9 minute read

Midway through a robust recovery, we pause to evaluate how we got here and where we are headed. With an uptick in COVID-19 cases, things are a bit more uncertain today than they were even just a few weeks ago, but nevertheless, growth has definitely been the prevailing sentiment in 2021.

The U.S. stock market and economy led the global growth parade in the first half of 2021. The U.S. economy essentially went from a depression to a recovery to an expansion in the span of a year. In the second quarter of 2020, U.S. gross domestic product (GDP) shrank by an astonishing 31.4%. That was followed by an eye-popping initial rebound of 33.4% in the third quarter of 2020, then a more moderate growth of 4.3% in the fourth quarter of 2020, and 6.4% in the first quarter of 2021. Growth in the second quarter of 2021 is expected to jump to 9.4% as the economy further reopens. The U.S. economy has been very strong this year, and the Fed now expects U.S. real GDP to grow at 7% this year, up from prior forecasts of 6.5%.

Global stock markets continued to surge in the second quarter and the first half of 2021 as a result of the strong economic growth. Developed markets led the way, with the S&P 500 gaining 8.5% in the quarter and at more than 15% for the year. Developed international stocks gained 5.7% and are up over 10%, while emerging markets stocks rose 4.9% and 9% for the year. Emerging market stocks were held back by mixed news on the COVID-19 front and a tightening in China’s financial conditions.

Within the U.S. stock market, growth stocks rebounded and did better than value stocks, outperforming them at 11.9% versus 5.1%. Large-cap stocks did better than small stocks for the quarter but still lag for the year. In the fixed-income markets, the 10-year Treasury yield dipped below 1.5% in June, ending the quarter at 1.45%, down from 1.75% at the end of the first quarter despite higher inflation readings during the quarter. This contributed to a solid 2% return for core bonds in the second quarter, but they still are negative for the year. Credit strategies continue to lead the bond markets with positive returns.

Our global strategies performed better than their benchmarks in the second quarter and for the year. Our overweight to global equities in most of our strategies and our emphasis on non-core bonds and credit strategies were beneficial. Our alternative investments also did well, with real estate leading the way. Overall, we are very pleased with our results in all of our strategies so far in 2021, however, there is no assurance as to future profits or that we will meet or exceed benchmarks in the future.

The Macro Backdrop

As it is for most seasoned investors, it’s important to take a look at the factors of the economy as a whole. Our assessment of the macroeconomic backdrop and outlook has not meaningfully changed since last quarter. We continue to expect a strong global economic recovery over the next 12 months, driven by expanding COVID-19 vaccinations and still-accommodative global monetary and fiscal policies. These macro conditions remain broadly supportive of corporate earnings and risk assets, such as global equities, corporate bonds, real estate, and commodities.

Inflation risks have increased since three months ago, but the weight of the evidence suggests much of the recent price surge is transitory and that sustained high inflation is not a risk. This is primarily because there remains meaningful slack in the economy and the labor market. We expect the competitive forces of supply and demand to restrain price increases over the coming months as economic activity continues to normalize. We are already seeing this trend in many commodity markets.

The U.S. economy has certainly been very strong this year, but it looks like U.S. GDP growth peaked in the second quarter and will decelerate going into 2022. However, global GDP growth is likely to strengthen in the second half of the year, driven by accelerating growth outside the United States. Overseas economic data is still surprising strongly on the upside, despite lagging the U.S. on reopening. Overall, global GDP had fully recovered by the end of the first quarter, and continued expansion in the second quarter likely lifted output above its pre-pandemic high. This pattern marks the sharpest economic “V” in history, with its deep recession and rapid recovery both contained in the span of four quarters.

European countries are only now starting to ease their restrictions on economic activity, just as Europe’s largest-ever stimulus plan is about to be deployed. This suggests eurozone growth still has some way to go before peaking and that eurozone stocks likely can still deliver further gains after outperforming in the first half of the year. Continued solid growth combined with signs that inflationary pressure may be transitory could ease concerns that central banks will tighten prematurely, a fear that weighed on emerging markets at the beginning of the year. This could mean the peak in eurozone economic momentum may not come until later this year, unlike in other major economies such as the United States, where growth will peak in the second quarter of this year, or China, where it peaked in the fourth quarter of last year. Other emerging markets will follow the eurozone economic activity.

The U.S. economy has led the global growth parade so far this year and will continue to grow at a well-above-trend rate. The Fed reflected the consensus growth view when it updated its economic forecasts at its June 16 meeting. The Fed now expects U.S. real GDP to grow 7% this year, up from its 6.5% forecast in March. Most economists estimate the longer-term growth rate of the U.S. economy at 2%.

Monetary and Fiscal Policy

When we look at the pillars of Fed policy, they are monetary and fiscal. Fiscal policy relates to government revenue and spending. Monetary policy refers to the actions related to controlling the money supply. Looking first at monetary policy, we believe the Fed and its monetary policy are still likely to remain accommodative for a long time, although increasingly less so at the margin. Before starting to raise the fed funds rate, the Fed will need to wind down its $120 billion-per-month quantitative easing (QE) asset purchasing program that it started last March. The consensus seems to be for the Fed to start QE tapering in early 2022 and to end QE by the end of 2022. The Fed is afraid of upsetting financial markets — it does not want another 2013 “taper tantrum” — and says it will give plenty of notice before tapering. Then, after tapering is complete, it will be some time before it starts signaling it is preparing to increase the fed funds rate. We still think we are at least a few years from Fed rate hikes. And we expect market volatility as markets react to each and very Fed comment.

The other policy pillar—fiscal policy—is a little less certain, as the American Rescue Plan and other emergency pandemic programs, including the $300-a-week enhanced unemployment benefits that expire nationally in September, lapse later this year. While the Biden administration clearly wants trillions of dollars more in government spending for infrastructure, the politics are proving challenging given the Democrats’ slimmest of Senate majorities. The U.S. economy will shift from getting a large fiscal boost to facing a fiscal drag as the pandemic programs expire. We are still anticipating further infrastructure spending.

Inflation Remains in the Spotlight

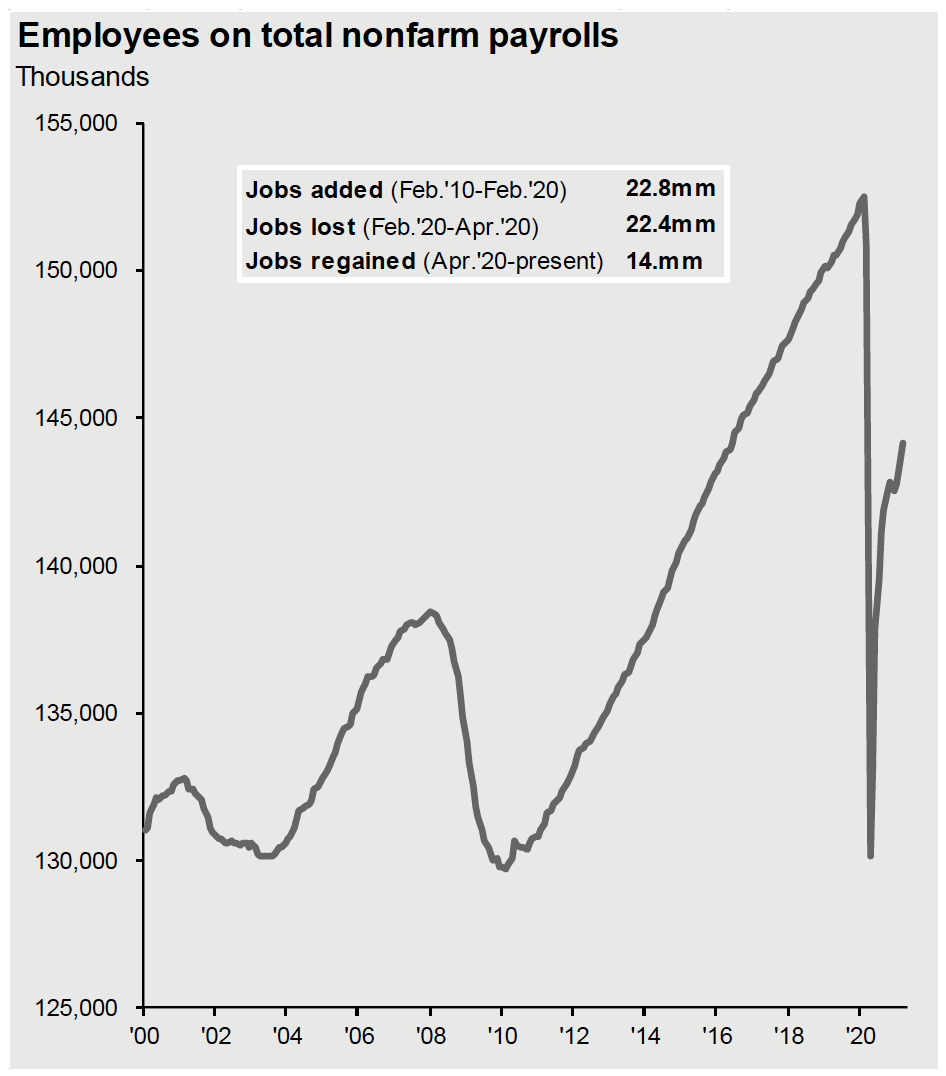

Absent a severe resurgence of the pandemic, inflation is probably the key current market risk. More specifically, is the recent surge in U.S. consumer prices transitory or permanent? Our view on this has not changed since last quarter. We think the recent surge is likely to be transitory. Our current view on inflation is driven by evidence that the U.S. economy still appears to have significant slack before aggregate demand would start overwhelming the economy’s productive capacity and drive prices higher. The labor market is a key supply-side indicator, and it’s the one the Fed is most focused on as part of its dual mandate. We’ve updated the nonfarm payrolls chart through the end of May (below). It still shows nearly 8 million fewer jobs compared to February 2020. And if we extend the pre-pandemic employment trend to account for labor force growth over time, it would take until early 2024 to reach the trend line, assuming the economy adds 500,000 new jobs per month. Meanwhile, more than 9 million people are currently unemployed and potentially available to work. As long as there is slack in the labor market, wage inflation is unlikely to surge.

Having said that, there is no question that the recent Consumer Price Index (CPI) inflation numbers have been surprisingly high. More than half of the monthly increases in core CPI in April and May are explained by higher vehicle prices (which largely are due to semiconductor chip shortages constraining new auto production and causing spiking demand for used cars), plus the sharp rebound in the prices of travel and leisure services most deeply hurt by the pandemic (airfares, hotels, and public events). This type of inflation is usually unsustainable. It’s important to note that some inflation pressures are already easing, as lumber and other commodity prices are declining from recent highs. As supply chain issues and production bottlenecks ease over time and as consumer demand shifts toward more services that were forgone during the pandemic, goods price inflation should moderate, easing the pressure on overall inflation. Bond yields validate this, as the 10-year Treasury has declined from the March high of 1.7% to 1.45% at the end of the second quarter. With nominal yields still at very low levels and real yields still negative, and with a sustained rise in inflation over the near term not being our base case, we don’t view a sharp rise in interest rates from current levels as a likely outcome. We hope to get more clarity on this inflation question over the next few quarters as additional wage, price, and inflation expectations come in.

Portfolio Positioning

Now we have to factor all this in to position our portfolios based on the data we know and what we expect to occur in the coming quarters. We believe our portfolios are well positioned for continued strong performance as the world emerges from the pandemic in a globally synchronized economic recovery. The relative valuation of U.S. stocks versus bonds is attractive and is even more so for foreign stocks. Despite high absolute U.S. stock valuations, stocks look relatively cheap when compared to 1% Treasury bond yields.

As long as bond yields remain very low and corporate earnings growth is meeting or exceeding expectations, U.S. stocks can continue to generate solid returns. We also see better tactical opportunities in foreign stocks in the second half of the year as their economies accelerate. Foreign equity markets should be even stronger beneficiaries of a global recovery, given their significantly lower valuations compared to U.S. equities. So, we see potential for better-than-expected earnings growth and possibly some increase in valuation multiples for stock markets outside the U.S.

In terms of our overall risk exposure in our globally diversified moderate portfolios, we are overweighting equities relative to bonds. We believe Treasury rates will be pressured higher from current low levels due to stronger global growth and reflation. As a result, we favor credit strategies over core bonds. We have a bias toward reflationary assets, and in our alternative investments, we own real estate, infrastructure, and commodities as portfolio diversifiers and risk reducers that should hold up better if inflation rises.

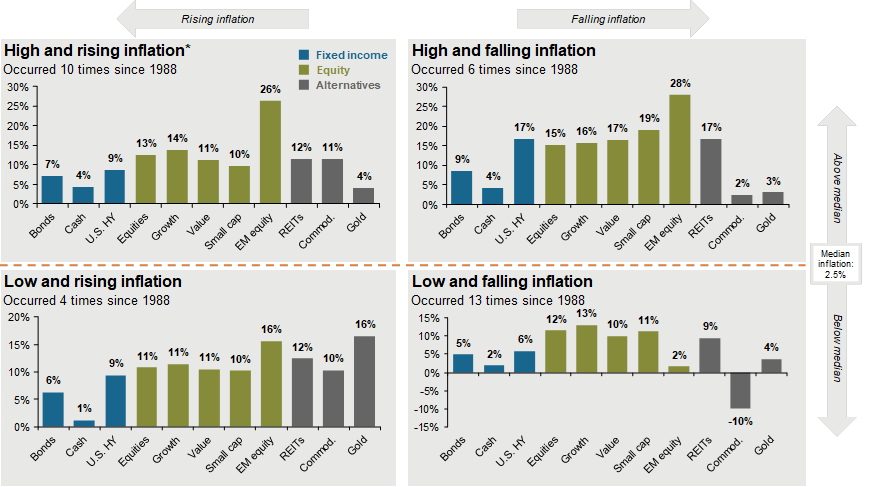

We also feel our portfolios will do fine in the event of unexpectedly strong inflation. The following chart shows various asset class returns since 1988 across different inflationary environments. Over the longer-term horizon, stocks have been excellent at generating returns above inflation. Moreover, when inflation was rising and economic growth was above trend, stocks rose at their fastest clip.

Closing Thoughts

As COVID-19 vaccinations spread across the globe (remember, the United States has led the way, while most countries are just now getting their programs going), we continue to expect a strong year for global economic growth. We believe our portfolios are well positioned for further gains over the next 12 months as the global economy continues to recover. Monetary policy and interest rates should remain accommodative for a while. We expect solid returns from global equities and alternative investments. As the macroeconomic environment evolves, we will tactically adjust our portfolio exposures based on our assessment of the risk and potential returns.

It is too early to say whether the inflation is transitory or permanent. Our base case is that it’s transitory, but we are prepared to update our views as new information becomes available.

As always, we like to say investing requires discipline, patience, and a willingness to stand away from the herd at times. This is the best approach we’ve found to achieving long-term returns.

We hosted a webinar Wednesday, August 11 to discuss our thoughts on the markets and economy, and how we are positioning portfolios as we head into the rest of the year. Watch the replay using the link below.