Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

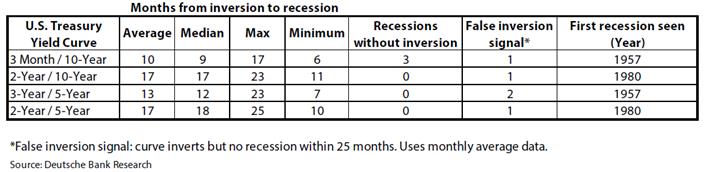

The first quarter of 2019 will go down as the best quarter for the S&P 500 index since 2009, when we were exiting the Great Financial Recession (but still worried about a double dip!). This is a strong contrast to last year’s fourth quarter, where we briefly saw a bear market. This quarter also saw the 3-month and 10-year Treasury yield curve invert, sending recession flags and fears over a few days of trading. What caused this brief volatility? Thank the Fed for bringing back out the punch bowl after being overly hawkish late last year. The Fed is stuck in a difficult role, being too hawkish (either with comments, rate hikes, or balance sheet reduction) sends signals to investors that the economic environment is running hot and needs to be cooled down, indicating that recession is coming sooner. On the flipside, being too dovish (either with comments, rate cuts, and ending balance sheet reduction) sends signals to investors that maybe the economy isn’t as strong as it should be, and that recession is coming sooner!

What is clear is that recession doesn’t occur overnight if the yield curve does invert (yet it seems that it gets traded by investors as such). The reality is that recession risk is at its highest when there is maximum bullishness across the board and there’s plenty of excess capital within the system. Central banks tried to get ahead of that last year, with 56% of global central banks raising rates in 2018 and the monetary base globally contracted by 8%. Liquidity is fuel for risk assets and central banks have reversed their language early this year or have actively begun easing (note: the People’s Republic of China pumped in a record $83 billion in one day just this January!). What we’ll see for the rest of 2019 is a continued tug o’ war between macro factors: Central banks easing and U.S.-China trade war resolution driving risk assets higher while yield curve fears and potential earnings slowdown driving risk assets lower (coming down from the tax cut sugar high).

The week ahead will be highlighted by Friday’s jobs report. Initial jobless claims have been trending lower which is consistent with tight labor market conditions. Current consensus expectations is for the unemployment report to stay at 3.8% as strong job gains will be offset by more workers reentering the labor market looking for employment. Last month’s wage growth of 3.4% year-over-year should hold steady and average hourly hours worked should tick back up now that winter has passed.

Data deck for March 30-April 5:

|

Date |

Indicator |

Period |

|

April 1 |

Advance Retail Sales |

February |

|

April 1 |

Construction Spending |

February |

|

April 1 |

ISM Manufacturing |

March |

|

April 2 |

Durable Goods Orders (Preliminary) |

February |

|

April 2 |

Total Vehicle Sales |

March |

|

April 3 |

ADP Employment |

March |

|

April 3 |

ISM Non-Manufacturing |

March |

|

April 4 |

Initial Jobless Claims |

---- |

|

April 5 |

Jobs Report |

March |

|

April 5 |

Consumer Credit |

February |