10 minute read

The year ended leaving many frustrated and confused about the financial markets, and as we start 2023 there are some glimmers of optimism. But, in order to appreciate the real story about the economy and the financial markets, we must look beyond the current environment.

First, 2022 by the Numbers

After a 14% rally in October and November, the S&P 500 Index dropped 5.8% in December to close out the year with an 18.1% loss while the Nasdaq tumbled 33.1%, its largest decline since 2008. It was a lackluster end to a brutal year. 2022 was only the third year since 1926 during which both U.S. stocks and core bonds declined, and the only year when both asset classes lost more than 10%.

Foreign stocks held up much better in the fourth quarter. Developed international stocks (as measured by the MSCI EAFE Index) gained 17.3% – one of the best quarters ever – and emerging markets (EM) stocks (as measured by the MSCI EM Index) were up 9.7%. For the full year, developed international stocks outperformed the U.S. market by nearly four percentage points, dropping 14.5% (in U.S. dollar terms). Yet EM stocks were down 20.1%, slightly worse than the S&P 500.

A major headwind for non-U.S. stocks was the strength of the U.S. dollar, which appreciated 8.3% for the year, reducing dollar-based foreign equity returns one-for-one. However, in the fourth quarter, the dollar dropped 7.7%, providing a boost to EM and international equity returns for U.S. investors to end the year.

Core investment-grade bonds (as measured by the Bloomberg U.S. Aggregate Bond Index, the “Agg”) had a solid fourth quarter, gaining 1.9%. But this was still the worst year for core bonds in at least 95 years, with the Agg dropping 13%. The key driver was the sharp rise in bond yields: the 10-year Treasury yield ended the year at 3.9%, which is up from just 1.5% a year prior. In other segments of the fixed-income markets, high-yield bonds gained 4% in the fourth quarter but were down 11.2% for the year. Floating-rate loans were the best segment within the bond markets, down less than 1% for the year. Municipal bonds were down 8% (as measured by the Morningstar National Muni Bond Category).

Our allocation to “non-traditional” asset classes – non-core fixed-income market segments and alternative strategies – benefited our balanced portfolios again in the fourth quarter. Private real estate, private credit and equity, infrastructure, and commodities have been the standout performers for the year. Their increase, however, has not been enough to offset the decline in public stocks and bonds for the year.

Looking ahead, there is some hope. It is still far too early to make any forecast for the coming year, but when the S&P 500 finishes the first five trading days of the year in positive territory – which it has so far in 2023 – the index has risen 75% of the time, with an average gain of 11.9% for the full year.

Inflation Outlook Is Improving

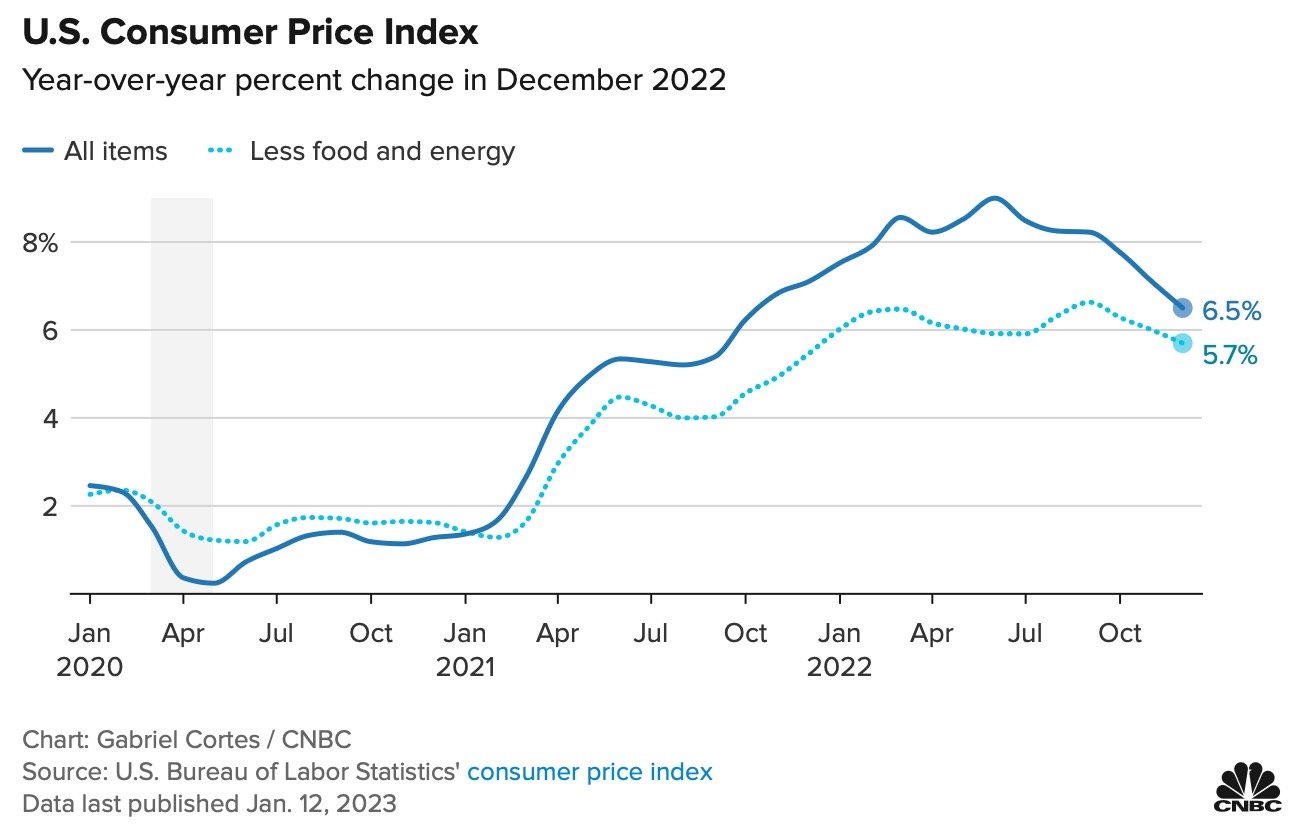

We frame the macroeconomic backdrop and outlook across two dimensions: (1) inflation and (2) growth. U.S. inflation data have improved, suggesting we’ve seen the peak in inflation for this cycle. But let’s look at the supporting data. The CPI, which measures a basket of items most frequently purchased by consumers – homes, food, energy, apparel, etc. – has not only stopped going up but, as of January 11, showed its first monthly decline since inflation broke out.

While inflation rose 6.5% on a year-over-year basis, consumer prices over the past six months advanced at a less than 2% annualized rate – right at the Federal Reserve’s (the Fed) stated target. Core consumer prices have also sharply and rapidly descended from their mid-2022 peak. The Fed’s preferred measure of inflation – the personal consumption expenditures deflator (core PCE) – has also slowed to about a 4% rate, still above the Fed’s target level but down sharply from its post-pandemic high. In the past three months alone, core inflation annualized at a 3.14% rate, down from 4.5%, on a six-month basis, just prior. All other measures of inflation have followed the same trajectory since June of 2022, though some components, like shelter, have continued to be elevated.

The data used to compute home prices and apartment rents tend to be old and outdated. Newer measures are showing that the cost of housing has come down and is likely falling far more quickly than official data suggest. While the Fed has yet to acknowledge these developments, financial markets have seemingly priced accordingly. Inflation expectations, as measured by so-called breakevens, have plunged. The St. Louis Federal Reserve’s measure of where inflation is expected to be five years from now, as measured by bond activity, has declined precipitously, from a peak of 3.59% on March 25, 2022, to 2.21% as of January 11, 2023. Similar declines are seen in the 10-year breakeven rate.

While we know that the ability of anyone to predict what the Fed will do next year, including the Fed itself, is nothing more than guessing, we think the following comments from Fed Chair Jerome Powell are worth highlighting, as they reflect the Fed’s most recent outlook:

“The inflation data received so far in October and November show a welcome reduction in the monthly pace of price increases. But it will take substantially more evidence to have confidence that inflation is on a sustained downward path … the labor market remains extremely tight.”

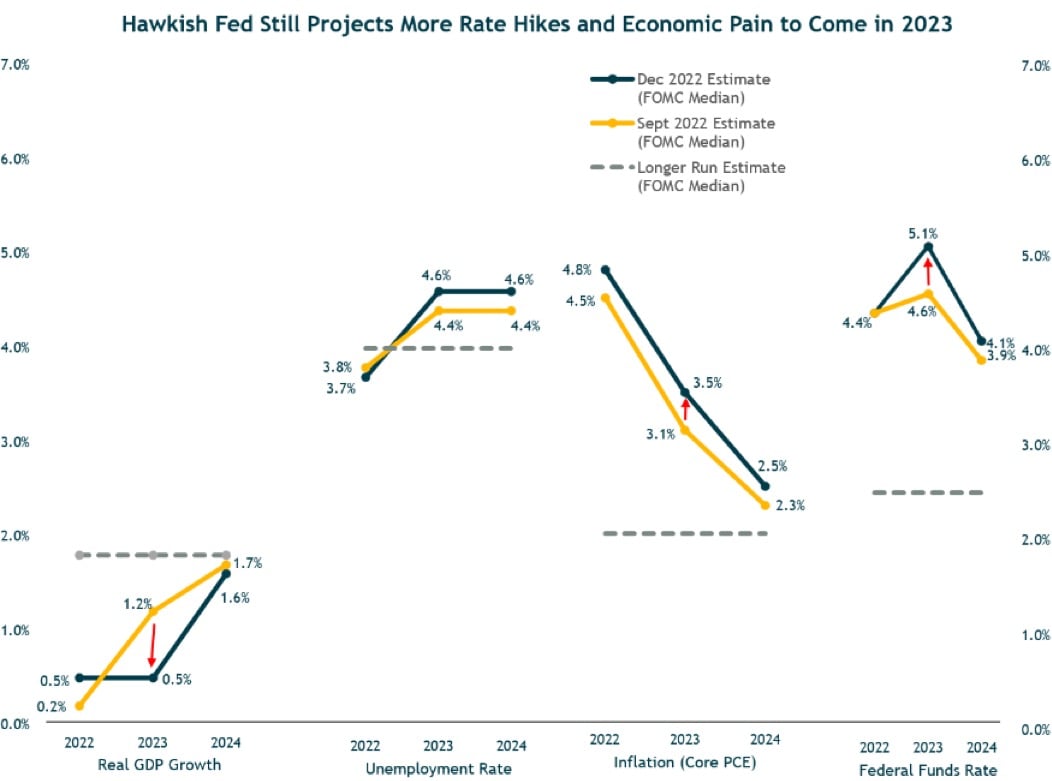

Each quarter the FOMC publishes its forecast for inflation, GDP growth, unemployment, and the Fed funds rate. Continuing the negative trend for the year, the December revisions were for lower GDP growth and higher unemployment, core inflation, and interest rates in 2023.

Source: Federal Open Market Committee (FOMC). Data as of 11/30/22.

Wage inflation – the Fed’s biggest fear – has also started to moderate, suggesting that the much-feared wage/price spiral is not an imminent threat to the economy. While it is true that the U.S. labor market has remained resilient throughout the single most aggressive rate-hiking cycle in modern history, layoffs are beginning to accelerate, while average hourly earnings, per the most recent jobs report, grew 0.3% last month and have essentially moved sideways for the past five months, mirroring all the collected inflation data since then.

While it is possible that inflation could reaccelerate, the markets are not the only indicators saying that inflation has peaked; the data are also making the same case. Inflation is quickly nearing the Fed target, and rate increases should be near the end.

2023 Growth Outlook

In our most recent commentaries, we highlighted that the 2023 growth outlook has worsened for the U.S. and the rest of the globe, and recession risks have risen. We’ve highlighted the widely followed Conference Board’s U.S. Leading Economic Index (LEI). This continued to deteriorate in the fourth quarter, signaling that a recession is likely in 2023. We placed particular weight on the LEI, which has a long track record of “calling” recessions. Adding to the magnitude of its recent decline, it has fallen for nine consecutive months (and likely will again in December). This has never happened without an ensuing recession.

Further supporting this recession thesis is that the Treasury yield curve continues to be inverted, meaning shorter-term yields are above long-term bond yields. An inverted yield curve is unusual and is typically a leading indicator of recession. The spread between the three-month T-Bill and the 10-year Treasury Note, as of January 12, is 1.1 percentage points. It topped 1.25 percentage points the day before. This marks the deepest inversion since the early 1980s. This degree of inversion has never occurred without a subsequent recession and is another piece of the puzzle.

Finally, the Fed funds target rate of 4.4% at year end and 4.6% by early 2023 are well above the neutral rate of 2%. And if those rate levels are not high enough to bring down inflation sharply, Powell and the Fed have made it clear they will keep tightening.

Financial Markets Outlook and Our Portfolio Positioning

Putting all the macro pieces together, our view remains the same from three months ago. We see a mild U.S. recession as the most likely scenario over the next 12 months. A recession is likely but not a certainty. Our best guess at this point is that if the U.S. economy does fall into a recession, it is likely to be much milder than the 2007-08 and 2000-01 recessions. Our confidence for the severity of a recession is not sufficiently high. So as a result, we have not made a further move to reduce our stock exposure based on a severe recession bet. We, however, have increased our allocation to treasuries and municipal bonds. Given the sharp stock and bond market declines we’ve already experienced in 2022, this leads us to a positive medium-term (five-year) outlook for financial markets asset class returns.

We face plenty of issues today, but rather than assume a severe recession will play out, we expect this to be a more typical cyclical recession. Our portfolios are built on the foundation of a long-term strategic asset allocation that aligns with each client’s risk profile, financial objectives, and investment temperament. As such, and given the uncertainty about the future, our portfolios are structured to be balanced, diversified, and resilient across a wide range of scenarios, but also with the flexibility to be opportunistic when the markets get out of whack (when current prices do not reflect long-term fundamentals) due to excessive fear or greed. In such cases, we may act contrary to the current market mood – following the axiom of trying to be greedy when others are fearful.

Valuations look attractive for U.S. equities. If this proves to continue to be true, that should set the stage for a subsequent cyclical recovery. As we pointed out in our last commentary, the market has robust one- and three-year returns after a recession. As we wrote in late June, our base case five-year expected return range for the S&P 500 is 7% to 12%, annualized. This is also in line with our long-term expectations for U.S. stocks, though there is never a guarantee of future profits.

Developed International and Emerging Markets

As noted, international and EM stocks have declined largely in line with U.S. markets in 2022, with developed international doing slightly better and EM slightly worse. Our base case five-year expected returns for EM and developed international stocks are in the low double-digits, supported by low starting valuations and depressed earnings. Things don’t have to become great for international and EM stocks to generate strong returns from here – they just need to get better from depressed levels.

Heading into 2023, the U.S. dollar should be an additional tailwind for foreign stocks. When the dollar depreciates versus EM currencies, EM stocks typically do very well. The dollar declined 8% in the past three months, which boosted returns overseas. We think this trend will continue for 2023, which may add upside to foreign stock returns.

Fixed Income

The past year has been one of the most difficult environments for the bond markets. The traditionally defensive Agg lost 13% in 2022 as high inflation led to a spike in interest rates. While declines have been painful, the good news is that current yields will translate into positive returns that bond investors have not seen in years. Coming into this year, we had a significant underweight to core bonds, reflecting very low starting yields. With the recent rise in Treasury and municipal bond yields to levels not seen since 2018 and, prior to that, 2009, we have significantly increased our core fixed income by purchasing high-quality municipal bonds and Treasury bonds while reducing our credit strategies. Our credit strategies performed well during rising interest rates, and we have now tactically shifted those positions into high-quality core fixed income. With their current yield, core bonds now also offer better portfolio stability and shorter-term return potential in many different economic scenarios.

Alternative Strategies

Our alternative strategies have been the bright spot in our globally diversified portfolios in 2022. Alternatives add diversification to stocks and bonds and improve risk-adjusted returns of balanced portfolios. Alternatives have different risk and return drivers than do traditional stock and bond investments. Given the current macro risks and market backdrop, we think they are especially valuable.

We currently favor private real estate investment allocation to multifamily, industrial, and self-storage for those with a longer investment horizon. We expect equity-like long-term returns from these investments with built-in inflation protection and tax-efficient income generation. We also favor private equity and credit opportunities. We eliminated our gold, commodities, infrastructure, and merger arbitrage and repositioned those investments into treasuries and municipal bonds.

Closing Thoughts

As 2022 has painfully reminded us, we should “expect the unexpected, and expect to be surprised.” This is expressed in our portfolio construction and investment management via balanced risk exposures, diversification, and forward-looking analysis that considers a wide range of potential outcomes.

We believe 2023 will present us with some excellent investment opportunities. In the near term, we expect more equity volatility, as an economic slowdown and potential recession will likely lead to slowing corporate earnings. While challenging, it is critical for long-term investors to stay the course through these rough periods in the markets. The shorter-term period of turbulence and discomfort is the price one pays to earn the long-term equity risk premium that most investors need to build long-term wealth and achieve their financial objectives.

Outside of the U.S. stock market, we already see attractive medium-term expected returns from international and emerging market stocks. A declining dollar, as we expect, would further fuel non-U.S. equity returns.

Fixed-income assets and high-quality bonds are also now reasonably priced with mid-single-digit expected returns. Core bonds will also provide downside stability in the event of a recession. Our investment in alternative strategies should provide further resilience to our portfolios no matter how the next year and the years afterward play out.

We wish you and yours a healthy, happy, and prosperous 2023. We sincerely thank you for your confidence and trust in us. Please do not hesitate to reach out to us if you have any questions or wish to discuss how all this relates to your specific financial situation in more depth.