Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week. This week's edition is being published a little late, but is still relevant for the rest of the week ahead.

Markets had another positive week last week, with the S&P index breaking through the critical 3000 level for the first time since early March. Investor optimism surrounding the ‘reopening’ narrative and a possible COVID-19 vaccine have outweighed concerns surrounding rising political unrest in the U.S., escalating tensions globally with China, and U.S. economic data that continues to bump along a bottom. It seems many have forgotten that, in 2019, markets and economies were already extremely stretched and struggling to grow. Instead, they have judiciously made the leap to expect earnings to somehow grow 14% from 2021 to 2022. A bridge too far, we think.

While Monetary policy by the Fed has done an excellent job plugging balance sheets with liquidity to ride out the COVID-19 storm, we strain to see how the economic environment has improved from 2019. In 2019, U.S. Economic growth came in at 2.3% – less than the 2.9% in 2018. Earnings growth for S&P companies was flat and contracted considerably for small-cap companies. Most importantly, Central banks around the globe were compelled to resort to synchronously cutting rates and engaging in bond-buying programs to stoke elusive self-supportive economic growth. Hence, we question – are we missing something? Can the Fed really print us out of this? Will handouts solve the hardships caused by this pandemic? Are all the lost jobs really coming back?

While the spike in unemployment certainly is skewed to extremes, companies and businesses will likely be much slower to rehire in any recovery. Thus we believe that a return to growth will be much more gradual as unemployment remains elevated. Increasing levels of social unrest across the country will reallocate efforts and scarce resources away from getting local economies back to some semblance of normalcy. The Congressional Budget Office just yesterday published new numbers that forecast the U.S. economy might not recover for another decade without additional federal aid or stimulus. Small businesses have been at the epicenter of the COVID-19 recession. Their ability to come back is a necessary condition for a broader economic recovery. It has recently been estimated that if one in ten small businesses don’t reopen, this would permanently destroy six million jobs or 5% of total U.S. employment. Hence, expectations for a quick economic recovery appear fanciful.

While an earnings recovery could prove quicker, given the tremendous amount of monetary and fiscal stimulus injected into the economy, markets are likely a year or two ahead of themselves. Especially considering markets and economies were already extremely stretched and struggling to grow to enter 2020, before the exogenous shocks of COVID-19. From where we sit, markets seem to be redux of the conditions at the beginning of the year – priced-to-perfection. Hence we promote caution as risk appears heavily skewed to the downside and again suggests investors prepare for rain.

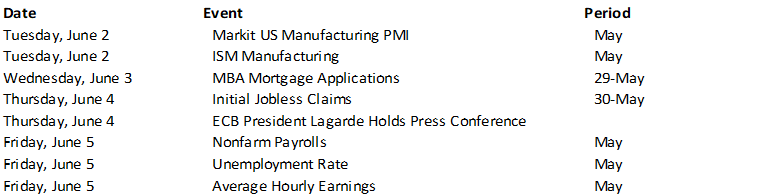

This week the economic focus will probably be on the ECB meeting on Thursday and the U.S. labor market report on Friday – with the unemployment rate anticipated to rise to 19.5% in May, up from 14.7% in April.

Data deck for May 30–June 5: