Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

What a start to the year it's been. Stocks have risen on two-thirds of all days since the start of November and have only been down six days so far this year. Moreover, the stock market has been up 13 of the past 16 weeks. A healthy U.S. consumer, a ceasefire in the U.S.-China trade war, signs of green shoots in the global economy, and accommodative central bank policies at seemingly any cost has left investors feeling good and focused only on the positives. While stocks wobbled a bit this week on news of a new virus from China, the market's recent run has our spidey-senses tingling and thinking the market is exhibiting a bit of complacency and failing to ponder alternative outcomes.

It is still the early days, but the unexpected outbreak of the Coronavirus appears to be tracking something close to SARS - the 2002-2003 virus that ended up slashing Chinese growth by two percentage points. With the global economy showing signs of re-acceleration, the Coronavirus could be the spark for an arguably long-overdue adjustment in the markets. In theory, any headline could be the spark. Today it’s the Coronavirus. Tomorrow it could be something else. Over the next nine days, we believe sentiment will be tested as complacency over earnings, global growth, and central bank policies will receive key updates.

In a busy week for economic data, Central Banks will take center stage with a possible rate cut from the Bank of England and the first Fed meeting of the year. We will also get the first print of fourth-quarter GDP and durable goods data that may show the impact of the Boeing 737 Max grounding.

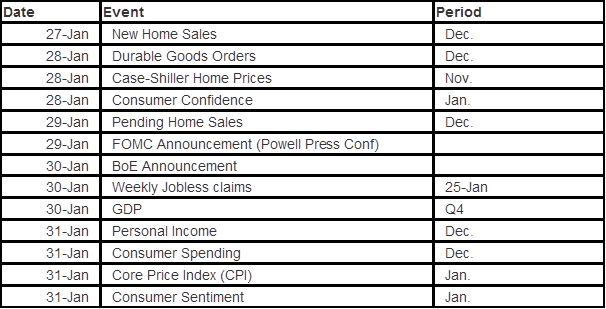

Data deck for January 25–January 31: