Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

This past week was full of hits and misses, with equity markets ending relatively flat for the week, but sentiment waning as we head into the latter stages of the summer. Markets are currently contending with three somewhat related issues: delta variant concerns, Fed policy concerns, and global growth concerns - particularly related to China, amidst their continuing regulatory crackdowns. We suspect that the market will require proof to sustainably shrug off these concerns, with the most tangible one coming from the Fed.

This past week, the Fed appears to have "started the clock" on the path to tapering. They said that progress had been made toward its employment and price stability goals, and "the committee will continue to assess progress in coming meetings." We expect Fed communications to evolve over the coming months to gradually prepare markets for the upcoming reductions in the pace of asset purchases, and we think their communication will continue to be critical. Many market participants seem to view the Fed's initial announcement about its intentions for tapering as a signal about the timeline for interest rate hikes. We see things differently. In our view, the Fed will remain accommodative for years to come. The Fed will likely hit the reset button if and when the tapering process is completed. They will then take a fresh look at the inflationary and labor market to start the clock on the rate hike cycle. We continue to believe the Fed would like to see an average above 750k jobs a month to feel comfortable progressing toward tapering.

We now enter a critical two-month stretch for the Fed that will feature the Jackson Hole Economic Symposium and the September Fed meeting. With markets focused on both to provide the first concrete details on how the Fed plans to approach tapering.

This week, the focus will be on the July employment report, what it says about Fed policy risks and what that, in turn, says about risks in global markets. We will also hear from Fed governors Clarida, Waller, and Bowman, with particular attention paid to how they characterize progress made towards the conditions for tapering.

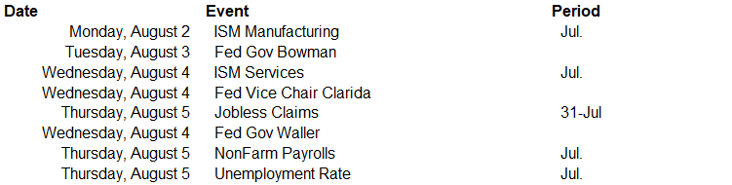

Data deck for July 31–August 6: