12 minute read

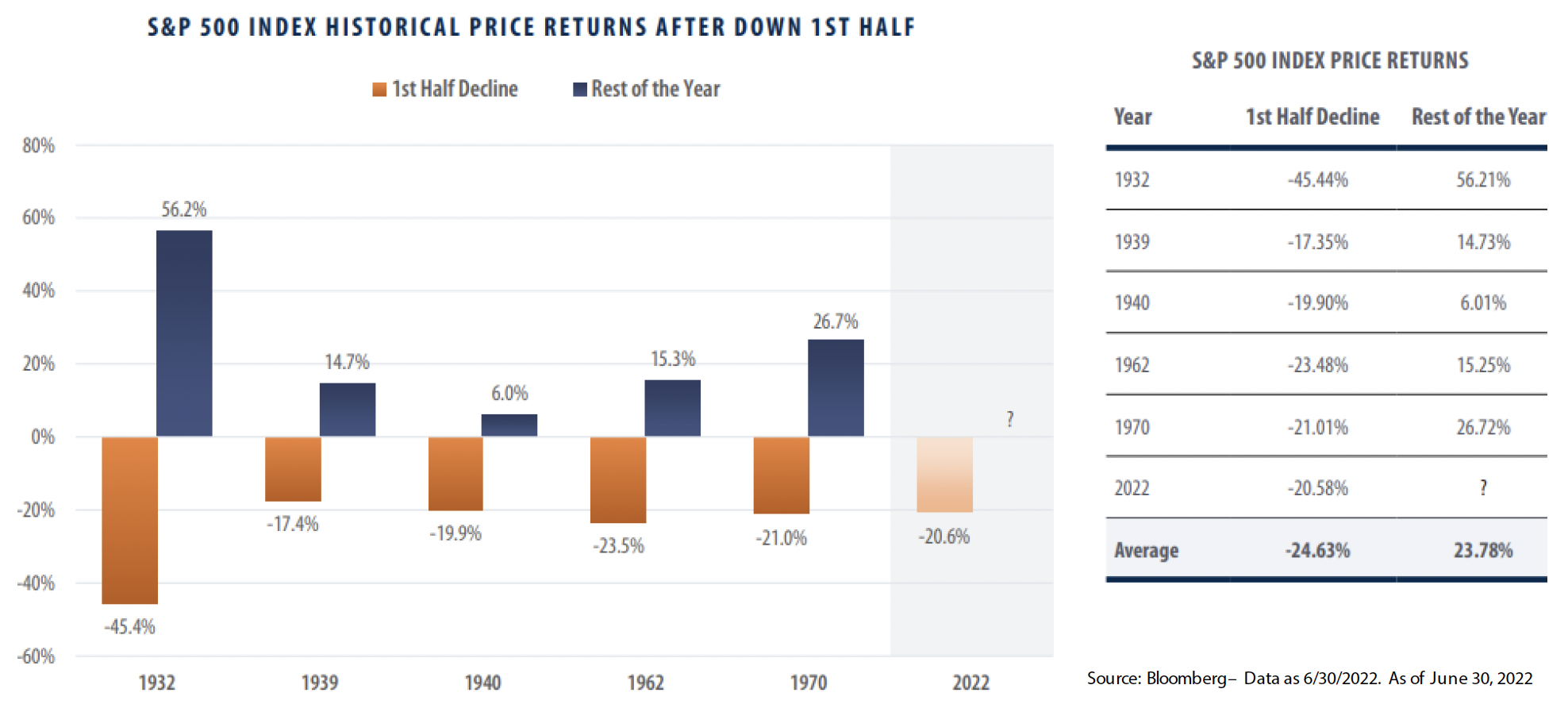

A lot has happened since our last investment commentary. The first half of 2022 has been the worst first six months of a year for stocks and bonds since 1970. No doubt it’s been an extremely difficult year, with equity markets falling into bear market territory (down more than 20%) and low-risk bonds also registering double-digit losses. Over the past few months, the economic backdrop has worsened, with sustained high inflation and slowing growth as the Federal Reserve and other global central banks aggressively tighten monetary policy. Exogenous shocks – the Russian war on Ukraine and China’s zero-COVID lockdowns – continue to further disrupt the global economy and financial markets.

We will dig into the recent market and economic developments in this commentary – what’s changed since the first quarter, and how it has impacted our near-term (6-to-12-month) and medium-term (five-year) outlooks.

In the near term, we think it is prudent to expect more equity volatility ahead, as an economic slowdown and potential recession will likely lead to slowing corporate earnings. But with global stock markets already down 20%+ due to valuation compression and sharply higher bond yields, we believe much of the damage has already been done. Over a medium-term horizon, we view this as largely a healthy “reset” for the markets: a normal cyclical downturn setting the stage for what we believe will be more attractive forward returns.

As always, investment discipline and patience – staying the course and remaining invested through these choppy waters – are necessary to be able to realize the better future returns. Given the wide range of potential outcomes, risk, and unknowns, portfolio diversification beyond traditional U.S. stocks and core bonds remains important.

Second-Quarter Market Recap

After a rough first quarter, global stocks and bonds suffered further sharp markdowns in the second quarter as stagflation fears and rising interest rates pummeled both broad asset classes.

Global stocks (as measured by the MSCI ACWI Index) fell 15.7% for the quarter and are down 20.2% for the year. The S&P 500 dropped 16.1% for the quarter and is also down 20% for the year, after being down as much as 25% through mid-June. Developed international markets (as measured by the MSCI EAFE Index) were down 14.5% for the quarter and 19.6% for the year. Emerging market stocks (as measured by the MSCI Emerging Market Index) held up a bit better, dropping 11.4% for the quarter and down 17.6% for the year.

Foreign equity market returns for U.S. dollar-based investors were hurt by the sharp appreciation of the dollar; the dollar index was up 6.5% for the quarter and 9.5% on the year. Conversely, a weakening dollar versus other currencies would benefit foreign asset returns, as we continue to expect over the medium term.

Core investment-grade bonds declined again in the second quarter, with benchmark Bloomberg U.S. Aggregate Bond Index (the Agg) dropping 4.7%. This puts the Agg down an incredible 10.3% for the year – its worst first half ever. In other segments of the fixed income markets, high yield bonds fell 9.9% and floating rate loans dropped 4.5% for the quarter.

As we have stated in the past, core bonds are not low-risk or defensive assets in an inflationary (rising interest rate) environment. Taken together with the equity market declines, this is by far the worst first-half performance for a traditional “60/40” balanced portfolio (60% S & P 500/40% Agg) in modern history, down 16.1%. The previous worst first half was 1962, down 12%.

Portfolio diversification into “nontraditional” asset classes, noncore fixed income market niches, and alternative strategies can particularly be valuable in an inflationary environment. We saw this again in the first quarter, and it continued in the second quarter. Private real estate along with private credit and equity have posted positive results so far in 2022. Our commodity investments, along with gold and our merger arbitrage fund, also provided diversification benefits over traditional stocks and bonds. These investments have served us well in our globally diversified portfolios.

Macro Backdrop: Recession Risk Continues to Rise as High Inflation Persists

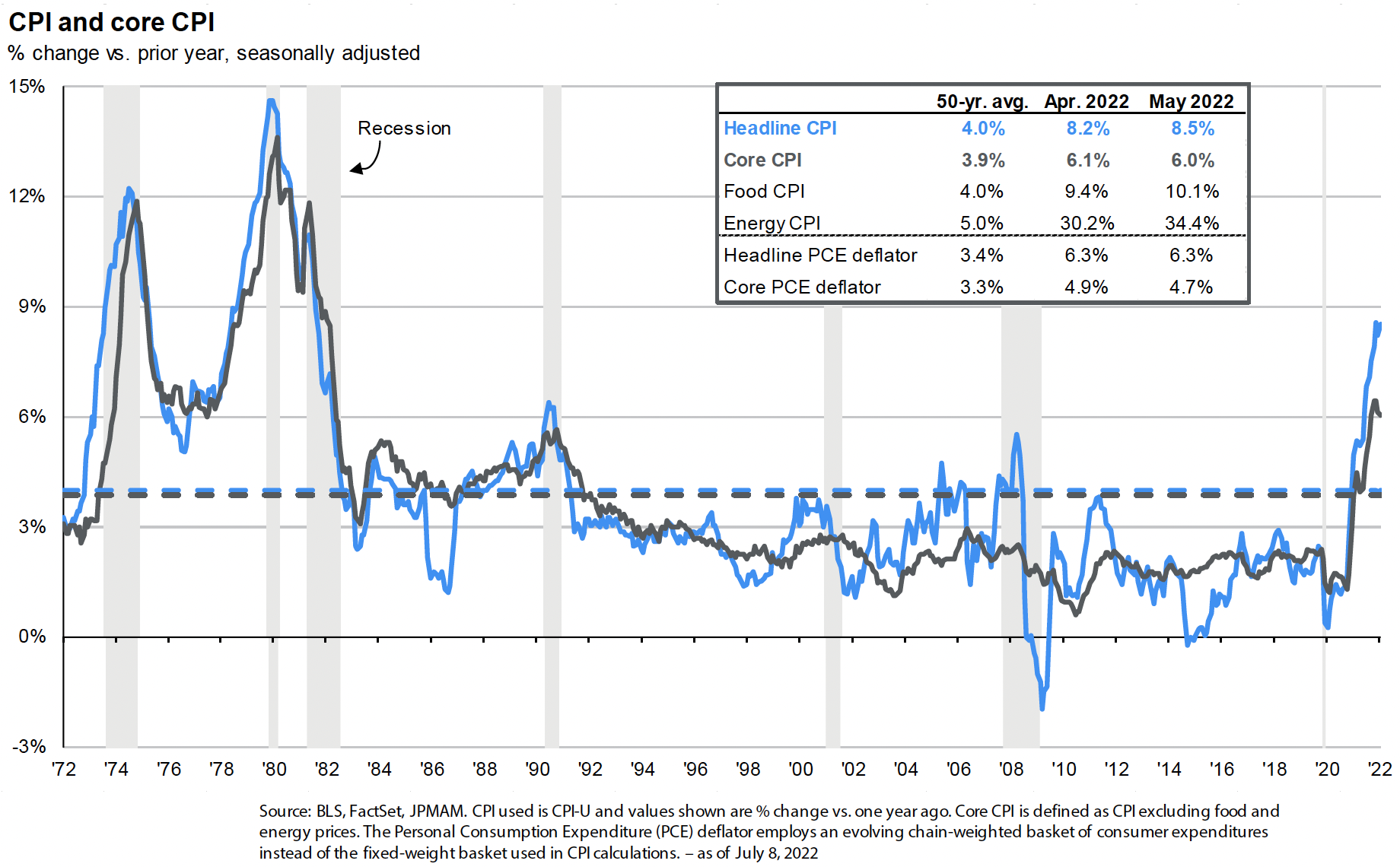

In our first-quarter commentary, we wrote that we remain cautiously optimistic, but inflation and recession risks have risen. Unfortunately, economic conditions have worsened since then. The key is inflation, which, counter to our earlier expectation, has not yet peaked. The May year-over-year headline CPI inflation rate (published in June) rose to 8.6% from 8.3% in April. The median (5.5%) and trimmed-mean (6.5%) inflation rates also rose in May, although core CPI (6.0%) dipped.

In response to the disappointing May inflation data, the Fed turned even more hawkish. At its June 15 FOMC meeting, the Fed hiked the policy interest rate (the federal funds rate) a larger-than-expected 75 basis points (.75%), to a range of 1.5%-1.75%. The Fed committee members also sharply raised their median forecast for the year-end fed funds to 3.4% (from a 1.9% forecast at their March meeting). This implies another 175 basis points of rate hikes over their next four meetings and would put the rate into a restrictive zone for the economy, i.e., well above the Fed’s 2.5% estimate of the neutral long-run equilibrium fed funds rate. The committee members also sharply downgraded their median forecasts for U.S. real GDP growth to a below-trend 1.7% for 2022 and 2023, reflecting their hope for a soft landing… but not recession.

A sharp economic growth slowdown in the U.S. and abroad is all but certain this year. The risk of a U.S. recession within the next 12 months continues to rise. Having said that, it is the severity of any potential downturn and its impact on corporate earnings across a range of reasonably probable scenarios that are relevant for our investment approach, not forecasting recession versus no recession. What we are certain of is that the business cycle has not been revoked; recessions are inevitable – as are recoveries.

Labor market conditions are no longer driving the Fed’s price stability and full-employment dual mandate. It’s now all about inflation, inflation, inflation. “We are absolutely determined to keep them anchored at 2%,” Fed Chair Powell said.

