Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

For a change, the S&P 500 did not have the best of weeks. Equity markets were battered as a relentless backup in long-term interest rates weighed on valuations. The S&P 500 slipped 2.4% but suffered deeper declines of more than 4% in some of the market's higher growth areas. Still, the S&P 500 is 3% higher than where it was at the start of this year, and we believe that is the most appropriate perspective.

As to why yields are rising, we believe it reflects a gradual healing of the economy, rising inflation expectations, and so-called bond vigilantes' return. It has long been our view that long-term interest rates should increase as the economy recovers and eventually return to pre-pandemic levels. It merely appears to us that the U.S. bond market has awakened fully to policymakers' extraordinary attempt to overheat the U.S. economy in 2021.

Higher bond yields often strike fear into equity investors, especially now with markets juiced by ultra-low rates. However, it's essential to keep in mind why rates are rising, as we do not believe this to be a second taper tantrum episode. The current episode is characterized by increasing long-term yields in anticipation of a broader economic recovery and gradually rising inflation expectations. In this sense, the recent selloff in long-term interest rates is more like the "inflation scare" episodes of the 1980s, where bond markets were worried about easy monetary policy creating excessive economic growth and inflation.

In our view, the reopening of economies seems increasingly imminent, and the Fed's message remains quite clear. Recent vaccine data from Israel, where the rollout is most advanced, suggests vaccination lowers the transmission rate of COVID-19, fueling additional optimism for a faster, broader easing of restrictions. Additionally, in Fed Chair Powell's recent testimony to Congress, it was reiterated that the Fed does not plan to change anything in the short run and that inflation fears may be overdone. The Fed thinks it will take years for inflation to reach 2.0% on a sustainable basis, even after considering the big fiscal package to be introduced by the government. In short, the Federal Reserve will continue to sit on the sidelines, allowing the yield curve to steepen. Historically, the combination of an economic recovery, rising rates, and a steepening yield curve have been positive for equities. We expect that to continue.

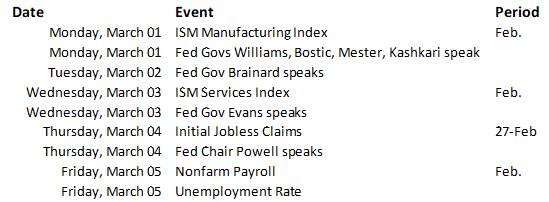

This week, the most significant piece of news will be February's non-farm payrolls. Friday's report is expected to signal a return of job growth, following a soft patch in the last few months. It will be the first data in several months that will not be affected by either one-off's or by seasonal factors. Several Fed officials are also scheduled to give speeches this week, with Fed Chairman Jerome Powell discussing the U.S. economy on Thursday.

Data deck for February 27–March 5: