3 minute read

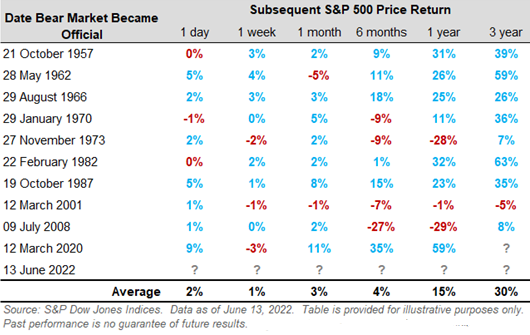

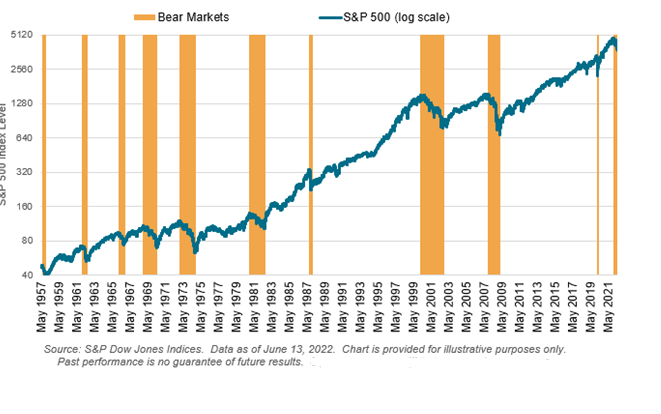

The S&P 500 officially entered “bear market” territory after flirting with it in the month of May. This is now the eleventh bear market for the S&P 500 since it was first created back in 1957, and the first since March 2020. In the last few days the S&P 500 has experienced declines of -1.08%, -2.38%, -2.91%, and -3.88%, for a whopping -10.25% correction. As noted in our most recent The Week Ahead – The Same Story… On Repeat, last week’s hot CPI reading has the market pushing the Fed to update their interest rate outlook. The futures market is now pricing in a 3.6% fed funds rate by December 2022 where prior it was at 2.8% which is still higher than the Fed’s estimate of a neutral rate at 2.5%. As goes the Fed, so do interest rates. This week, in one day, the 10-year U.S. Treasury rose from 3.15% to 3.43% and the 2-year U.S. Treasury jumped from 3.06% to 3.40%!

Investors have experienced a years’ worth of adjustments–both in terms of interest rates and equity moves–in just four short days. This reset has been startling quick even with the volatile year that we’ve had so far. We’ve highlighted the current regime change that has been on going over the course of the year: Negative/low interest rates to rising interest rates. Quantitative easing to quantitative tightening. Low inflation to elevated inflation. A supercharged economy to a more normal economy.

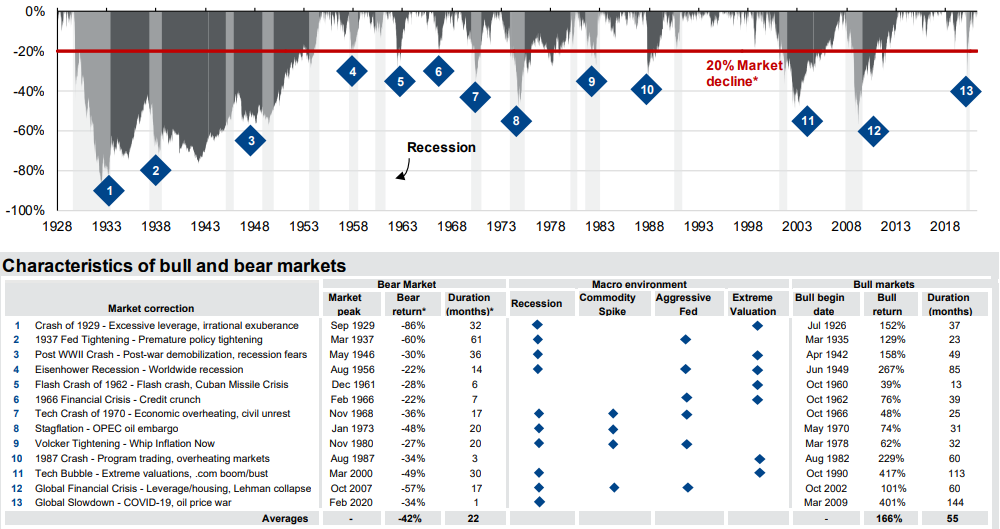

Recession odds have continued to increase as the landing zone for a so-called soft landing by the Fed has shrunk considerably. A look back at past bear markets shows that half the time an overly aggressive Fed was a cause for a recession. Only time will tell as the Fed has continued to play catch up in the near-term. Markets, alongside the Fed, are continuing to look for peak inflation.

It’s natural for investors to fear volatility and uncertainty. Every bear market and crisis is different in nature however innovation and perseverance has always been constant. With so much liquidity in the financial system today, our base case for a domestic recession by year-end is still off the table. In the event we do enter a recession in 2023, history also shows the U.S. has done pretty good, batting 100% in recovery. As we look ahead, it is important to remember: Bear markets recover.