Tightening monetary policy leads to tighter financial conditions: higher interest rates, higher corporate bond yields (wider credit spreads), lower stock prices, and a rising dollar. Tighter financial conditions in turn depress consumer and business spending, reducing aggregate demand in the economy. Lower demand (lower GDP growth) should reduce overall price pressures and hence inflation. That’s the Fed’s playbook and tool kit.

This simple economic cause-and-effect assumes the supply side of the economy remains steady. However, this has not been the case due to (1) the Russia/Ukraine war’s impact on energy and agricultural commodities, and (2) COVID-related supply chain disruptions. We expect these exogenous shocks will recede with time. But the Fed can’t do anything about them. A soft landing has been made significantly more challenging by the events of the past few months.

There is abundant evidence that economic growth is slowing in the U.S. and abroad. Two widely followed monthly indicators are the Leading Economic Index (LEI) and the Purchasing Managers’ Index (PMI). Both have turned sharply lower – declining in each of the past three months – but still don’t (yet) indicate a recession is imminent, based on their typical historical relationship.

On the other hand, there are also several important economic indicators that remain strong, including job growth in May and June, a very low unemployment rate (3.6%), very low weekly unemployment claims (though starting to move higher), and consumer and corporate balance sheets that can support additional spending and borrowing. Given this strength, a recession in the next year is not inevitable.

Big picture: Balancing these and many other data points, our base shorter-term (6-to-12-month) economic outlook on the U.S. and global economy is for continued deceleration in economic growth driven by rapidly tightening monetary policy in response to sustained high inflation. A recession is a possibility but not a certainty. We are not economic forecasters. Much more relevant for us as investors is assessing the potential severity of any economic slowdown/recession and its impact on corporate earnings and interest rates and what is being discounted in asset prices. Our best guess at this point is that if the U.S. economy does fall into a recession, it is likely to be a more “normal” type of cyclical recession as compared with the 2008-2009 financial crisis, the 2000-2002 dot-com bubble burst, or the 2020 COVID recession. We are less certain about the severity of a recession, and as a result, we have not made a tactical move to further reduce our stock exposure based on a recession bet. The sharp stock and bond market declines we’ve already experienced this year lead us to a relatively positive medium-term (five-year) outlook for financial markets asset class returns and a slight overweight to equities.

Financial Markets Outlook and Our Portfolio Positioning

In short, if U.S. stocks drop further this year – due to increasing recession fears – we will look to add incrementally to our portfolio allocations as their medium-term expected returns improve. Alternatively, if we’ve already seen the market bottom for this cycle with the S&P 500 down 24% – for example, if the Fed engineers the fabled soft landing – our current moderately “all weather” portfolio positioning we expect to perform well in recovery.

Nevertheless, one might ask why we are not tactically reducing our equity exposure, since we view the risk of recession as materially higher now than we did a few months ago. The answer is that we believe stock markets in the U.S. and abroad have largely already priced in this risk with year-to-date declines of 20%-30%. As we’ve often stated, the key question for a fundamental investor is, “What’s in the price?” What consensus expectations and assumptions are implicitly being discounted in current market prices?

We’ll now focus on our current assessment and outlook for global equities and U.S. stocks.

We face plenty of issues today, but rather than believing a severe recession will play out, we expect this to be a more typical cyclical recession, where central bank (and fiscal) tightening in response to an overheating economy and rising inflation ultimately trigger a bear market and an economic downturn.

