11 minute read

2023 was supposed to be the year of a likely recession. That did not happen. In fact, the U.S. economy proved remarkably resilient and global stock and bond markets were able to shake off a host of uncertainties to post strong gains for the year; unlike 2022, when virtually every asset had negative returns.

What a difference a year makes. The 4th quarter was aided by a powerful year-end rally as U.S. stocks (S&P 500) jumped nearly 12% in the quarter to finish up the year up 26% and near its all-time high. Smaller cap stocks (Russell 2000 Index), which lagged large cap stocks for most of the year, also rallied sharply in the 4th quarter (+14%) to end the year with a respectable gain of 17%. In an encouraging sign, during the year-end rally we saw a shift in market leadership and equity gains broaden beyond the “magnificent seven” stocks (Apple, Microsoft, Nvidia, Facebook, Alphabet, Netflix, Amazon) which had been responsible for much of the U.S. equity markets returns prior to the 4th quarter.

Developed international and emerging-market stocks also posted solid gains but weren’t able to keep pace with the U.S. markets. Developed international stocks (MSCI EAFE) gained a very respectable 18%, while emerging market stocks (MSCI EM Index) posted a nearly 10% return.

Bonds also rallied sharply in the fourth quarter aided by a significant drop in Treasury yields. The benchmark 10-year Treasury yield declined over 100 bps in the fourth quarter resulting in a 6.8% return for the Bloomberg U.S. Aggregate Bond Index. Interestingly, despite massive intra-year volatility, the 10-year Treasury yield ended the year exactly where it started. For the year, U.S. core bonds (the Agg) finished up 5.5%. Credit was a standout performer both in the fourth quarter and for the full year. High Yield bonds (ICE BofA High Yield Index) were up 7% in the quarter, finishing up 13.4% for the year.

Finally, our alternative strategies which include real estate, private credit and equity have outperformed core bond for the year but have underperformed equities right in line with our expectations.

We are pleased with our Global Asset allocation strategies as most have outperformed their strategic benchmarks for the year, though, there never being any guaranty that this will continue or be profitable . Returns were strong across the board, with higher returns from our more growth-oriented strategies as would be expected in a strong period for equity returns.

The sharp fourth quarter rally was driven in large part by the Fed policy and falling inflation. The Fed made it clear they believe the end of the war on inflation is near, and not only are they preparing to take their foot off the brake in terms of future rate hikes, but they anticipate interest rate cuts in 2024.

Macro Outlook

Looking ahead to 2024, all eyes will be on the Fed. When will the Fed start to cut, by how much, and why? With Fed policy top of mind, a key question will be whether the Fed cuts rates because of restrictive policy in the form of high real yields (lower inflation and unchanged Fed Funds) or because economic growth slows more than anticipated. While this question will be in focus, monetary policy is just one of many factors that will influence markets. Geopolitical risk, the U.S. presidential election, labor markets, and inflation will likely fill the headlines and all could be sources of volatility.

A recession is unlikely in the first half of 2024. There are several positives supporting our view including solid economic growth, resilient labor market, good corporate earnings, declining inflation, and ample liquidity. We think the biggest recession risk will come from weakness among consumers in the latter half of the year and we will continue to closely monitor economic data and adjust our views accordingly.

Inflation

We stated in our third quarter commentary that we thought the Fed had the upper hand on inflation and that we would see inflation continue to trend lower. That has been playing out and we continue to believe that inflation will grind lower in the near term. Many of the metrics we observe suggest that inflation is already at or below the Fed’s target. We also continue to monitor the lag effect of monetary policy, i.e., rate hikes take time to flow through the system.

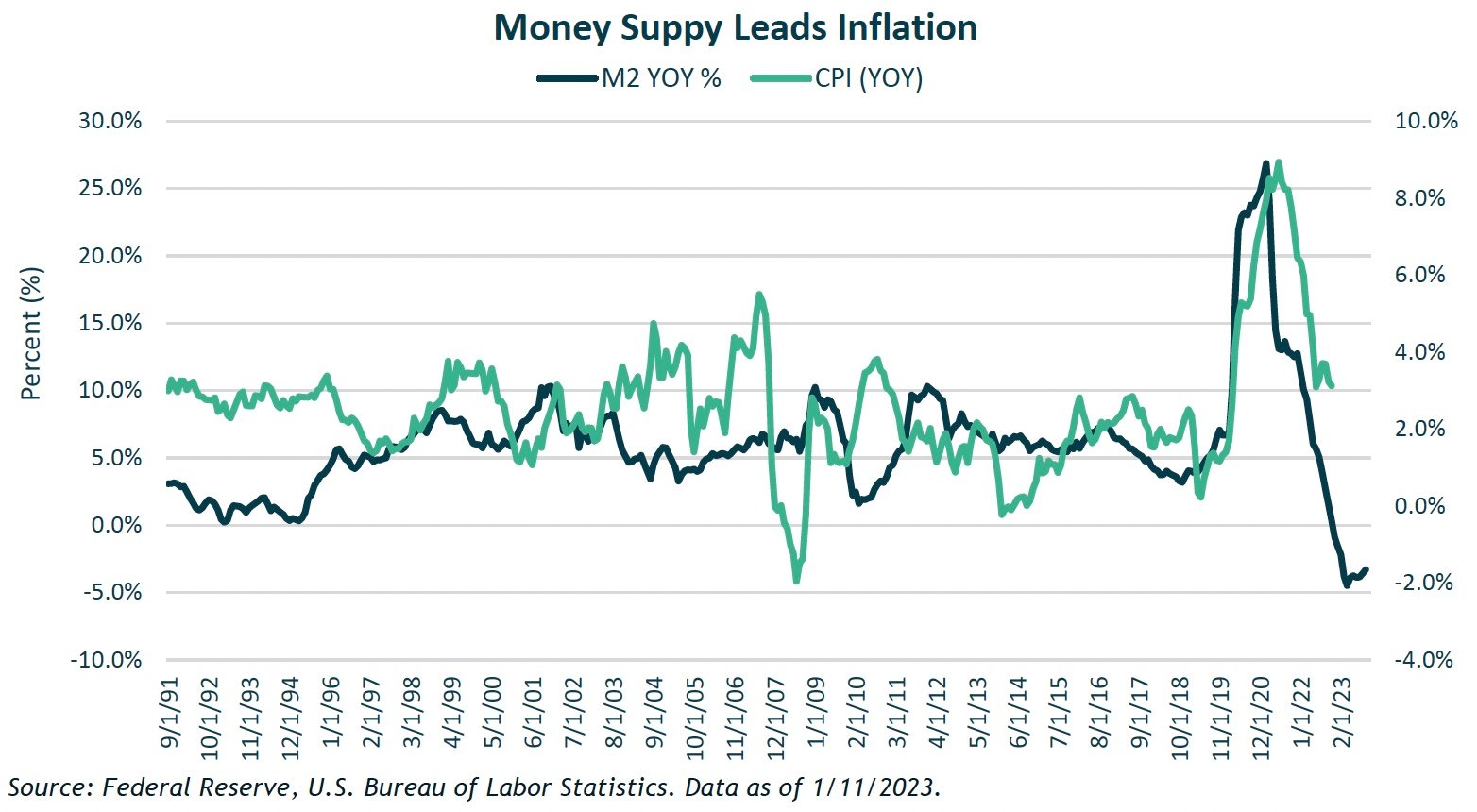

Below is a chart that shows the dramatic surge in money supply (or M2) that occurred because of the pandemic-related stimulus. Money growth tends to lead inflation by 12 to 18 months, and in the chart below we lag the CPI by 12 months to illustrate that inflation is likely to continue to fall in 2024 heading towards the Fed’s 2% target.

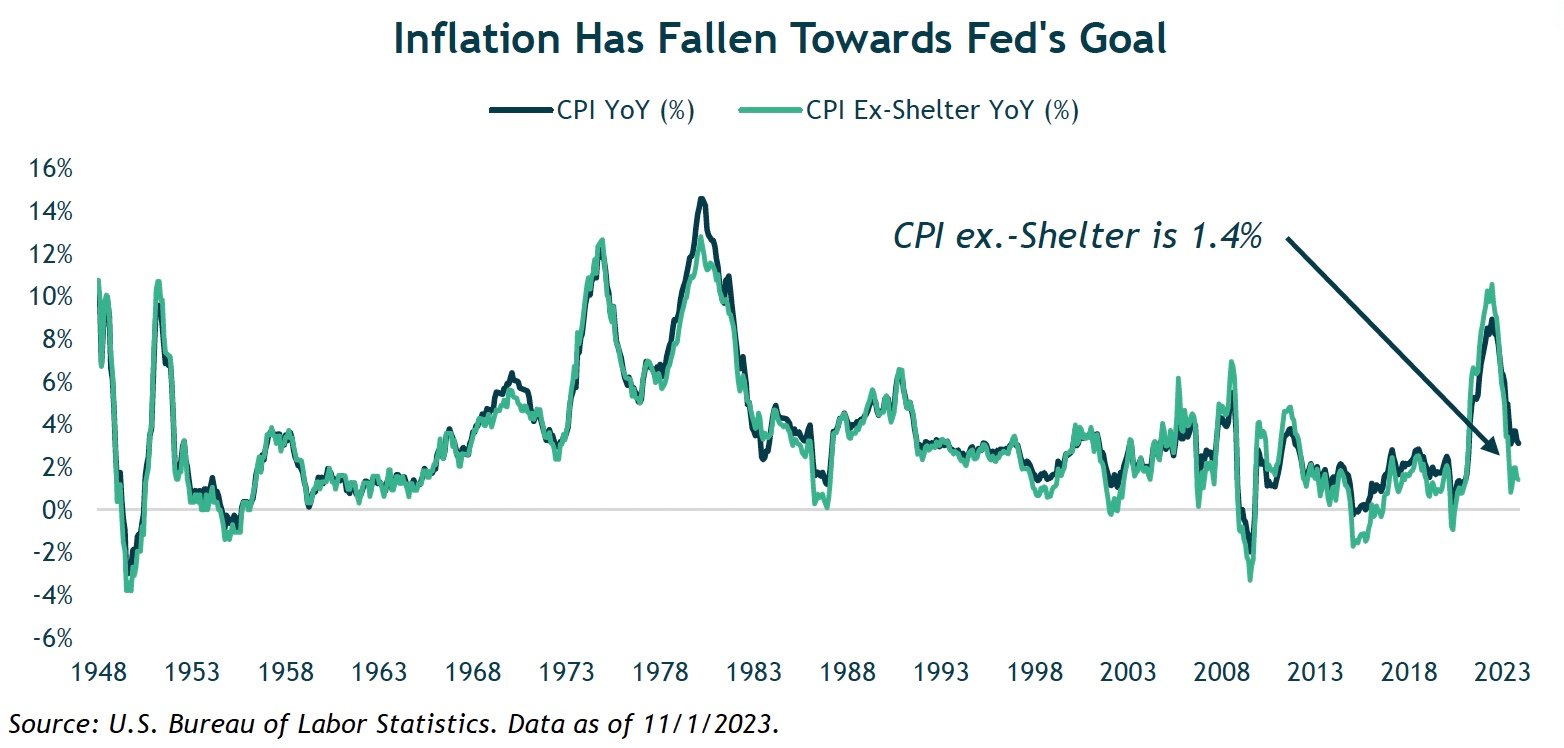

The chart below illustrates the year-over-year inflation and year-over-year inflation excluding shelter costs, which is a key CPI input. (It makes up about 30% of the CPI.) While year-over-year inflation recently came in at 3.1%, the number drops to 1.4% when excluding shelter. These levels are not far from or below the Fed’s goals, which suggests that the Fed’s policy has been working, and with time inflation could continue to fall, particularly if shelter continues to decline.

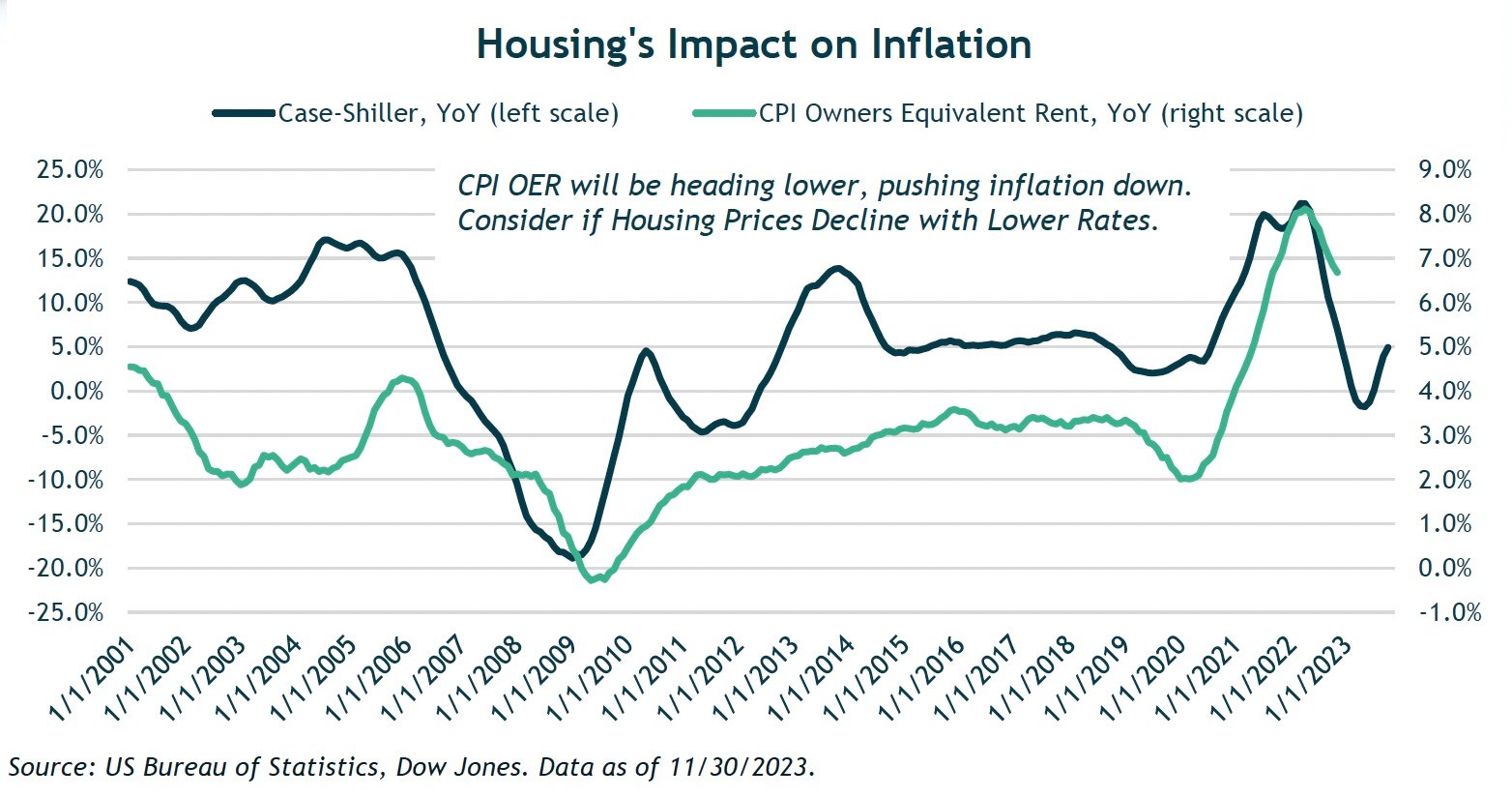

Looking at shelter, below is a chart showing that year-over-year housing prices have historically led inflation, with a lag. In this chart, we lag housing by 12 months. If this relationship holds, this measure suggest that inflation will continue to decline in subsequent months.

Another indicator of the direction of consumer inflation is the Producer Price Inflation (PPI). The PPI measures the average change over time in the selling prices received by producers for their output. Therefore, it tracks the wholesale-level price trends for goods and services before they reach consumers. So, a higher PPI could mean that these higher prices get passed on to consumers as some producers pass along increased costs to their buyers. Conversely, consumers may benefit from a shrinking PPI in the form of lower prices. In recent years, supply chain problems and labor shortages have contributed to spikes in the PPI. For example, year-over-year PPI increases for six of the 12 months in 2022 hit double digits. The highest year-over-year jump (11.6%) occurred in March 2022, following Russia’s invasion of Ukraine in February 2022. Much of the year-over-year PPI surge stemmed from higher energy prices tied to the invasion. Currently, the PPI is slightly negative.

We continue believe that near-term inflation is under control. We would not be surprised to see inflation temporarily fall below the Fed’s 2% target, although we would not expect it to stay there. Importantly, we know that historically inflation tends to come in waves, so we continue to closely monitor trends in inflation, anticipating a subsequent rise at some point. The Federal Reserve’s decisions and the government’s use of fiscal policy will play a role in the outlook for inflation.

Economic Growth

Transitions from one economic cycle to next can be challenging. For example, economic data can present mixed signals, while the timing and magnitude of economic policy and how it flows through to the economy can create uncertainty that leads to volatility. Furthermore, while there are often similarities, there are unique aspects to each.

Since the Fed started their aggressive tightening cycle, the debate has been about the odds of a “hard landing,” “soft landing,” or “no landing” for the economy. The business cycle since the onset of the pandemic has been anything but ordinary. Instead of a simultaneous and broad-based decline in economic activity, we’ve observed industries face isolated declines over time or rolling recessions, while the broad economy has managed to stay afloat.

With various sectors of the economy experiencing contractions at different times over the last few years, we would anticipate more of a mild slowdown, not a deep economic downturn. There is growing consensus that a soft landing may occur in the U.S. in 2024, and we are not ruling that out, especially if the Fed cuts rates sooner than later.

Indeed, the most anticipated recession ever has yet to happen. Many economists now expect it to happen in the 2nd half of the year.

Accordingly, the market has gained confidence that interest rates have peaked, and it has been bringing forward the expected timing of rate cuts in hopes of the Fed avoiding a recession. As of year-end, the market’s expectations are for the Fed to lower rates beginning in March and or May. And by the end of 2024, the expectation is for the rate to be in the 3.5-4.0% range, or 150-200 basis points lower than current levels. We note that the path of Fed hikes commonly resembles an escalator on the way up, but an elevator on the way down, meaning the Fed slowly staircases rate hikes on the way up, but waits too long to cut rates creating an economic slowdown and the need to drop rates swiftly and meaningfully to avoid a deep recession.

Financial Market Outlook

In November, the Fed made it clear they believe the end of the war on inflation is near, and not only are they preparing to take their foot off the brake, but they are also anticipating interest rate cuts in 2024. At the same time, the Fed also said it foresees the economy remaining relatively healthy with steady growth and modest levels of unemployment. Historically, the end of the Fed’s hiking cycle usually serves as a tailwind for stocks.

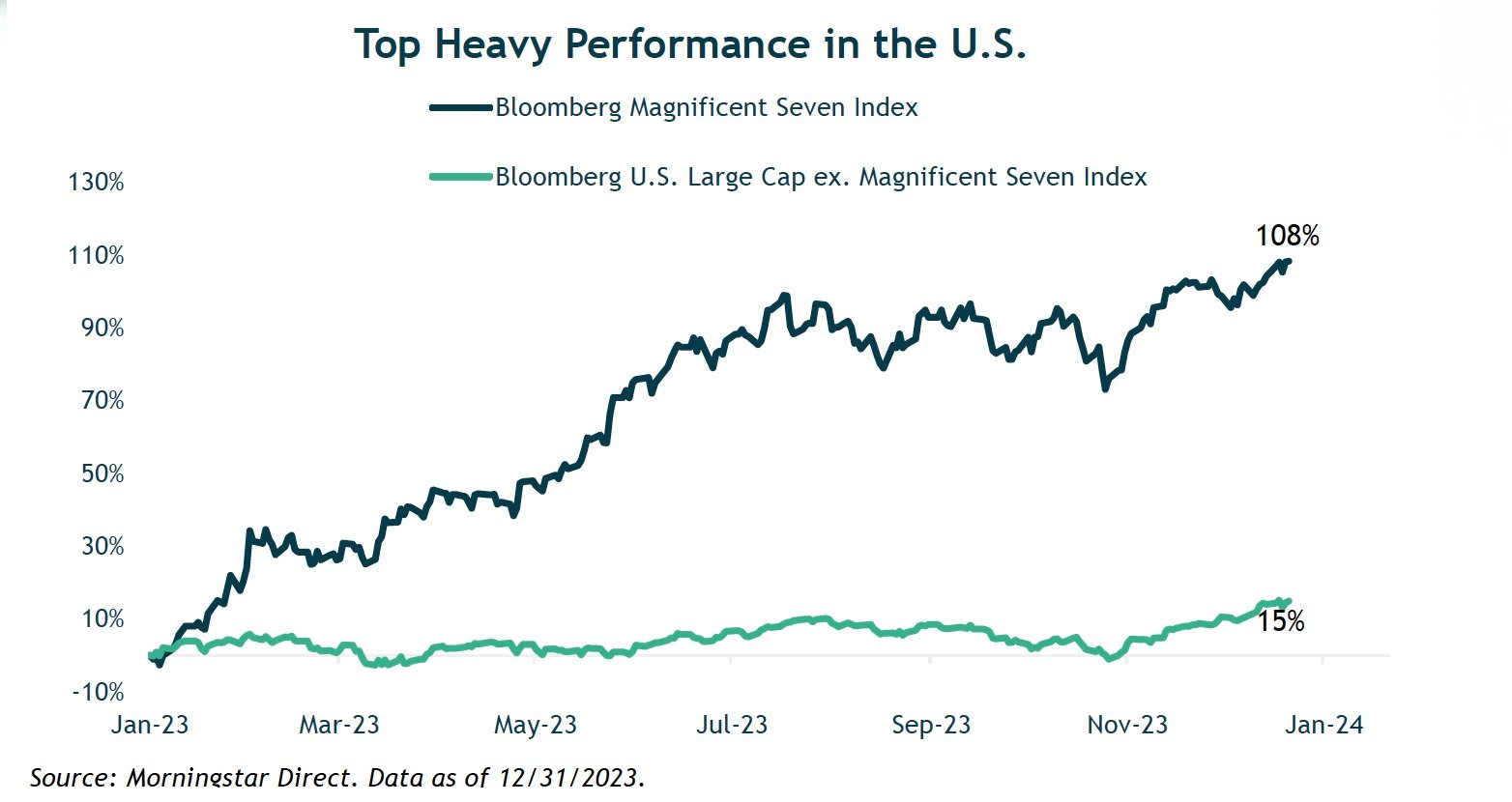

Within the U.S. market, performance in 2023 was driven by the handful of mega-cap growth stocks (the “magnificent seven”) and concentration in these names at the top of the index remains at historical levels. These stocks had an average return in excess of 100% for 2023 and now represent a combined weight of more than 28% in the S & P 500 and 47% in the Russell Growth Index.

With the market confident that interest rates have reached their cyclical peak, we also saw a shift in market leadership with equity gains broadening out beyond the "magnificent seven." As seen in the chart above, the remaining 493 stocks in the index rallied 15% to end the year. We believe the recent broadening out of equity performance has the potential to persist over the course of 2024 and could see areas of the market that have significantly lagged perform much better. For example, small-cap stocks beat large cap stocks and value outperformed growth late in the year.

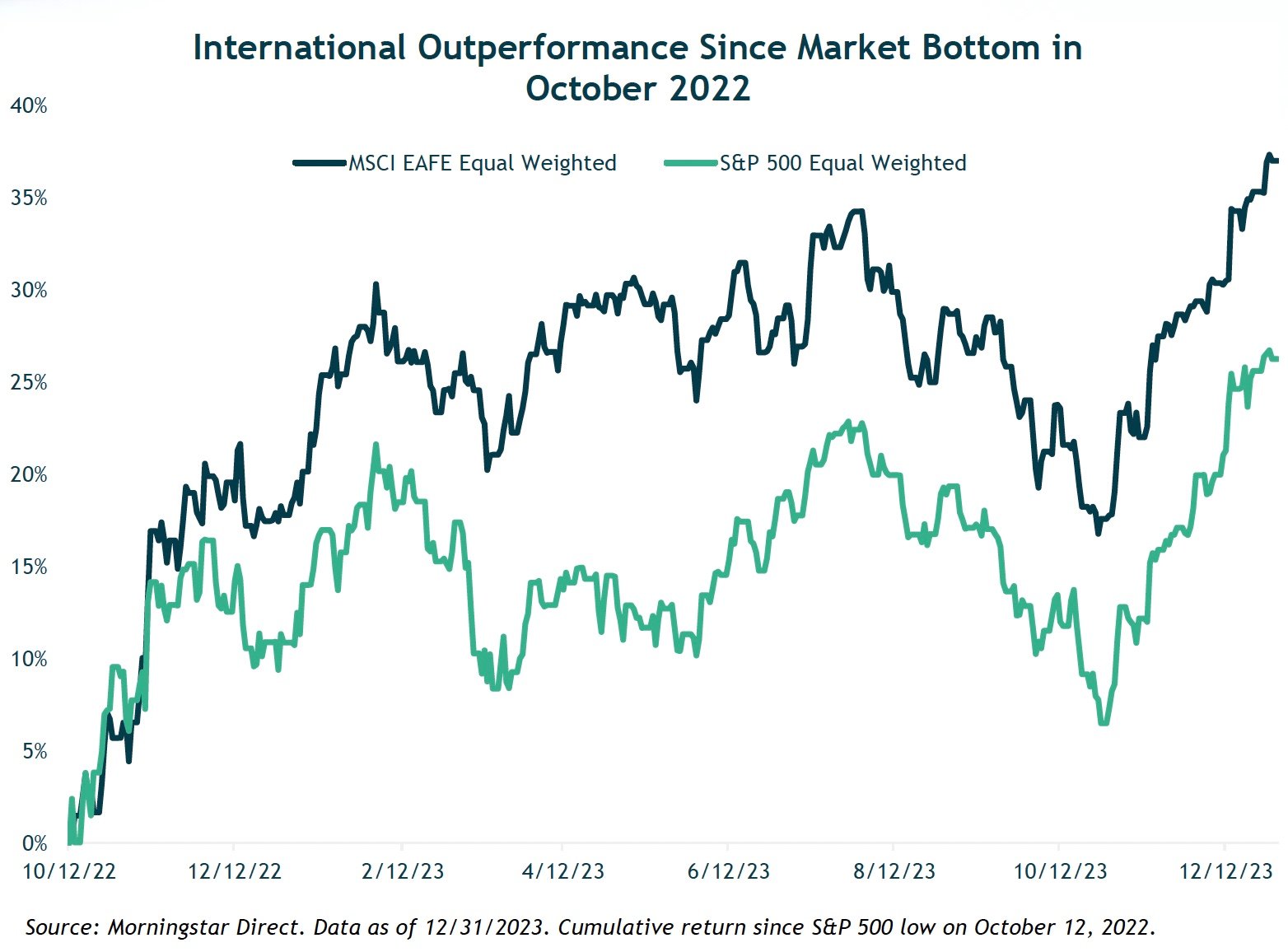

Our overall equity allocation continues to favor another unloved part of the market – developed international and emerging market stocks. While much of the talk is about continued U.S. outperformance, the average international stock outperformed the average U.S. stock last year. The MSCI EAE Equal-weighted index bested the S & P 500 equally weighted index last year – gaining 16.3% returns versus 13.9%. This adds to the outperformance that started when U.S. markets bottomed in mid-October 2022. Since then, the average international stock is up 37% compared to a 26% cumulative return for the average U.S. stock. A more than 10% decline in the U.S. dollar over the same period has been a tailwind for international stocks.

Heading into 2024, the valuation discount for developed international and emerging market stocks versus the U.S. is the widest it’s been in decades. The S & P 500 now trades at nearly 20x forward earnings while the MSCI remains close to 13X. The valuation disparity is even larger in emerging markets. Our strategy is to remain fully diversified among U.S. large cap, mid cap and small cap equities while also investing in developed international equities with an underweight in emerging market equities.

Fixed Income

Inflation and Fed policy will continue to be major drivers of bond market returns in 2024. The question now is how to position for the peak in interest rates. The market is anticipating a handful of cuts in 2024, which could help avoid a recession and guide the economy in for a soft landing. We think the Fed will cut rates and we will finally get back towards a normal shaped yield curve, with the front end of the curve declining more than long end. Our thinking is based on our views of near-term inflation grinding lower, Fed policy becoming too restrictive, deteriorating trends in the consumer, and comments from policymakers.

For now, investors can continue to benefit from higher short-term yields. The Agg is yielding 4.5% which is above the current in 3.1% inflation rate. So bonds finally provide a positive real (after inflation) yield. Core bonds offer good return potential with downside protection. We favor treasuries, long term municipal bonds and high-quality credit issues.

Alternative Strategies

Alternative strategies can provide powerful long-term portfolio benefits and non-correlated returns to traditional stock and bond holdings and improve risk-adjusted returns of balanced portfolios. Given the current macro risks and market backdrop, we think they are especially valuable.

We favor private real estate investment allocations to multi-family, industrial and self-storage and selected grocery anchored centers. We expect equity like long term returns from these investments with built in inflation protection and tax efficient income generation. We also favor private equity and credit opportunities. We will continue to add alternatives to our diversified balanced portfolios.

Closing Thoughts

2023 reminded us that we should continue to “expect the unexpected and expect to be surprised”. Global stocks and bonds turned in a solid year of returns despite the consensus expecting a recession that never materialized. We expect more volatility given the headline risks related to the economy, Fed policy, geopolitical events and the presidential election.

While challenging, it is critical for long-term investors to stay the course through these rough periods in the markets. The shorter-term turbulence and discomfort are the prices one pays to earn the long-term equity risk premium that most investors need to build long-term wealth and achieve their financial objectives.

Outside of the U.S. stock market, we already see attractive medium-term expected returns from international and emerging stocks. A declining dollar, as we expect would further fuel non-U.S. equity returns.

Fixed-income assets and high-quality bonds are also now attractively priced with mixed single digit or better expected returns. Core bonds will also provide downside stability in the event of a recession. Our investments in alternative strategies should provide further resilience to our portfolio.

We wish you and yours a healthy, happy, and prosperous 2024. We sincerely thank you for your confidence and trust in us. Please do not hesitate to reach out to us if you have any questions or wish to discuss how all this relates to your specific financial situation in more depth.

IMPORTANT DISCLOSURE INFORMATION

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by First Foundation Advisors (“FFA”)), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from FFA. No amount of prior experience or success should be construed that a certain level of results or satisfaction be achieved if FFA is engaged, or continues to be engaged, to provide investment advisory services. FFA is neither a law firm nor a certified public accounting firm and no portion of the commentary should be construed as legal or accounting advice. A copy of FFA’s current written disclosure statement discussing our advisory services and fees is available for review upon request, or at www.firstfoundationinc.com. Please remember that if you are a FFA client, it remains your responsibility to advise FFA, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. Unless, and until, you notify us, in writing, to the contrary, we shall continue to provide services as we do currently. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general information/comparison purposes only, and generally do not reflect the deduction of transaction and/or custodial charges, the deduction of an investment management fee, nor the impact of taxes, the incurrence of which would have the effect of decreasing historical performance results. It should not be assumed that your FFA account holdings correspond directly to any comparative indices or categories. Please Note: FFA does not make any representations or warranties as to the accuracy, timeliness, suitability, completeness, or relevance of any information prepared by any unaffiliated third party, whether linked to FFA’s website or incorporated herein, and takes no responsibility therefore. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.