10 minute read

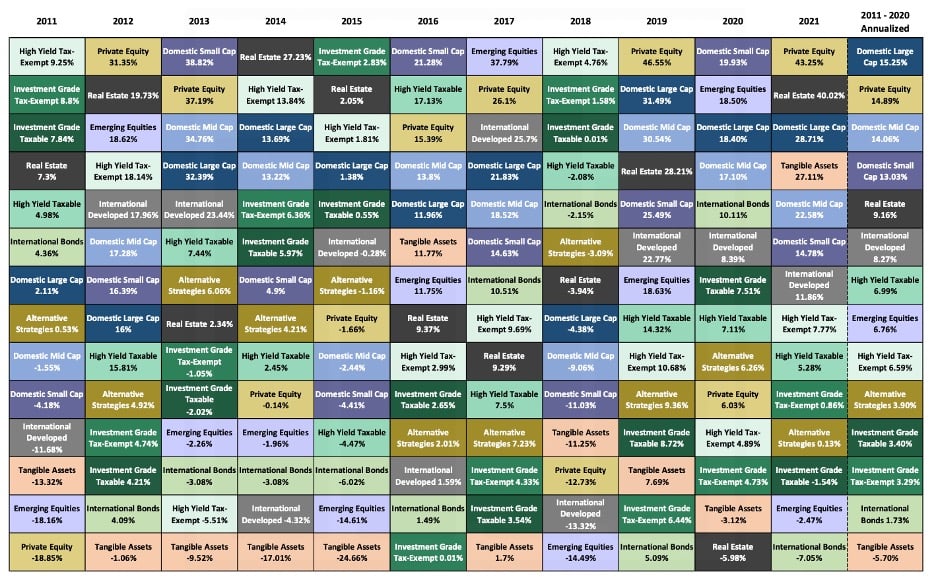

The fourth quarter capped another strong year for the financial markets. In particular, the S&P 500 returned a stunning 28.7% for 2021, nearly tripling its long-term historical average, and for only the second time in history, the index reached a new high in each and every month. A large part of the increase happened in the fourth quarter, with the S&P gaining 11% compared to 2.1%, 2.7%, and 1.3% for small caps, developed international stocks, and emerging markets (EM), respectively. For the year, the S&P 500 dominated other assets classes, with U.S. small cap stocks rising 14.8%, international stocks up 11.9%, and EM declining 2.5%.

Source: Bloomberg, as of December 31, 2021

The renewed surge in COVID-19 infections late in the year and China’s policy-induced economic slowdown and stock market decline were key drivers of this relative performance (particularly in Europe and EM). The MSCI China Index plunged 21.7% for the year and lost 6.1% in the fourth quarter. Also contributing to the underperformance of international stocks for U.S.-based investors was the strength of the dollar. After falling early in the year, the U.S. dollar index appreciated sharply, ending the year with a 6.3% gain. It has been some time since we addressed inflationary factors, so as a reminder, a rising dollar is a negative when translating foreign-market local-currency returns into U.S. dollar-based returns.

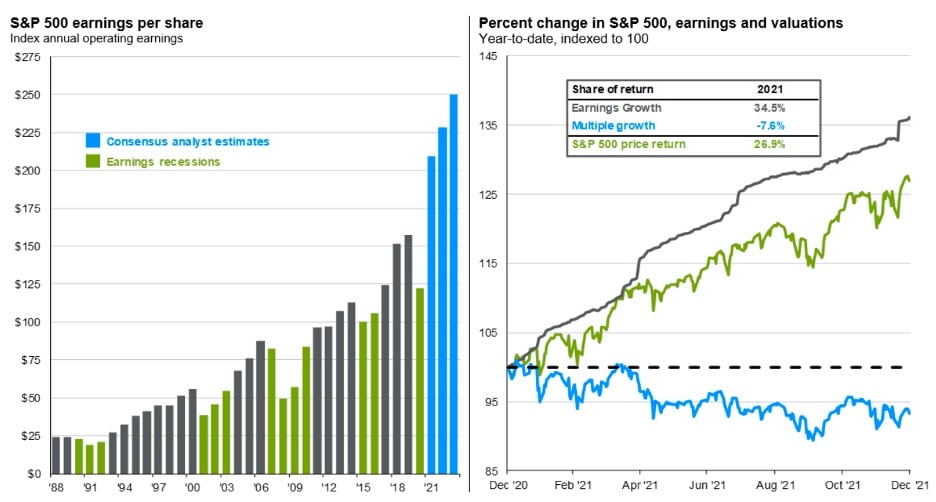

U.S. equity returns were exceptionally strong in 2021 and were powered by robust earnings growth (over 30%) driven by sales growth and margin expansion. Domestic equity returns have been driven by strong earnings growth, not by multiple expansion.

Source: FactSet, Compustat, Standard & Poor’s, JPMAM. Historical EPS levels are based on annual operating earnings per share. Earnings estimates are based on estimates from Standard & Poor’s and FactSet Market Aggregates, as of December 31, 2021

Both the large cap Russell 1000 Value and Growth indexes returned over 25% in 2021, but the strong rally in growth stocks in the second half of the year gave growth a slight edge over value once again for the year. The fourth quarter data, when it’s released in January, will show 2021 had the fastest GDP growth since the 1980s.

Turning to the bond markets, the core bond index lost 1.5% for the year as interest rates rose moderately. The benchmark 10-year Treasury bond yield ended the year at 1.51%, compared to a 0.92% yield at the end of 2020. Given the sharp rise in inflation, most investors would have predicted a higher rise in the 10-year Treasury bond yield, but, indeed, the rise of the benchmark only moderately increased. Credit markets fared much better than core bonds in 2021. The U.S. high-yield index returned 5.4%, and the floating-rate loan index gained 5.2%. These returns were consistent with our expectations, given a recovering and growing economy.

Lastly, real estate as measured by the NAREIT index was up over 40%. Both public and private real estate experienced strong returns driven by rising rents and cap rate compression. Other alternative categories like private equity and tangible assets also had strong returns.

For 2021, our global portfolio strategies generated solid absolute returns and performed better than their benchmarks. Positioning most of our strategies to be overweight to U.S. equities, together with our emphasis on non-core bonds and credit strategies, contributed to the strong gains. Our alternative investments also did well, with real estate leading the way. The main detractors from our performance were EM stocks. After outperforming early in the year, the EM stock index suffered declines in China as well as from the renewed surge in the pandemic. Overall, we are very pleased with our results in all our strategies in 2021.

The Macro Backdrop

COVID-19

As has been the case the past 21 months, COVID-19 remains a key variable for the near-term (12-month) global economic and market outlook. We still believe the most likely medium-term (multiyear) base case is for continued progress in the fight against the virus and therefore a lessening of its economic impact over time. We do not expect future variants to derail the economic recovery in 2022.

If the pandemic recedes in 2022, as seems likely, the current pandemic-related supply chain disruptions, U.S. labor market anomalies, and consumer demand distortions should also recede. This should both support overall economic growth and mitigate at least some of the inflationary pressures the U.S. and global economies experienced in 2021 related to supply-demand mismatches.

U.S. Economic Policy

In addition to the evolution of the pandemic, U.S. monetary and fiscal policy will have important impacts on economic growth, inflation, and the financial markets in 2022. After unprecedented stimulus in 2020 and 2021, both policy levers in the United States are set to tighten in 2022. But it is our belief that they should not become so tight as to cause a recession.

