Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Counted out repeatedly over the last decade, Tiger Woods stunned critics by winning his 5th Masters Tournament this weekend. He’s now won the Masters in three different decades – the 1990s, the 2000s, and the 2010s! Now the average “PGA Tour Pro” holds on to their tour card for 3-4 years, and if we went by the law of averages, Tiger’s career should have been over a long time ago. Similarly, the average NFL career lasts just 3.5 years, the NBA: 4.8 years, the MLB: 5.6 years, and the NHL: 5.5 years. Tom Brady just became the oldest quarterback to win the Super Bowl at 41. Nolan Ryan played 27 seasons and Gordie Howe played professionally for an astounding 32 seasons! Vince Carter just finished his 21st season in the NBA, tying the most seasons played, and he’s looking to play again next year.

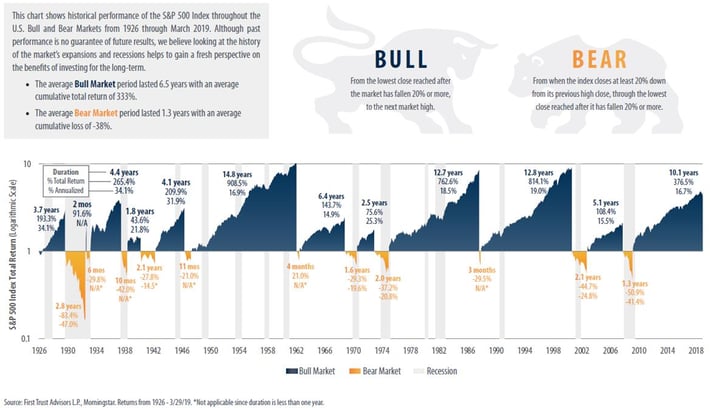

Now going back to the investment world, the average bull market length is 6.5 years and the average bear market length is 1.3 years. We’ve all heard that it’s “time” for a recession, but does the market really run on a clock? JP Morgan’s CEO, Jamie Dimon, recently spoke with analysts on their earnings call and said, “It could go on for years… there’s no law that says it has to stop. We do make lists, and look at all other things: geopolitical issues, lower liquidity. There may be a confluence of events that somehow causes a recession, but it might not be in 2019, 2020, 2021.” By the way, Australia is about to have 28 straight years with no recession! The last time domestic equity markets hit new highs (September 2019), WTI Oil was at $75 vs. $64 today. The 10-year US Treasury was yielding 3.23% vs. 2.56% today. The US Dollar was weaker, trade discussions with China were less resolved, and the Fed was looking to hike in December and telegraphed multiple rate hikes in 2019. While it’s important to keep abreast with the media and macro events, it’s even more important to look through to what the fundamental data is telling us.

In the week ahead, investors will checking in on the housing market as well as industrial production/ inventories. Spring is normally the start of the home selling season and, with mortgage rates further declining, we could see homebuilder sentiment and activity pick back up. Per Prequin research, at the end of November 2019, there was a record $180 billion in dry powder held within private real estate funds. This isn’t counting the individual real estate investor waiting for a good deal!

Data deck for April 13-April 19:

|

Date |

Indicator |

Period |

|

April 15 |

Empire Manufacturing |

April |

|

April 16 |

Industrial Production |

March |

|

April 16 |

NAHB Housing Market Index |

April |

|

April 17 |

Trade Balance |

February |

|

April 17 |

Wholesale Inventories |

February |

|

April 18 |

Advance Retail Sales |

March |

|

April 18 |

Philadelphia Fed Manufacturing |

April |

|

April 18 |

Business Inventories |

February |

|

April 18 |

Housing Starts |

March |

|

April 18 |

Building Permits |

March |