Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

March Madness is upon us! Boy, do I miss those old, gritty Big East Pitt Panther teams – and boy, do they miss making the NCAA tourney annually because, let’s face it, it’s been a while, but I digress. With the heightened focus this past week on the Fed and bond yields, markets had yet another volatile week as they continue to adjust to higher bond yields. The Fed’s message has been clear – financial conditions will remain accommodative, and higher yields are a sign of confidence rather than a hindrance to the economic recovery. The Fed’s days of preemptively tightening monetary policy based on forecasts are over; no matter how robust the outlook may be, the path of policy will depend on realized results. This past week, the Fed held its March FOMC meeting. They indicated their desire to keep rates low and policy accommodative. Markets are anxious about interest rate effects on the economy. Hence, the tug of war between the market and the Fed appears likely to intensify. Investors should expect further volatile weeks over the coming months. It is refreshing in some ways, however, that the Fed is comfortable sitting back and letting the market sort itself and find its equilibrium; it has been a while.

We continue to believe that rates are rising for the right reasons – better economic growth expectations. Markets are pricing in the first Fed rate hike in early 2023. With strong growth and above-target inflation likely to prevail for the remainder of 2021, the Fed will have its work cut out to persuade markets that no change should be expected for the next couple of years. During his recent press conference, Powell reasserted that “the economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved,” and confirmed that the Fed “will continue to provide the economy the support that it needs for as long as it takes.” If markets are to take Chair Powell’s statements at face value regarding “actual progress, not forecast progress,” we believe the employment trend over the next few quarters will be crucial in determining when the debate on tapering begins. At this point, we expect markets will need to see it, to believe it. Game on!

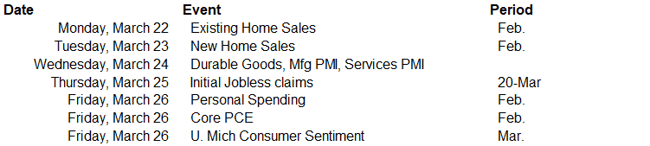

This week, the focus will be on inflation, new and existing home sales, durable goods, and scheduled remarks from several Fed voting members. Additionally, Treasury Secretary Yellen and Fed Chair Powell will testify on the fiscal and monetary policy response to the pandemic. Still, their comments are not expected to be market-moving.

Data deck for March 20–March 26: