Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

The spread of the Delta variant is weighing on both consumption and production and pushing out expectations for economic growth. Despite this backdrop, the S&P 500 has still gained an astounding +18% YTD.

The narratives driving current investor negativity are familiar:

- Concerns about the spread of the Delta variant

- Policy clampdowns in China

- Supply chain bottlenecks’ impact on global growth

Additionally, the FOMC’s July meeting minutes this past week further reinforced that tapering is approaching. The headline from the July FOMC minutes is that “most participants noted that, provided that the economy were to evolve broadly as they anticipated, they judged that it could be appropriate to start reducing the pace for asset purchase this year because they saw the Committee’s ‘substantial further progress’ criterions as satisfied with respect to the price-stability goal and as close to being satisfied with respect to the maximum-employment goal.”

It should come as no surprise that some FOMC members openly favor tapering this year, as they have been on parade with that message in the press over the past month. However, markets are trading a Fed taper this year as if it is a sure thing; it is not. In our view, “progress” is not the same as “substantial further progress.”

Given the lack of consensus in the July FOMC minutes and only “some” participants favoring a September announcement, we do not believe Chair Powell will use his speech at Jackson Hole to alert markets of new clues about tapering, as some expect. We expect Chair Powell’s Jackson Hole speech to remain consistent with a Q4 tapering announcement.

We continue to believe the Fed’s tapering decision will depend on the economy, the labor market, and the impact of the current Delta wave. With case rates peaking out in some of the U.S. states most heavily impacted by the Delta variant, a crest in the Delta wave could provide the basis for some of the negativity in markets to subside sooner than some fear.

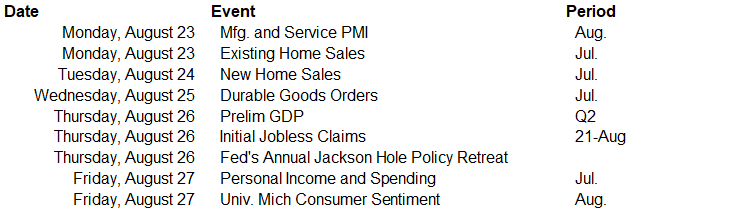

This week, all eyes are likely to be on Jackson Hole, given the Fed’s influence on markets and its current QE program. This week also brings the final week of August and the first found of month-end data. Q2 GDP, July PCE inflations, and preliminary PMIs for August, along with personal income and spending figures, new home sales, and durable goods to gauge U.S. economic growth and inflation.

Data deck for August 21–August 27: