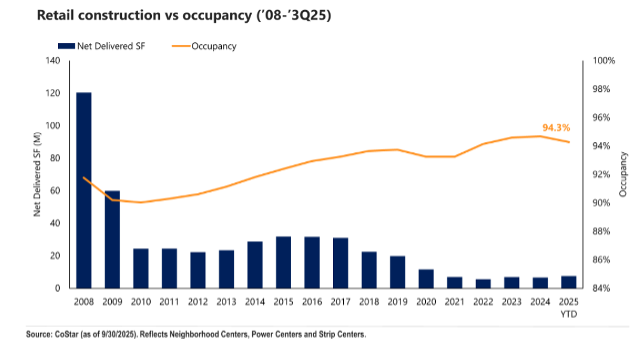

We continue to see open-air shopping centers facing structural supply demand issues leading to strong performance within the private real estate market. Retail is surprisingly resilient. After small losses in 2022–2023, it posted strong gains in late 2024 and early 2025 (up to +2.0%). Despite low construction, occupancy rates (orange line) have remained high and stable, climbing from about 92% in 2009 to 94.3% in 2025.

Federal Reserve

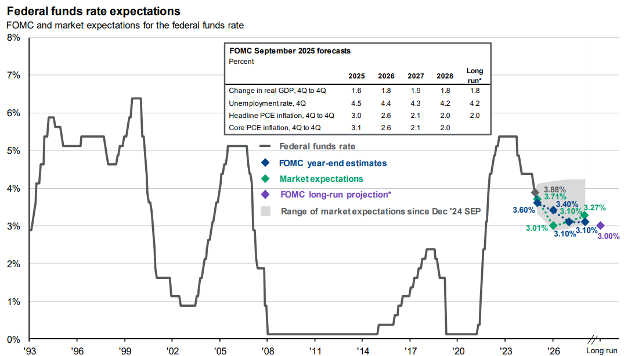

On Wednesday, policymakers at the Federal Reserve cut the benchmark federal-funds rate by a quarter-point, the third such cut since September. The rate now stands at 3.5% to 3.75%. The approval was after a 9-3 vote with some of the committee wanting a 50 bps cut. The central bank said it will buy $40 billion of short-term bills as part of a monthly program aimed at stabilizing markets and keeping the fed funds rate within its quarter-point range. Market is pricing in one rate cut in 2026 but the FOMC is likely to add new members who are dovish.

Economic Calendar: Week Ahead

Mon, 12/15 @ 830 am: Empire State Manufacturing Survey

Mon, 12/15 @ 10 am: Home Builder Confidence Index

Tues, 12/16 @ 830 am: U.S. Unemployment Report

Tues, 12/16 @ 830 am: Retail Sales

Thu, 12/18 @ 830 am: Initial Jobless Claims

Thu, 12/18 @ 830 am: Consumer Price Index

Thu, 12/18 @ 830 am: Philadelphia Fed Manufacturing Survey

Fri, 12/19 @ 10 am: Existing Home Sales

Fri, 12/19 @ 10 am: Consumer Sentiment

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by First Foundation Advisors (“FFA”)), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from FFA. No amount of prior experience or success should be construed that a certain level of results or satisfaction be achieved if FFA is engaged, or continues to be engaged, to provide investment advisory services. FFA is neither a law firm nor a certified public accounting firm and no portion of the commentary should be construed as legal or accounting advice. A copy of FFA’s current written disclosure statement discussing our advisory services and fees is available for review upon request, or at www.firstfoundationinc.com. Please remember that if you are a FFA client, it remains your responsibility to advise FFA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general information/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your FFA account holdings correspond directly to any comparative indices or categories. Please Note: FFA does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to FFA’s website or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.