10 minute read

After a strong first half of the year, global equities faced several headwinds in the third quarter. Oil prices surged nearly 40% between mid-June and late September; Treasury yields have pushed to new cycle highs as the Federal Reserve has maintained a restrictive policy stance, which in turn has boosted the U.S. dollar. The S & P 500 Index reached a 2023 high at the end of July, but from its intra quarter high the index declined 6.3% through the end of September. This was the second meaningful decline this year; the S & P 500 fell 7.5% in February and March during the regional banking crisis. Despite the decline in third quarter, the index is still up 13.1% year to date.

Small-cap stocks (Russell 2000 Index) also had momentum early in the quarter but changed course and ended the quarter down 5.1%. Year-to-date, small cap stocks are still up 2.5%, but meaningfully trail large caps. On a style basis, growth stocks lagged value stocks during the quarter.

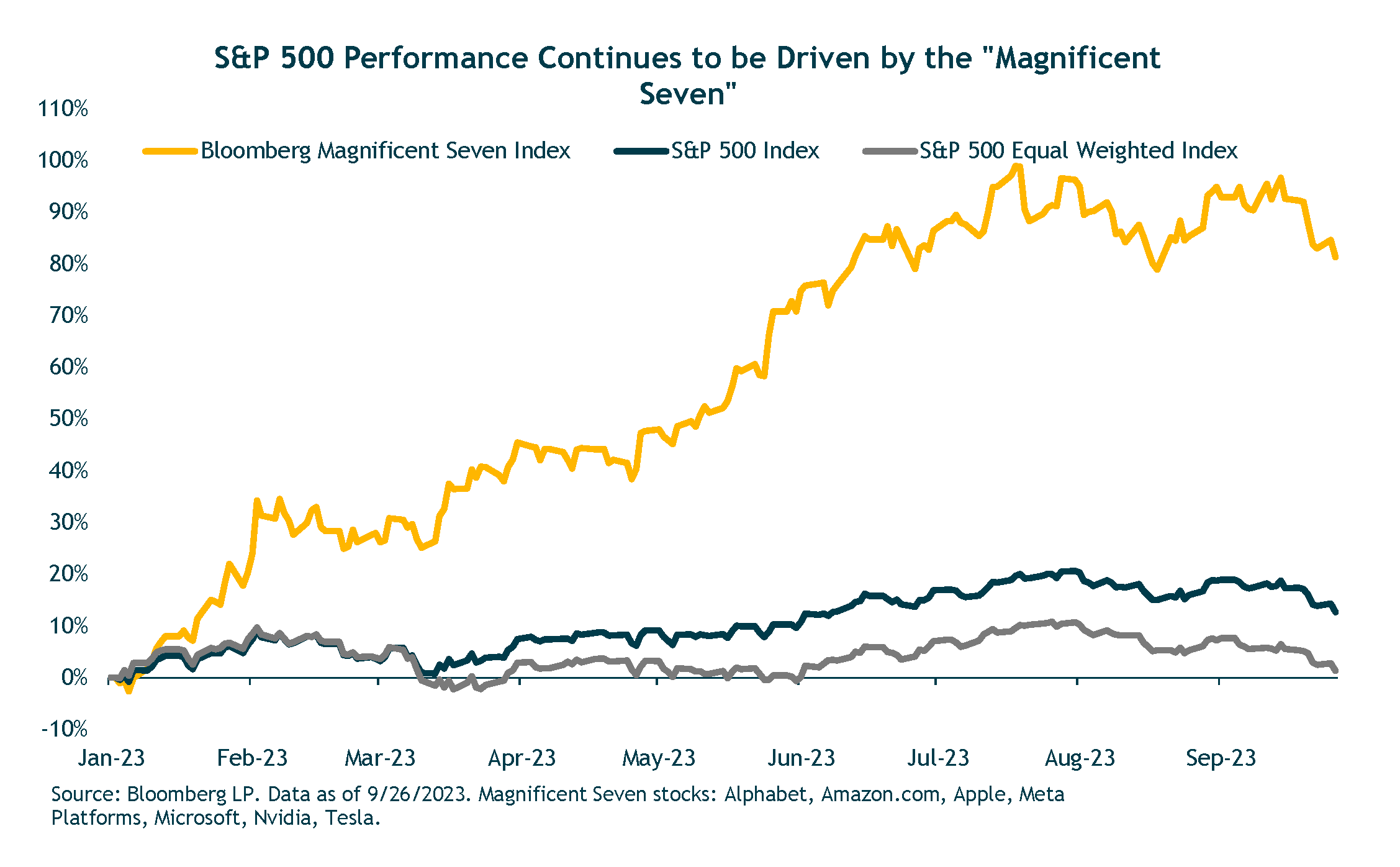

Stock gains have remained unusually narrow, with the largest stocks in the index leading the way. The standout performers are those sectors with the largest stocks while most other sectors have been relatively flat. Consumer discretionary has been driven higher by a 51% gain from Amazon and a 103% return from Tesla. The information technology sector has outperformed thanks to Apple (32%), Microsoft (33%) and NVIDIA (198%). Communication services has been propelled higher by a 48% return for Alphabet and 149% from Meta Platforms. These seven stocks make up the “Magnificent Seven” that account for the majority of year to date returns of the S & P 500. The equally weighted S & P 500 index is roughly flat this year in comparison.

Within foreign markets, developed international stocks (MSCI EAFE) declined 4.1% in the quarter, and are up roughly 7.1% year to date. Emerging markets stocks (MSCI EM) fell 2.9% in the quarter are are up 1.8% this year through September. The U.S. dollar surged over 3% during the quarter, resulting in a headwind for foreign markets. Both developed international and emerging markets stocks outperformed the S & P 500 in local currency terms but underperformed after converting returns to U.S. dollars.

Moving to the fixed income markets, core bonds (the AGG) fell 3.2% in the quarter as interest rates rose. The benchmark 10-year Treasury yield climbed nearly 70 bps in the quarter, ending the period with a 4.59% yield, the highest level since 2007. High yield bonds managed to eke out a small quarterly gain and are up 6% for the year.

Finally, our alternative strategies which include real estate, private credit and equity have outperformed core bonds for the year but have underperformed equities right in line with our expectations.

We are pleased with our Global Asset Allocation strategies as most have outperformed their strategic benchmarks for the year. Absolute returns were positive across the board, with higher returns from our more growth-oriented strategies as would be expected in a strong period for equity returns. There never being any guaranty as to future profits, based upon current conditions, we remain confident that our investment approach will lead us to opportunities which will serve our clients well over the long term.

Macro Outlook

The big questions remain – are we going to have a soft landing or a hard landing, and the timing. The answer will likely lead to meaningfully different market outcomes. If the Fed can manage to guide the economy to a soft landing, we would expect to see the market’s gains broaden out to beyond the large-cap technology related sectors. Conversely, a hard landing would likely lead to further declines.

We believe both growth and inflation have peaked. We expect growth to slow and inflation to continue to contract. This year’s broad based economic resilience will likely give way to weakness next year as sources of fiscal support diminish and the delayed effects of tighter monetary policy exert a stronger influence on the economy. With tighter money and credit conditions, it’s likely that the impact of higher rates is just at the beginning, and we expect it will be a drag on consumers and corporations. Higher rates should result in less spending, which eats into consumption. Bank lending should remain constrained in the near to intermediate term further constraining growth.

We maintain our view that the most likely outcome over the next few quarters is a mild recession. Historically, the odds are unfavorable for the economy avoiding a recession after the Fed has been aggressively tightening. And we have yet to see the full (lagged) impact of this cycle’s monetary tightening on the real economy. There have been three instances out of 13 where the Fed tightening cycle ended without a recession. We don’t expect a severe 2008 or 2020 type of recession. Household and corporate balance sheets appear to be in good shape and raising rates to 5% the Fed now has room to cut them again in the next recession, which should soften any downturn.