Monetary Policy

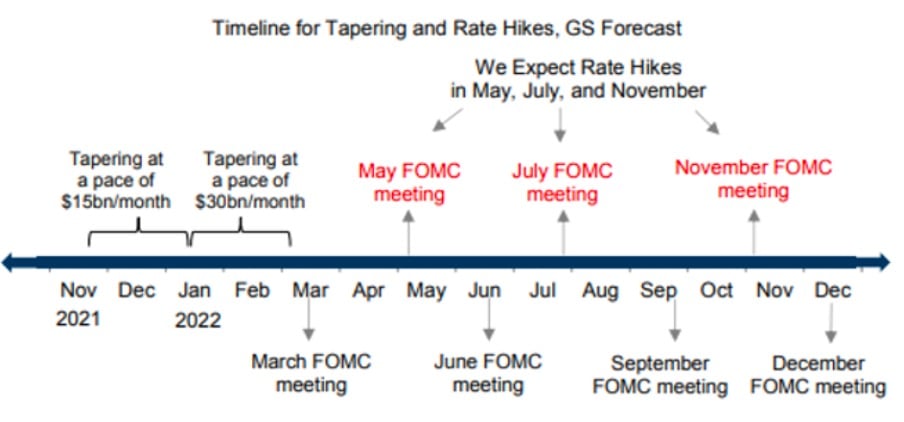

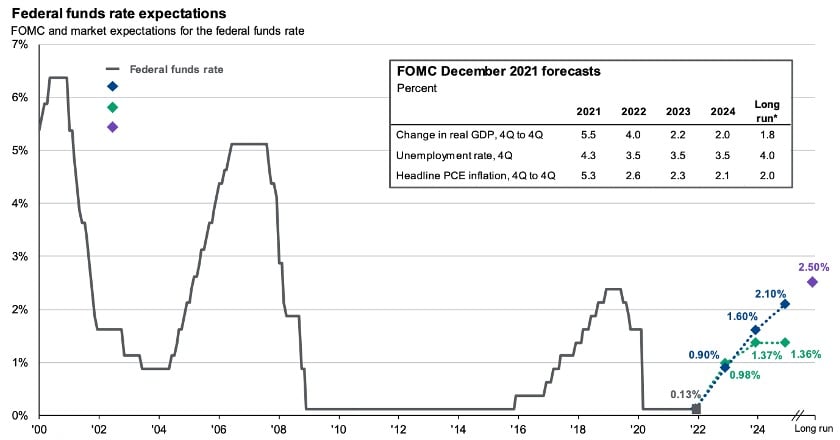

At its December Federal Open Market Committee (FOMC) meeting, the Federal Reserve expressed increasing concern about inflation and signaled it would accelerate its timeline and pace for interest rate hikes in 2022. Also, as expected, the Fed doubled the monthly pace of reducing (tapering) its quantitative easing (QE) of asset purchases; QE should end in March 2022, if not earlier. More hawkish than the accelerated taper, the updated Fed member “dot plot” now indicates a median of three rate hikes in 2022 (up from only one at the previous FOMC meeting in September) and three more in 2023.

Source: GSAM, as of December 31, 2021

Source: Bloomberg, Factset, Federal Reserve, JPMAM, As of December 31, 2021

Of course, the dot plots are subject to change – and the track record of the dot plot in predicting the Fed’s actual behavior a year or two out has actually been abysmal. But the dots indicate the Fed’s current mindset and expectations, and the financial markets pay close attention to them, so we track them closely.

In his comments after the FOMC meeting, Fed Chair Jerome Powell noted that core inflation has broadened beyond the industries most impacted by the pandemic and is well above the Fed’s 2% average inflation target. He also cited a range of economic indicators that suggest the labor market is rapidly tightening. This could include, for example, a falling unemployment rate, rising wage growth, abundant job openings, and a high employment quit rate. Powell said, “We are making rapid progress toward maximum employment.”

With both its inflation and full employment mandates likely to be met, the Fed will be in position to start tightening policy – raising rates and reducing its balance sheet assets – in 2022.

Labor Market: Headline Strength with Confirmations Still Lingering

Key to the 2022 outlook for the consumer, but also for the broader economy and inflation, is the labor market. Total nonfarm payrolls have made a remarkable recovery since the trough in April 2020 but remain 4.2 million below the pre-pandemic peak. At the same time, the breadth of gains is lessened due to the still-anemic labor force participation rate, which has moved sideways since August 2020 and is well below its pre-pandemic peak. While we think that the participation rate has room to increase in 2022 – boosted by stronger business capital spending and a broadening out in job creation – the climb will likely be slow.

A slower improvement in participation is due to the unfortunate reality that 2.5 million individuals are still hesitant to reenter the workforce because of the virus. Another large slate – estimated by the St. Louis Federal Reserve to be nearly 3 million – has retired early. Finally, a third cohort is reassessing their work/life balance. As we see it, there are many headwinds to a labor market recovery.

Fiscal Policy

Fiscal policy is also set to turn from a tailwind to a headwind for U.S. GDP growth in 2022. This is not to say the United States won’t have another large budget deficit this year, but relative to the huge fiscal boost in 2020-2021, 2022 will see less stimulus. This will amount to a “fiscal drag” – a negative impact on GDP growth next year. Further, with the passage of the Build Back Better legislation now in doubt (as of late December), economists have started to factor in an even larger fiscal drag, reducing their forecasts for 2022 GDP growth.

Economic Outlook

The consensus forecasts for economic growth and inflation in 2022 are broadly consistent with our base case, which envisions decelerating growth and moderating inflation but both still meaningfully above the economy’s longer-term trend. From an investment portfolio perspective, this macroeconomic backdrop should again be generally supportive for “risk asset” returns such as global equity and credit markets and be a headwind for core bond returns in the face of rising government bond yields.

The consensus expects roughly 4% real GDP growth for the United States (same as the FOMC forecast) and slightly higher growth for Europe in 2022. This compares to 5.5% (U.S.) and 5% (Europe) growth in 2021. Total global real GDP grew at roughly 5.6% in 2021 – its fastest pace since 1980 – and the consensus expects growth in the 4.5%-5% range in 2022.