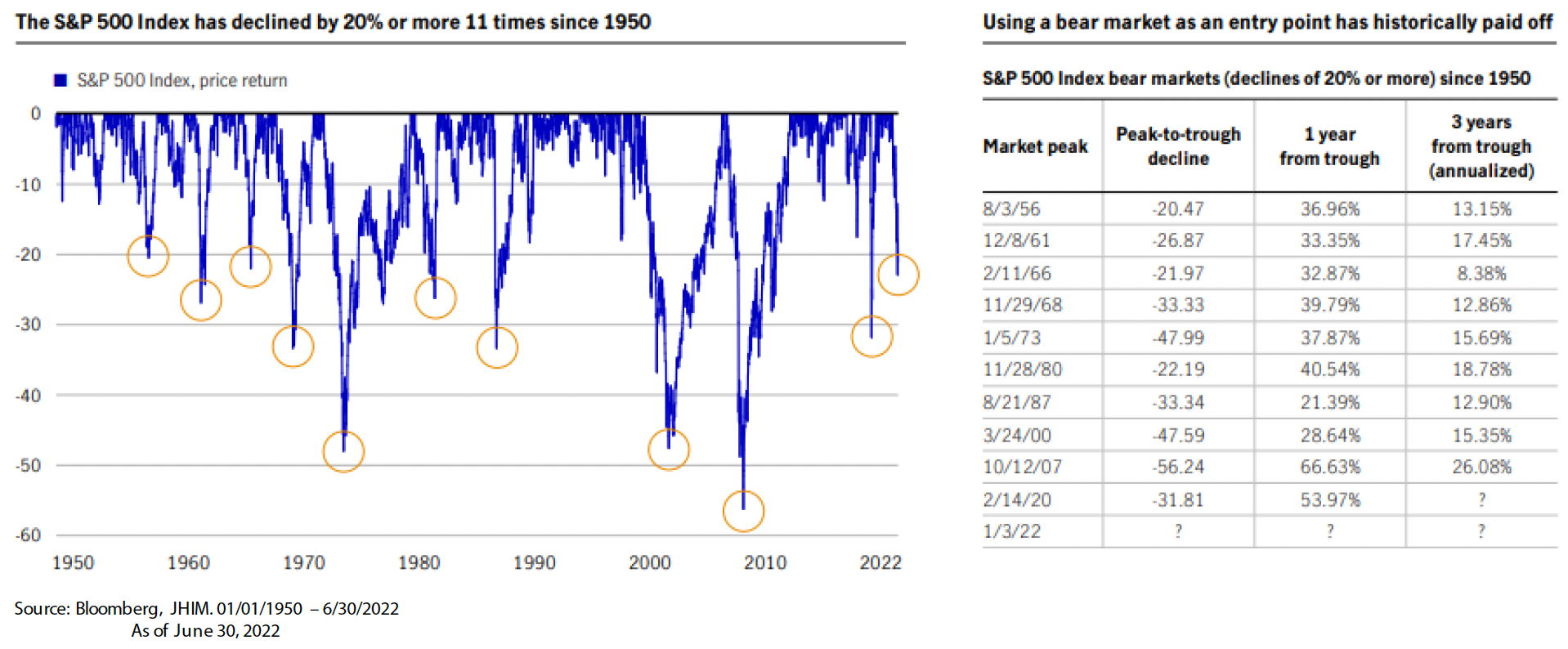

If so, that should set the stage for a subsequent cyclical recovery. And history can be a useful reference and reality check. We looked at all the U.S. bear markets since WWII and calculated the forward one-year and three-year returns of the S&P 500 starting from the peak through to trough decline, under the assumption that if we do have a recession, the market will soon take another leg down from here and we will start tactically adding to our U.S. equity exposure. There are not a lot of data points, but we think the following table supports prudent optimism for disciplined investors. On average, the market was up over 30% one year later and over 15% annualized three years later with a cautionary note that past performance may not be indicative of future performance.

The table also shows the additional losses the market suffered after the initial 25% decline on its way to its ultimate bottom during severe recessions, which we are not forecasting. There’s no denying the range of outcomes is very wide, with a few subpar outcomes during the extreme bear market periods. That is the reality of investing in stocks – they can be quite volatile and incur large short-term drawdowns. But in exchange for bearing that risk and that discomfort, they have historically provided investors with substantially higher long-term returns than have lower-risk asset classes.

The entire drop in the S&P 500 this year and then some has been due to valuation compression – a sharp decline in the “P” of the market’s P/E ratio. Earnings have grown while the market price level has declined. This has caused a nearly 30% reduction in the market’s 12-month forward P/E ratio, one of the sharpest valuation compressions on record. The valuation risk that we have been discussing for the past several years has finally normalized.

This is good news as it provides a better (lower) valuation base from which to compound returns looking out over the next five years; valuation should be much less of a medium-term return headwind, or no headwind at all, from current levels. Lower valuations may also provide some cushion, or margin of safety, if S&P earnings disappoint current expectations. As we write this in late June (with the S&P 500 around 3900), our base case five-year expected return range for the S&P 500 is 7%-12% annualized. This is in line with our long-term expectations for U.S. stocks, and it offers an attractive premium above the expected returns for core bonds.

Developed International and Emerging Markets

Our tactical views and positioning on international and emerging markets (EM) stocks have changed modestly. These markets have declined largely in line with the U.S. market this year, with EM doing a bit better. Our base case five-year expected returns for EM and developed international stocks are in the low double digits, supported by low starting valuations and cyclically depressed earnings. This offers a margin of safety for investors, as a lot of bad news and negative sentiment are already priced into these markets. Things don’t have to become absolutely great for international and EM stocks to generate strong returns from here – they just need to get better from currently depressed levels.

The U.S. dollar strength remains a substantial headwind for foreign stocks’ returns to dollar-based investors. We expect the dollar to remain strong in the short term and economic risks to remain elevated in Europe, and as a result, these are modestly underweighting developed international and emerging markets and keeping our slight overweight to U.S. equities. The monetary easing signal may also be the catalyst for a broad global rally. In that case, we would expect EM and developed international stocks to outperform the S&P 500, boosted by the tailwind of a depreciating U.S. dollar but also by those markets’ generally higher sensitivity (beta) to cyclical global conditions compared with the U.S. market.

China remains a key driver of overall EM economic and equity market performance. Due to its low inflation rate, China is in a unique position to be able to ease monetary/credit policy and take other steps to boost its economy and financial markets. We expect these stimulus measures to continue throughout the year. These measures should help support emerging markets generally, but they likely won’t be enough on their own to trigger an emerging market rally without a Fed policy pivot and reversal in the U.S. dollar.

Fixed Income

Coming into the year, we had been expecting interest rates to rise, putting continued pressure on core bond returns. That played out again in the second quarter, and fixed income returns were negative across the board. The benchmark 10-year Treasury yield rose from 2.3% at the end of March, peaked at 3.5% on June 14, and ended the quarter at 2.98%. Incredibly, the June high marked the highest 10-year Treasury yield since April 2011.

The recent losses for the bond market are painful, but the good news is that declining prices result in higher yields and higher future expected returns. We can’t rule out further price declines, but at current yield levels, the return potential for bonds has increased to attractive levels across most areas of fixed income. For example, core bonds (the Agg) at the end of the second quarter are yielding close to 4%, while municipal bonds are over 3%. These are levels we have not seen since 2018 and, prior to that, late 2009.

In terms of fixed income in our globally balanced strategies, we have maintained our significant underweight to traditional core bonds, reflecting concerns about rising interest rates and very low starting yields. With the recent rise in Treasury and municipal bonds yields, we plan on adding more core fixed income in our strategies by purchasing high-quality municipal bonds and Treasury bonds while maintaining some of our flexible credit strategies. We will remain modestly underweight to fixed income but will tactically add to it as rates rise.

Alternative Assets and Strategies

Well-managed alternative strategies with reasonable fees can add beneficial diversification and improve risk-adjusted returns as part of traditional stock/bond balanced portfolios. Alternative investments have different risk and return drivers than do traditional stock and bond investments. Given current macro risks and market backdrop, we think they are especially valuable.

We continue to favor private real estate investment allocations in multifamily, industrial, and self-storage. We expect equity-like long-term returns from these funds with built-in inflation protection and tax-efficient income generation. We also favor private equity and credit investments with carefully selected managers.

We do hold some marketable alternatives in the commodity and merger arbitrage category to provide further diversification and better upside potential than fixed income.

Closing Thoughts

It’s natural to be concerned about the current developments and worry about what the future holds. It always feels better when our investment portfolios are going up than when they are going down. Rest assured, we are carefully watching the current developments and will make changes when they are needed. We think volatility will continue for the remainder of the year, and we will take advantage of any price declines to improve our portfolio positioning. If the economy avoids a recession and the markets rebound, we are well positioned to benefit with our current allocation to equities and fixed income alternatives.

Our globally balanced strategies remain positioned with (1) a small overweight to global equities, coming primarily from U.S. large stocks, (2) core positions in alternative strategies, and (3) a modest underweight to fixed income but a larger position in core fixed income versus prior quarters. Our portfolios remain strategically balanced and well diversified across multiple global asset classes and investment strategies.

We sincerely thank you for your confidence and trust, and please do not hesitate to reach out to us if you have any questions.