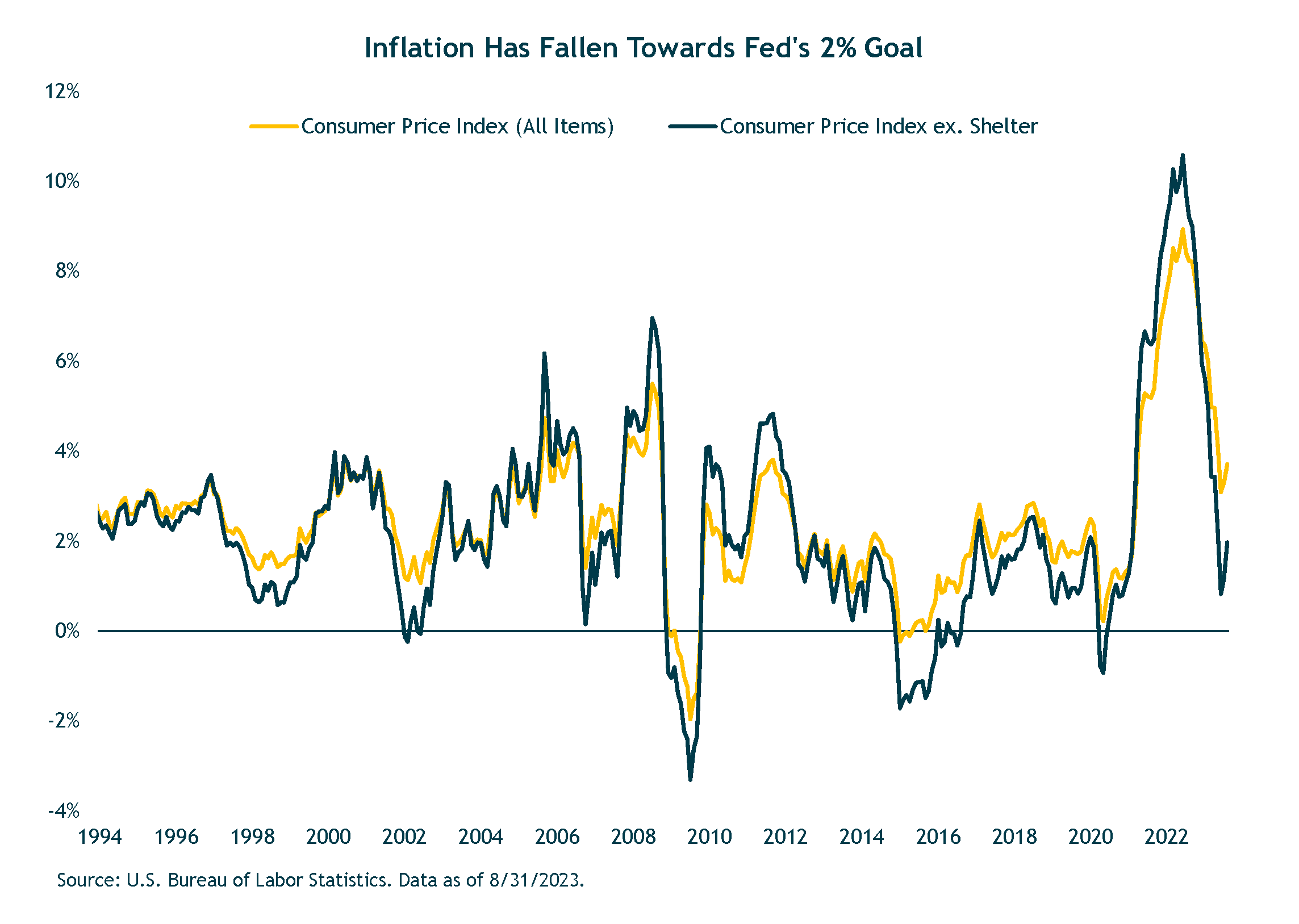

Inflation Has Peaked

The good news is that inflation has come down meaningfully from its June 2022 high of 9.1%, thanks in part to the Federal Reserve’s rapid rate hikes. At this point, it seems that the rate hikes are close to an end. In late September, the Federal Reserve maintained the target range for the federal funds rate at a 22-year high of 5.25%-5.5%, following a 25 bps hike in July. The September pause was in line with market expectations. But Fed Chair Powell signaled there could be another hike this year saying that the FOMC cannot allow inflation to get entrenched in the U.S. economy, and they will do what it takes to get it down to their target of 2% over time. The most recent year-over-year inflation number was 3.7%, still higher than the Fed’s long-term target but meaningfully lower than the June peak. Projections released in the Fed’s dot plot showed the likelihood of one more 25 bps increase at the November meeting, then two cuts in 2024.

While the Fed continues to be concerned about inflation, there are signs that the effects of Fed policy are working their way through the system. We believe that the Fed has gotten the upper hand on inflation and the lasting impact that the pandemic had on prices due to supply shortages and the dramatic shift in consumer behavior is clearly over. With the recent surge in Treasury yields, we think the Fed is done raising rates.

The chart below shows the year-over-year inflation and year-over-year inflation excluding shelter costs, which is a key CPI input. While year-over-year inflation came in at 3.7%, the number declines to 1.97% when excluding shelter. We also look at more recent trends by annualizing the latest six months of inflation data, to get a sense for shorter-term trends. Annualizing the latest six months, inflation is 3% and inflation ex-shelter is 1.8%. These levels are not far from the Fed’s goals, and suggest that the Fed’s policy has been working, and with time inflation will continue to fall, as shelter continues to decline.

Economic Growth Has Peaked

So far this year, the global economy led by the U.S. has shown remarkable resilience despite one of the most rapid tightening cycles in modern history. We believe that growth has peaked and expect resilience to turn into weakness as growth slows later this year and into 2024. Fiscal headwinds – especially in the U.S. – will soon come into play. We think that monetary policy is still working. And at this late stage in the economic cycle, credit conditions are likely to tighten further. This will further weigh on business investment, capex and consumer spending.

A U.S. recession is not a certainty but weighing the evidence we believe a mild recession is still the most likely outcome.

Financial Markets Outlook and Portfolio Positioning

Just as the U.S. economy has been more resilient than expected so has the U.S. stock market. The aggressive hiking cycle that started roughly 18 months ago was put on pause in late-July. Since March 2022, the Federal Reserve increased rates from zero to a target level of 5.25-5.5%. Around the same time that the Fed hiked for what might be the final time in this cycle, the S & P 500 hit an intra-year high and started to decline. Since the end of July, the S & P 500 has fallen 6.3%. The index remains up a solid 13.1% so far this year – defying many expectations in what was widely anticipated to be a year in which the economy hit the skids.

Last year the S & P 500 profits fell by nearly 13%. The consensus going into 2023 was for a recession and that profits would likely fall further. With the recession having been avoided so far, profits are showing signs of troughing and improving. The third quarter should show improvement and the fourth quarter expectations has the potential for year over year growth in double digit range.

Better than expected profit growth in recent quarter has been bolstered by strong revenue growth. S & P 500 sales are growing at a double-digit pace thanks to a stronger than expected consumer and price increases that are still being pushed through. Profit margins have fallen back to 10%, which was where they stood prior in 2019. But despite lower margins, companies can continue to have decent earnings growth if revenues remain robust. Not until there is a recession will revenues and GDP take a hit.

If the FED has paused, what’s next for equities? Historically, the track record for what happens for stocks over the next 6-12 months following a pause in a tightening cycle is mixed. Equity returns have differed depending on the inflation environment. Because of higher inflation, the Fed will typically maintain a more restrictive policy – take longer to pivot and cut rates. On the other hand, when inflation is not elevated, the Fed can move to a more accommodative stance much sooner. Today, inflation remains elevated but on a clear path downwards. However, the S & P 500’s current 7.5% drawdown that started right around the day of the final rate hike could be a sign that equity markets are finally starting to believe the Fed’s “higher for longer” mantra.

Our assessment is that the market is fairly priced and that earnings will grow at a slow pace over the next year given the headwinds of a slowdown and higher rates. As a result, we believe the easy money has been made and U.S. equity returns will be modest over the next 6-9 months, and we may take some profits where appropriate.

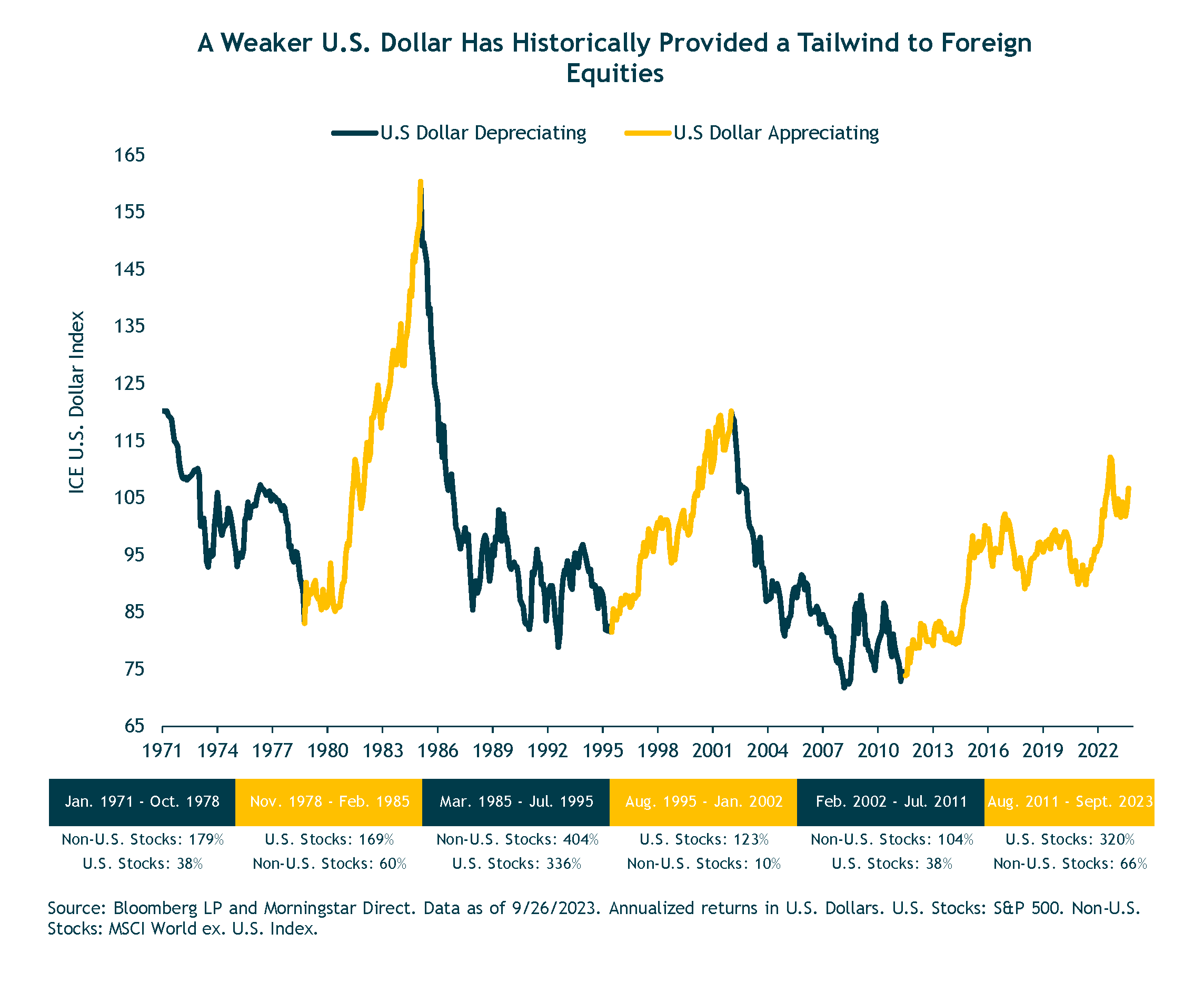

Foreign markets are much less expensive than the U.S. market – reflecting low earnings expectations and depressed sentiment. The U.S. dollar appreciated 3.1% during the quarter and was a major headwind for foreign assets. The appreciating US. Dollar has been a significant deterrent for international stocks (see chart). In the current regime of U.S. dollar strength that started in 2011, U.S. stocks have significantly outperformed foreign stocks. There was short reprieve from dollar strength from 2017 into early 2018 during which European stocks outperformed by near four percentage points and emerging-market stocks did nearly 20 percentage points better. When the dollar declines again, we would expect foreign equities to outperform – much like other cycles over the past 50 years. We are modestly overweight international developed and underweight emerging market stocks.

Fixed Income Outlook

One of our key changes last year was our significant increase in core bonds as a result of the rise in interest rates which made bonds much more attractive from a risk and return perspective than they had been in years. With the recent rise in Treasury and Municipal bonds yields to levels not seen since 2018 and prior to that 2009, we have significantly increased our core fixed income by purchasing high quality municipal bonds and Treasury bonds while reducing our credit risk. Inflation and Fed policy continue to be major drivers of bond market returns. The Bloomberg U.S. Aggregate Bond Index is currently yielding 5.4%, which is above the current 3.7% inflation rate. So, bonds are finally providing a positive real (after inflation) yield. This looks very attractive and can offer downside protection in our balanced portfolios in the event of a recession. The outlook for fixed income looks compelling given starting yields and a slowing economy.

Alternative Strategies

Our alternative strategies are a large part of our globally diversified portfolios. They were a bright spot in 2022 in an otherwise difficult year for stocks and bonds. Alternatives may provide long-term benefits and non-correlated returns to traditional stocks and bonds and improve risk adjusted returns of balanced portfolios. Our baseline scenario of slower growth and inflation continuing to decline make them especially valuable in a globally diversified portfolio.

We favor private real estate investment allocation to multi-family, industrial and self-storage and selected grocery anchored centers. The objective is to provide built in inflation protection and tax efficient income while receiving above average returns. We also like selected private credit and equity opportunities.

Closing Thoughts

While a recession is still a likely outcome, it may be a mild one given the strength of the labor market, ample household savings and solid business balance sheets. The Fed’s response will also be critical in terms of the timing and magnitude of when it starts cutting rates.

Given the range of outcomes, we expect more volatility, and we think it will be more important than ever to keep our pencils sharp and be ready to take advantage of market dislocations. The shorter-term turbulence and discomfort usually result in better opportunities and better long-term returns. We continue to believe that taking a disciplined long-term view is the path to successful investing. We will maintain a balance of offense and defense, seeking attractive opportunities.

Outside of the U.S., we already see attractive medium-term expected returns from international stocks. A declining dollar, as we expect would further fuel non-US equity returns.

The outlook for fixed income looks compelling given starting yields and a slowing economy. We expect mid-single digit or better returns. Core bond will also provide downside protection in the event of a recession. Our alternative strategies should also provide resilience to our portfolios.

We sincerely thank you for your confidence and trust in us, and please do not hesitate to reach out if you have any questions, comments, or concerns.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by First Foundation Advisors (“FFA”)), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from FFA. No amount of prior experience or success should be construed that a certain level of results or satisfaction be achieved if FFA is engaged, or continues to be engaged, to provide investment advisory services. FFA is neither a law firm nor a certified public accounting firm and no portion of the commentary should be construed as legal or accounting advice. A copy of FFA’s current written disclosure statement discussing our advisory services and fees is available for review upon request, or at www.firstfoundationinc.com. Please remember that if you are a FFA client, it remains your responsibility to advise FFA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general information/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your FFA account holdings correspond directly to any comparative indices or categories. Please Note: FFA does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to FFA’s website or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.