Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

The S&P 500 fell 1.6% last week as markets continue to contend with an unprecedented backdrop of high inflation, an intensifying war in Ukraine, turmoil in the U.K., an energy crisis in Europe, and uncertainty in China. The most closely-watched piece of economic data last week was the inflation data for September, and the news wasn’t great—overall prices were up 8.2% YoY, with core inflation moving higher to 6.6% from 6.3% in August.

Fed participants have warned of “some pain” for months due to their policy campaign to combat high inflation. The past two weeks have indicated the pain is no longer hypothetical as fragile liquidity in U.S. markets and financial instability in markets outside of the U.S. have begun to emerge. As Fed Governor Neil Kashkari explained, however, the Fed cannot stop tightening because the Fed is the reason longer-term inflation expectations are low. The Fed has signaled further tightening, he noted. Expectations will surge if the Fed does not follow through, he said. We agree.

Eventually, however, there will be a meeting where the Fed bumps its rate forecast and triggers a financial market break that reprices risk enough to achieve the Fed’s desired slowdown in GDP and level of unemployment. When that happens, they will stop tightening. Until then, the hikes will keep coming as long as the factors underlying core inflation remain intact.

This week’s key economic data release is the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials, including governors Jefferson, Cook, and Bowman, and presidents Bostic, Kashkari, Evans, Bullard, and Williams. However, after two weeks of Fed commentary, we doubt there will be any additional meaningful commentary to surface this week.

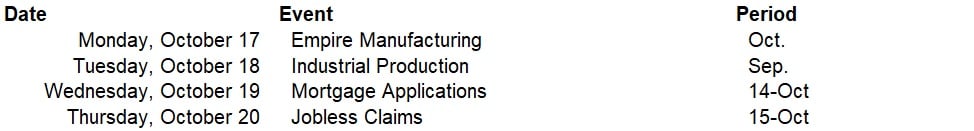

Data deck for October 15 - October 21: