Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Since the March 23 market low, seven months have passed, and the S&P 500 is up an astonishing 53%. Yet, uncertainty remains high regarding the spread of the virus, additional fiscal aid, and the outcome of the election. Last week, investors digested a busy week of earnings and political updates ahead of the election. Markets swayed as lawmakers continued to negotiate a fifth coronavirus relief measure. While earnings continue to come in ahead of expectations, equity markets have been soft. U.S. Treasury yields have moved higher as markets weigh the rising trend in new infections against hopes for fiscal stimulus. Regarding earnings, 88% of companies have beaten earnings estimates by an average of 18%; however, the average price reaction has been muted at -1.0%, inferring that market expectations were already sufficiently high.

On the virus front, new COVID-19 daily infections have continued their upward trend globally and now stand at 350,000/day. The second wave in Europe is now resulting in almost three times the number of confirmed cases than the first wave. The U.S. is also on its way to setting new daily records. Pressure is now mounting for fresh lockdowns, highlighting the risks of a worse economic outlook than many expect. Given the impact of a second COVID-19 wave, the absence of fiscal stimulus, in our view, increases the likelihood of further QE increases by the Fed.

As economist Herb Stein said, “If something cannot go on forever, it will stop.” While the virus is likely something that we learn to live with forever, the end, or the threat of an end, to the current pace of monetary expansion could well cause all markets significant pain. Until then, positive news flow on vaccines and therapeutics, as well as additional fiscal stimulus post-election and unprecedented levels of global monetary stimulus, will continue to drive markets.

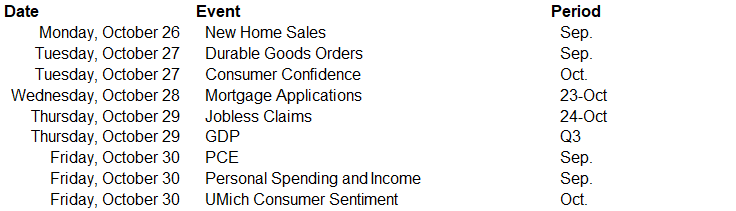

This week is a big one on the data front. We close out October with a slew of consumer and regional business sentiment surveys as well the 3Q GDP report, September PCE inflation, more housing data, and a Durable Goods release. The focus for most will be on the GDP data as consensus estimates imply that Q3 is likely to show the steepest quarterly expansion ever and reverse much, but not all, of the Q2 drop. Other releases should be constructive on balance as estimates submitted to Bloomberg and Reuters expect small gains across September readings for new home sales (Monday), big-ticket durable goods orders (Tuesday), and consumer spending (Friday).

Data deck for October 24–October 30: