8 minute read

The economy is off to a strong start, as it’s experiencing the powerful effects of broad vaccinations and fiscal and monetary stimulus. The road to recovery has been uncertain over the past year, but with the combination of vaccine progress and unprecedented stimulus, the economy is showing signs that the road to recovery is more like an express lane; recovery is accelerating and is likely to continue to do so for several years.

Global stock markets celebrated the one-year anniversary of the pandemic-induced bear market low (March 23, 2020) with another strong quarter of returns. The S&P 500 gained 6.3%, developed international stocks rose 4.5%, and emerging markets gained 4%. From the low on March 23, these benchmarks are up an astonishing 80.6%, 74.8%, and 74.6%, respectively. In fact, the S&P 500’s one-year return from the low was its best since 1936. Clearly, it paid not to panic and get out of the markets last spring, despite the natural fear, anxiety, and uncertainty that everyone was feeling at the time.

The first quarter also saw a continuation of the “reflation rotation” trend that has been happening over the past several months. Specifically, smaller company stocks have outperformed large caps, with the Russell 2000 Index gaining another 12.8% in the first quarter. And value stocks maintained their edge over growth stocks for the quarter. Commodity investments also delivered another strong quarter.

The reflationary trend tore through the fixed-income markets as well. The benchmark 10-year Treasury jumped nearly 75 basis points from year-end to close the quarter at 1.74%, a 14-month high. The core bond index lost 3.6% for the quarter. This is its worst quarter since 1981. Core municipals did better, with a loss of 0.3%. On the flip side, credit strategies benefited from the reflation trend, as high-yield bonds and floating-rate loans turned in a positive quarter.

The broad reflationary market trends in the first quarter had a positive impact on portfolio performance. Our strategic position to be underweight on core bonds in favor of credit strategies added meaningful returns over the Barclays Bond Index, a key benchmark. Our positions in alternative strategies also outperformed core bonds by a wide margin. On the equity side, we are pleased with our U.S. equity performance, while our international managers were in line with benchmarks. Overall, our balanced portfolios delivered a solid quarter of performance. While we are confident in our investment approach and pleased with the overall first quarter performance, there is no assurance as to future profits or that we will meet or exceed benchmarks.

The Macro Backdrop

As mentioned, early signs clearly show that the recovery is accelerating, suggesting a faster return to normal than many would have dared to publicly proclaim a few months ago. Remember, this virus was new, and so much was unknown about its impact. But cutting through the noise, we have remained focused on two key variables since the pandemic began: (1) the progress of the vaccinations and (2) the monetary and fiscal response.

Substantial progress on vaccines is reason for optimism. Over the past two months, the United States has seen a very sharp decline in daily new cases of, current hospitalizations for, and daily new deaths from COVID-19. Meanwhile, the rate of COVID-19 vaccinations has soared to over 3 million doses per day. At the current pace, experts estimate the United States could achieve herd immunity by late summer.

From an economic perspective, getting the pandemic under control will allow the reopening of the economy. This will allow increased activity, employment, household income, consumer spending, economic growth, and corporate earnings. Overall, the light at the end of the pandemic tunnel certainly appears to be getting brighter.

Economic Data Heating Up

While we still have some distance to travel in overcoming the pandemic, economic data is perhaps just finding its way into the express lane, as the latest data points from March suggest that a robust recovery is already underway.

The ISM Manufacturing Index for March came in at a 37-year record high of 64.7, blowing past an expectation of 61.5.

March light-vehicle sales came in at 17.7 units annualized, their strongest reading since 2017.

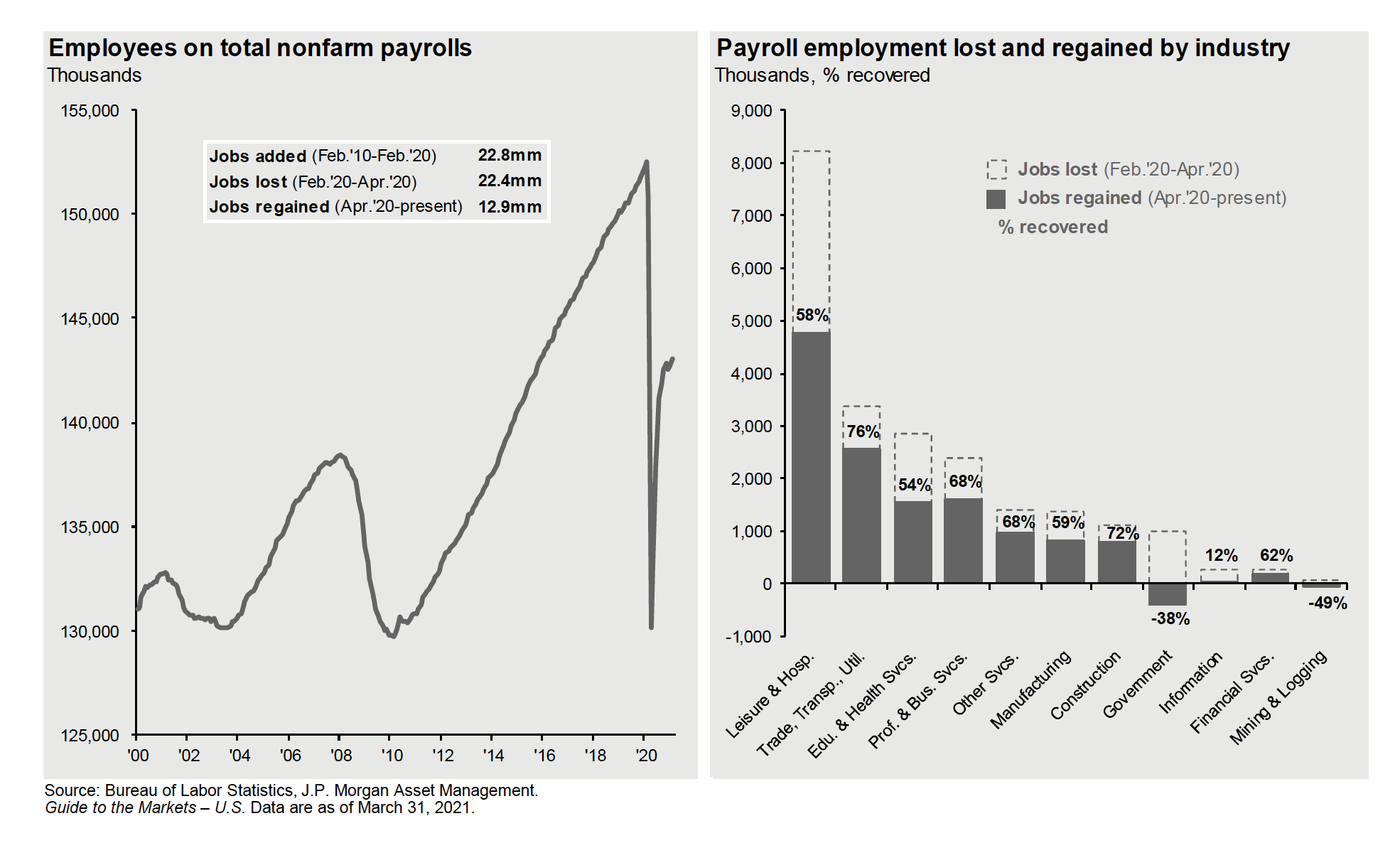

And one data point that we find very important is non-farm payroll employment, which rose by 916,000 in March, with upward revisions adding a further 156,000 to combined job gains in January and February. With these increases, the economy has now recovered 62% of the 22.4 million jobs lost in the pandemic.

Monetary and Fiscal Policy: Full Speed Ahead

U.S. monetary and fiscal policy are both highly supportive of an economic recovery. Starting with monetary policy, the Federal Reserve reinforced its commitment to its new monetary policy framework (introduced last fall) and its highly accommodative current stance. Unlike in the past, when the Fed would start raising interest rates to preempt higher inflation based on its forecasts, the Fed says it will now wait to see actual sustained core inflation reading above its 2% average inflation target (AIT) before starting to tighten. Consistent with its new AIT framework, the Fed continues to emphasize it is seeking to achieve not just “full employment” — as measured by the headline unemployment rate — but also a “broad-based and inclusive goal” of “maximum employment,” which puts additional focus on harder-hit segments of the labor force, such as minorities, women, and low-income workers.

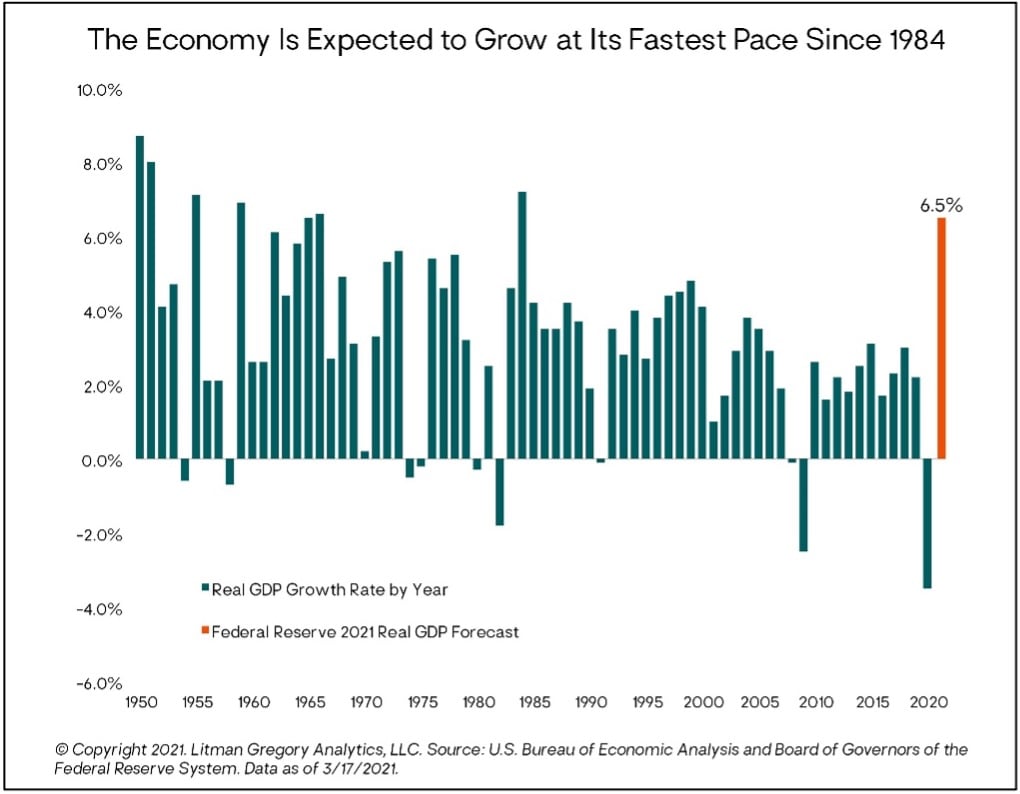

After the March Federal Open Market Committee (FOMC) meeting, Fed Chair Jerome Powell summed up the Fed’s current stance as follows: “The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved. We will continue to provide the economy the support that it needs for as long as it takes.” The Fed kept interest rates unchanged at near zero percent and gave no indication it is planning a reduction (or tapering) any time soon in its $120 billion-per-month quantitative easing (QE) asset purchase program. Moreover, the majority of FOMC members (11 out of 18) still do not expect the Fed to even start raising rates until at least 2024. This is despite the Fed’s sharply increasing its median forecast for 2021 U.S. gross domestic product (GDP) growth to 6.5% — driven by the accelerating vaccine rollout, declining virus spread, and the passage of the $1.9 trillion American Rescue Plan (ARP) in March. In contrast, at the December meeting, its median 2021 GDP forecast was 4.2%.