We view these forecasts as reasonable estimates, given our macro backdrop. They reflect the inevitable slowing of growth after the historic pandemic rebound but would still be well above the estimated long-run potential real growth rate of around 1.5%-2% for the U.S. and other developed economies, and around 3.5% for the overall global economy.

The forecasts for inflation seem to be more varied. That said, as long as the pandemic recedes over the year, the core inflation rate is almost certain to decline as the pandemic-induced supply-demand distortions normalize, even if things aren’t all the way back to “normal.” However, with labor markets tightening and upward pressure on wages and labor costs, the core inflation rate is likely to be closer to 3% than 2% for 2023. It is important to remind everyone that our views are never set in stone – they continuously evolve and adapt as new data comes in.

We always consider a range of risks and alternative scenarios outside of our base case. Building a diversified portfolio, with a long-term outlook, that is resilient across a range of potential outcomes while positioned to particularly benefit in our base is our objective.

Financial Markets Outlook

Moving from the macro to the markets, we see the strongest likelihood for continued positive returns for equity and credit markets or risk assets in general. This will be driven by continued economic and corporate earnings growth, albeit decelerating in the United States and supported by still accommodative monetary and fiscal policy, even if the growth is less than what we have seen in the U.S. in the past year. The 10-year Treasury yields are likely to rise, although we don’t expect a sharp increase, which means a poor environment for core bond returns, both in absolute terms and relative to other asset classes and alternative strategies.

We expect international and EM stock markets to outperform the S&P 500 due to their sensitivity to global growth, their larger potential for earnings acceleration from still subpar levels that have lagged the U.S. recovery, and their much lower starting equity market valuations. Therefore, we see potential for strong returns from both a cyclical earnings rebound and an increase of valuations in foreign stock markets over the coming years.

A new cycle of economic expansion could bring new leadership by international stocks relative to U.S. stocks, supported by better than average global growth and lower stock valuations. COVID-19 concerns have weighed on the global growth outlook, prompting a rotation to U.S. equities in the fourth quarter. However, signs that the variant may not derail growth could mean a rotation back as economic growth accelerates in 2022. European stocks have done well in 2021 while EM has lagged, driven by Chinese market concerns. All of this underlines the importance of global diversification, because market leadership and trends can change quickly.

For the U.S. market, with valuations stretched, we see little room for valuation expansion. Earnings growth should be the primary driver of U.S. equity returns. We expect single-digit returns rather than the robust returns of the past two years. We expect low returns from fixed income as the Fed begins its tightening process and rates trend up. We also expect solid returns from real estate, private credit, infrastructure, and other alternative investments over the next several years, and they will become a larger part of our diversified portfolios.

Portfolio Positioning

There never being any guaranty as to future profits, based upon current conditions we believe the portfolios are well positioned to benefit from the long-term opportunities that we see arising in our most likely baseline scenario of a continued global economic recovery with moderately rising interest rates and inflation and decelerating growth in the United States. Our portfolios are strategically balanced and well diversified across a range of global asset classes and alternative strategies. This should enable them to be resilient should a risk scenario or unexpected shock outside our base case occur.

In terms of our overall risk exposure in our globally diversified moderate portfolios, we are overweighting equities relative to bonds. The relative valuation of U.S. stocks versus bonds is attractive, and even more so for foreign stocks. Despite high absolute U.S. stock valuations, stocks look relatively cheap at a 5% earnings yield when compared to a 1.5% Treasury bond. We also see tactical opportunities in foreign stocks as their economies accelerate.

We believe Treasury rates will be pressured to move higher from current levels due to stronger global growth and reflation. As a result, we favor short-term credit strategies over core bonds. We have a bias toward reflationary assets, and in our alternative investments, we own real estate, infrastructure, and commodities as portfolio diversifiers and risk reducers that should do better if inflation rises.

Closing Thoughts

We believe our portfolios are positioned to serve our clients well over the long term given our base-case macro and market scenarios in which the pandemic recedes, the global economy slows but still grows above trend, corporate earnings growth slows but is still solid, the U.S. rate of inflation remains elevated but is falling, and U.S. interest rates rise moderately.

We know that even in the best case, the journey likely won’t be smooth. There are a number of unpredictable bumps along the road that may occur. But we are confident in our long-term investment process, discipline, and ability to navigate whatever comes our way, with the objective of achieving your investment and financial goals. We sincerely appreciate your confidence and trust as well.

From all of us at First Foundation, we wish you a wonderful start to 2022 and a prosperous year ahead.

We hosted a webinar on Thursday, February 3 at noon PT to hear from our team about how we are evaluating the current economic backdrop and how we continue monitoring change while positioning portfolios for the future. Please use the link below to watch the replay.