In 2001, the British rock band Coldplay released a single titled “Don’t Panic.” The track opens with an acoustic melody and the lead singer, Chris Martin, singing in his characteristic falsetto voice the decidedly dystopian lyrics:

Bones sinking like stones

All that we've fought for

Homes, places we've grown

All of us are done for

The stock market seems to be reflecting a similar dystopian sentiment in reaction to news of the spreading coronavirus. On Friday, the Dow Jones Industrial Average plummeted 603 points, a loss of 2.1%. The S&P 500 dropped 1.8%, wiping out all its gains for the year. The tech-heavy Nasdaq, helped partially by a surge in Amazon after the company beat earnings estimates, fared slightly better, dropping 1.6% on Friday. With the outbreak and spread of the coronavirus, are “all of us done for” as the opening lines to the Coldplay song suggest?

Investors may not be fully panicking just yet, but they’re clearly becoming increasingly alarmed. The stock market initially shrugged off the news of the outbreak, posting only a slight decline before recovering. But now, investors’ concerns have intensified and the selling pressure has picked up as a result. What prompted the change in sentiment? On Friday, China’s health authorities confirmed that there have been 10,000 cases of infection and the death toll at that point had risen to more than 210 people. The three major U.S. airlines, Delta, United, and American, announced they were suspending flights to China. The U.S. government declared the outbreak a national health emergency. On Thursday, the World Health Organization held an emergency meeting and declared the outbreak to be a public-health emergency of international concern. The U.S. State Department issued a travel warning advising Americans not to go to China and urging those in China to consider leaving. The first person-to-person transmission was reported in the U.S.

The Chinese authorities, after a slow response to the initial outbreak, seem to now be in full panic mode, locking down tens of millions of people. Wuhan, the epicenter of the outbreak, with 11 million people, has been essentially shut off from the rest of the world. They are building hospitals from scratch in as little as two weeks, preventing citizens from traveling to other cities, fumigating apartments, and roaming the streets with loudspeakers announcing warnings about the virus. Is it any wonder that investors have suddenly become alarmed?

From a human standpoint, the toll the virus has taken on those who have died or have fallen ill is tragic, of course. The outbreak has the potential to become a global pandemic, which could have dire consequences in terms of both its economic impact and human toll. But, while we certainly don’t want to minimize the impact of the crisis to date, or its potential future impact, based on what we know so far, we would suggest that now is not the time for investors to panic.

How bad could it get?

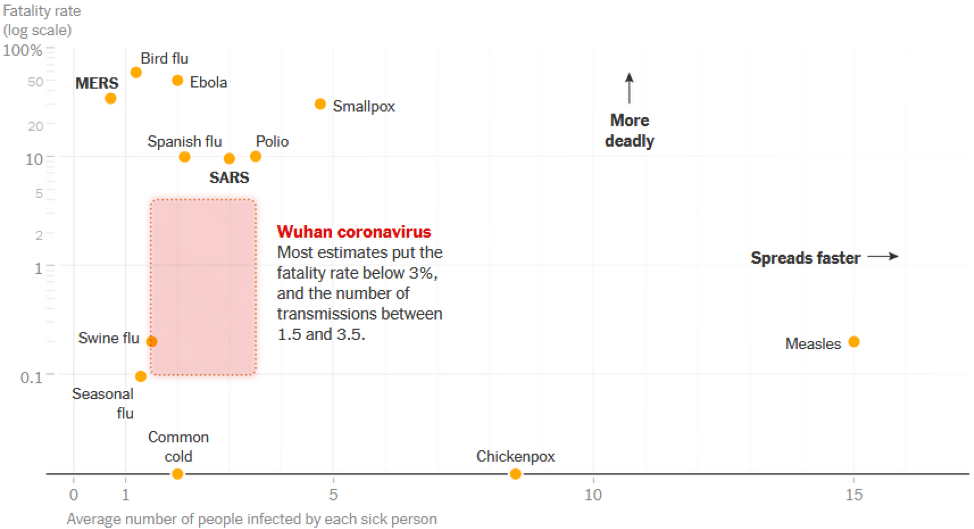

The New York Times wrote an article over the weekend that provided some helpful guidance as to how bad the outbreak could get. The scale of an outbreak is related to how quickly and easily the virus can be transmitted. Based on the assessment of researchers so far, the coronavirus appears to be moderately infectious. The initial thinking was that it was about as contagious as SARS, which sickened 8,098 and killed 774 people, although more recent reports suggest that it’s spreading faster than SARS. Scientists estimate the fatality rate of the coronavirus is about 3%, which is less than the 10% fatality rate of SARS. The coronavirus has already eclipsed SARS in term of the number of people who have fallen ill, which currently stands at 14,000 in 23 countries, but the number of those killed is lower at 300. For now, SARS seems to be about the best guide we have for estimating the potential impact of the coronavirus. However, if the coronavirus turns out to be more infectious than SARS, and spreads faster, it could turn out to be more like influenza. Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Disease, believes the coronavirus will almost certainly become a global pandemic, defined as an epidemic on two or more continents. According to the New York Times, some epidemiological models suggest that the actual infection rate could be more like 100,000 already, which is much greater than SARS or MERS, but less rapid than the flu or measles. As the following diagram indicates, MERS, Bird flu, and Ebola were all more deadly, though less infectious than the coronavirus.

Source: New York Times, “How Bad Will The Coronavirus Outbreak Get? Here Are 6 Key Factors”

The Spanish flu in 1918 was much less deadly than SARS, killing only 2.5% of those infected, versus 10% for SARS, but because it spread so much more quickly than SARS, it resulted in an estimated 20–50 million deaths. But, then again, our ability to control infectious pathogens in 1918 was quite a bit different than in 2020.

The economic and financial market impact

Given our interconnected world, there is no question that the virus’ spread will have an effect on the global economy. With the epicenter of the outbreak in Wuhan, and the virus spreading initially to other parts of China from there, China’s economy will be hit the hardest. According to Bloomberg, China’s economy has quadrupled since the SARS outbreak in 2003. China now represents 17% of global GDP. It’s the largest market for cars, semiconductors, and international tourism. It’s the largest exporter of clothes and textiles and a key manufacturer of personal computers. Nearly all of Apple’s iPhones are made in China. China plays a key role in the global supply chain for many companies globally. McDonalds has shut down all of its restaurants, Starbucks has shut down nearly all of its stores, and Disney’s theme parks are closed in China and Hong Kong. Airline travel is has fallen off sharply due to a downturn in demand. Consumer spending, which grew at 5.5% in the fourth quarter of 2019, is forecast to be cut by half in the first quarter of this year.

Economists estimate that with the slowdown in consumption, investment, and manufacturing, China’s GDP growth could slow from the 6% rate it grew at in 2019 to as low as 4.5% in the first quarter of 2020. The slowdown could be offset somewhat by a new fiscal stimulus program launched by the Chinese authorities, but it’s hard to estimate what the impact of that might be. Hong Kong and South Korea are likely to be most affected by China’s slowdown. GDP growth in Germany and Japan is forecast to slow by 0.2%, while GDP growth in the U.S. and the U.K. is estimated to be 0.1% lower. Some economists have indicated that the overall reduction to global GDP growth could be as much as 0.25% to 0.50%. That’s a significant reduction with world GDP growth forecast to rise 3.5% in 2020. Of course, the ultimate impact on China’s economy and the overall global economy depends on how long the outbreak lasts and how severe it becomes. SARS, which began in March of 2003, was largely contained by July, which is a relatively short period of time and thus encouraging as a guide to what might happen this time.

With the coronavirus outbreak impacting China’s economic growth – and given China’s role as a leading driver of global growth, and global GDP growth overall by extension – how are markets likely to react?

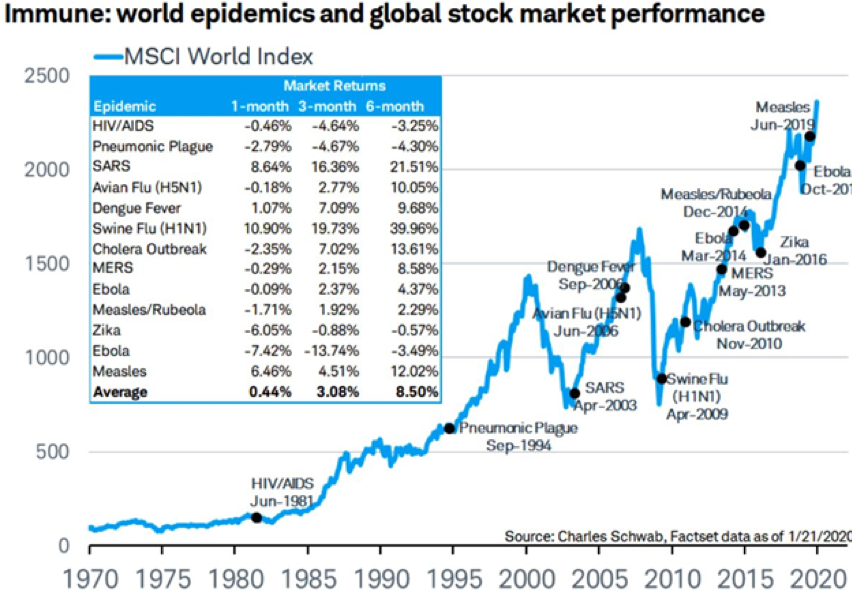

As the following chart illustrates, the impact of the last 13 worldwide epidemics on global markets indicates that the impact has been modest. Market returns over 1-month, 3-month, and 6-month periods have actually been positive, on average. The returns for certain epidemics, such as HIV/AIDS and Ebola, for example, were negative, but modestly so. The market returns in the wake of SARS, which as we pointed out is probably the best model for the potential impact of the coronavirus we have at this point, were strongly positive.

What steps are we taking to address this risk?

Our investment team has been focused on this risk from the very beginning of the outbreak. We identified this issue as one of several potential risks faced by the financial markets in 2020. Our Investment Committee, which meets formally on a weekly basis, and is engaged in communication on a daily basis, has been conducting ongoing research on the potential impact of the outbreak. We have held discussions about what steps, if any, we should take to address this risk. Based on our research to date, some of which is summarized here in this piece, our conclusion so far has been to deliberately not react in a knee-jerk fashion, but rather stay the course with our existing portfolio allocation. The reason we feel it would be a mistake to take action at this point, despite the seemingly worsening situation, is because, as the analysis of past epidemics indicates, we think this one will eventually be contained and the economic and financial market impact will be short-lived. Just as the case was with SARS, we think the impact of the coronavirus will be limited. Moreover, we feel that our current portfolio allocations are appropriate for dealing with risks such as this. We have already put various defensive measures in place in our asset allocation strategies that are designed to help deal with these risks. Knowing that we faced many risks, besides simply this one, including ongoing tensions with Iran, a flare-up of the trade war again, an unfavorable election outcome (unfavorable at least by the standards of business and investors’ interests), a tumultuous Brexit process, rising tensions with North Korea, and any number of other possible and even unforeseen events – we deliberately added defensive positions (to complement offensive positions) in our strategies. These defensive positions, which we have outlined before in our recent quarterly commentaries, include, for example, holding cash, U.S. T-bills and notes, investment-grade fixed income, defensive equities, non-correlated (or less-than-perfectly correlated) alternative investments, and gold. As outlined in our most recent quarterly commentary, “Terra Incognita,” despite our generally optimistic base case scenario for 2020, we have deliberately maintained these defensive positions in the portfolio as a hedge against the various risks and alternative scenarios that may unfold.

Don’t Panic

As the Coldplay song “Don’t Panic” continues, the lyrics shift from their initial negative theme to a decidedly upbeat sentiment:

We live in a beautiful world

Yeah we do

Yeah we do

We live in a beautiful world

While a world where tens of thousands are sickened or killed each year from infectious pathogens like SARS, MERS, Ebola, the seasonal flu, and the coronavirus, may not be always seem like “a beautiful world,” if history is any guide, with the ability to contain the virus and limit its toll, as was the case with SARS, the future certainly seems a lot brighter than investors currently think. Rest assured that we are monitoring this crisis carefully and should the situation worsen, we will take decisive action to preserve and protect our clients’ capital. For now, however, our advice would be, “Don’t Panic”. Stay the course. This too shall pass.

As always, we appreciate your confidence in us. Please don’t hesitate to reach out to your wealth advisor for questions.