Moving to fiscal policy, the big news was the passage of the $1.9 trillion ARP, equivalent to 9% of U.S. GDP. While most expected the Biden administration to enact a large fiscal package, many were surprised Congress passed the full $1.9 trillion initially proposed. Adding in the prior two pandemic-relief fiscal packages passed in March and December 2020, the total fiscal stimulus equates to more than 25% of GDP. This is a huge number and roughly five times the fiscal response during the 2008 great financial crisis. It also contributed last year to the largest federal budget deficit since World War II, at 15% of GDP. The 2021 budget deficit is projected to be the second largest, at 10% of GDP. The ARP should produce a big short-term boost to GDP growth. However, the effect on GDP will be temporary, as the relief programs are set to expire later this year. Without additional stimulus, the positive fiscal growth will turn into a fiscal drag as early as next year.

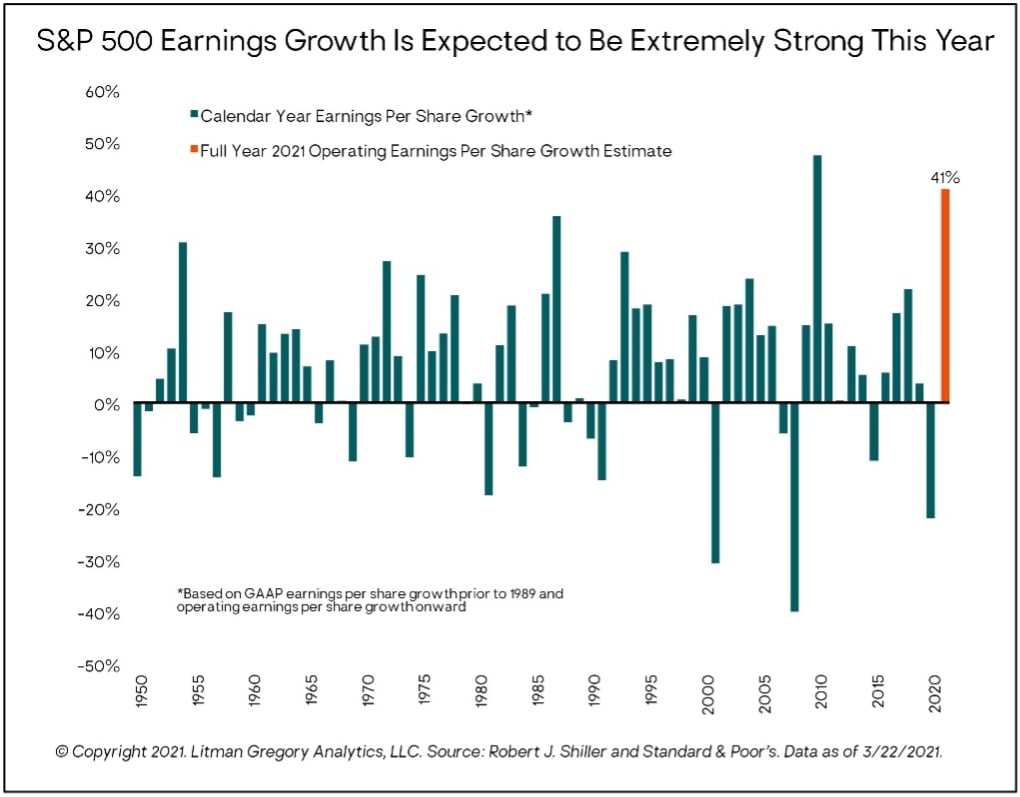

The prospects for further stimulus need to be factored in. At the time of this writing, President Biden has outlined his infrastructure plan, in which $2 trillion in additional spending over the next eight years would be paid for by higher corporate taxes over the next 15 years. If the Fed and economists are in the ballpark, the U.S. economy in 2021 will generate its strongest real GDP growth in 37 years (albeit coming off its deepest recession since the 1930s). The consensus is also expecting extremely strong corporate earnings growth in 2021. S&P 500 Index operating earnings are forecast to increase 41% this year, which would be the second-highest earnings per share (EPS) growth rate in more than 70 years. (The highest was in 2010, at 47 %.)

Inflation and Interest Rates

One of the key economic risks over the next several years is inflation. The primary catalyst for the recent uptick in inflation fears is the combination of the positive macro factors we discussed above: (1) the expected reopening of the economy as the pandemic is brought under control, (2) ongoing highly accommodative monetary policy, and (3) unprecedented fiscal stimulus and the prospect for more to come from the new administration and Congress.

In the next few months, the headline inflation rate will spike higher. This will happen because of a combination of commodity price inflation, temporary supply-chain bottlenecks, and the year-over-year inflation calculation based on the temporarily depressed price levels during the early months of the pandemic. As the months roll on, the base effects from a year earlier will roll off. We continue to believe there’s a low likelihood inflation will have a sustained rise over the next several years. The key reasons behind our conclusion are that the economy still has tremendous slack in terms of the gap between current and potential GDP, and to reach maximum employment. The pandemic-related fiscal stimulus is temporary. Structural disinflationary forces — such as demographic trends and technology, automation, and digitalization adoption — also remain, with the latter accelerating during the pandemic.

With nominal rates still at very low levels, real (inflation-adjusted) yields still negative, and a sustained rise in inflation over the near term not being our base case, we don’t view a sharp rise in interest rates from current levels as a likely outcome.

Portfolio Positioning

In an environment in which U.S. and global economies are in a synchronized early-cycle growth phase, corporate profits should be strong. Consensus estimates are for S&P 500 operating earnings growth of more than 40% in 2021 after a 23% drop in 2020. The relative valuation of U.S. stocks versus bonds is attractive, and it is even more so for foreign stocks. Despite high absolute U.S. stock valuations, stocks look relatively cheap when compared to 1% Treasury bond yields. The risk premium for owning equities relative to bonds is high and attractive, suggesting stocks should outperform bonds over a medium-term horizon.

As long as bond yields remain very low and corporate earnings growth is meeting or exceeding expectations, U.S. stocks can continue to perform well. We also see better tactical opportunities in foreign equities. Foreign equity markets should be even stronger beneficiaries of a global recovery, given their generally higher cyclical sensitivity to global growth, and they have significantly lower valuations compared to U.S. equities. So, we see potential for better-than-expected earnings growth and possibly some increase in valuation multiples for stock markets outside the U.S.

In terms of our overall risk exposure in our balanced portfolios, we are overweighting equities relative to bonds. We still believe bonds play an important role in portfolio diversification. We have a bias toward reflationary assets. We favor credit strategies over core bonds and own real estate, infrastructure, and commodities as portfolio diversifiers and risk reducers that will hold up better if inflation rises.

Closing Thoughts

A double dose of vaccines and fiscal stimulus should make 2021 a strong year for economic growth. We believe our portfolios are well positioned for further gains this year as the U.S. and global economies continue to recover. We expect solid growth from global equities and our alternative investments. As the macroeconomic environment evolves, we will tactically adjust our portfolio exposures base cases on our assessment of the risk and potential returns.

Investing requires discipline, patience, and a willingness to stand away from the herd at times. It can feel uncomfortable to stay the course, or add to equities, when markets are plunging, or to care about valuation and not chasing higher returns when are soaring. But in the end, this is the best approach we’ve found to achieving long term returns.

Again, we are here and ready to do our best to answer any questions you may have or to just simply talk things through at times when you feel it may be helpful. We can navigate this current together; we are here for you.

We hosted a webinar on May 5 to discuss how we are evaluating current economic data and positioning portfolios for the future. You can watch the replay by using the link below.