Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

2.3%. The U.S. economy’s growth rate for all of 2017. Many were hopeful for a 3.0% reading for the fourth quarter of 2017, however it came in at a still-solid 2.6% on the backs of consumer spending and a large rebound in home construction. Compared to 2016 when the domestic economy grow at 1.5%, 2017 was a nice rebound. However, 2017 was right in line with the average economic growth we’ve seen since the Great Recession, an average of 2.2%.

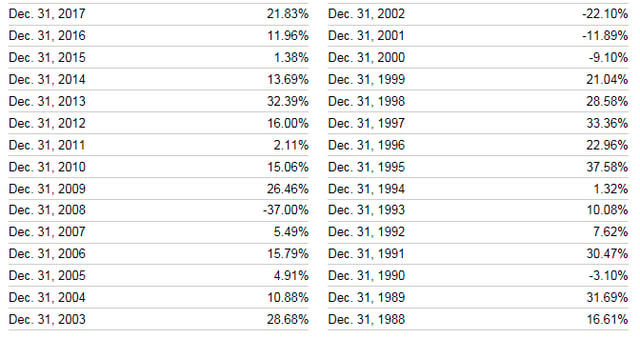

The tug of war between bulls and bears since the Great Recession has been constant and investors’ psyches have definitely been scarred. Double dip fears. Oil fears. Volatility fears. Liquidity fears. Fed hike fears. Looking back at annual returns for the S&P 500 going back to 1988, it shows just how hard it is to time the market. As painful as the Great Recession was, it was over relatively quick compared to the Tech Wreck of 2000-2002. Tech was the high flying sector in 2017 and many expect it to correct significantly at some point as valuations get stretched. Tech Wreck 2.0? Maybe not – what’s different this time is that many tech companies have actual earnings (Tesla aside) and are seeing positive earnings revisions combined with multiple expansion.

S&P 500 Annual Total Returns:

We’ve got a busy week ahead of us with an inflation reading, an FOMC meeting, a manufacturing update, and the latest employment report. The unemployment rate has held steady over the last three months at 4.1%, and many expect for it to break 4% sometime in 2018 as the economy continues to improve.

Data deck for January 27- February 2:

|

Date |

Indicator |

Period |

|

January 29 |

PCE Reports |

December |

|

January 29 |

Personal Income |

December |

|

January 30 |

S&P Case Shiller Home Price Index |

November |

|

January 30 |

FOMC Meeting |

---- |

|

January 31 |

ADP Employment Report |

January |

|

January 31 |

Chicago Purchasing Managers Index |

January |

|

January 31 |

Pending Home Sales |

December |

|

January 31 |

FOMC Meeting Announcement |

---- |

|

February 1 |

Initial Jobless Claims |

---- |

|

February 1 |

PMI Manufacturing Index |

January |

|

February 2 |

Employment Report |

January |