Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

The S&P 500 was down less than 0.3% last week. Earnings and the economy have, so far, held up relatively well, helping prevent a major leg down, and the market index has been flat since early April. Last week’s most significant news was the softening of inflation for producer and consumer prices during April, which both showed signs of progress. Headline CPI slowed to a 4.9% annual pace in April from 5%, while the 12-month core measure dipped from 5.6% to a 16-month low of 5.5%. Headline PPI dropped from 2.7% to 2.3%, a multi-year low.

Despite the improvements, inflation remains high, so markets are likely too optimistic about rate cuts. Rate cut speculation has been all over the place lately, with markets already pricing in around two percentage points of rate cuts over the next 12 months. We are about 18 months into the lagging effects of when bond markets began to price in tighter monetary policy. Yet, despite trending down, jobs and core inflation remain sticky and above target. Immediate rate cut expectations seem premature. Recent Fedspeak is consistent with our expectation that the Fed will likely enter a wait-and-see mode for the next few months. Only time will tell how long that period lasts. In our view, if the economy continues to grow, the unemployment rate remains below 4%, and underlying inflation comes down only slowly, Fed officials are likely to keep rates unchanged at what they view as a restrictive level well into 2024.

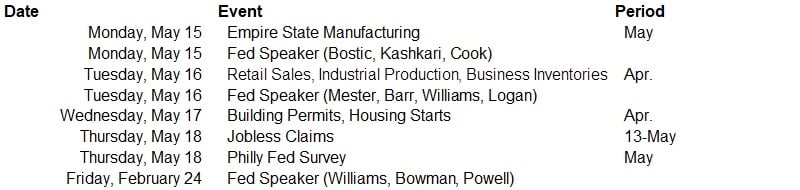

This week, there are several important data releases, and the focus is likely to be on retail sales in April and the May business sentiment indicators that should provide a better view of the pace of growth of the US economy. Many FOMC participants will also speak at various events this week, the most important occurring Friday, in which Fed Chair Powell and Former Chair Bernanke Speak on a Policy Panel titled ‘Perspectives on Monetary Policy.’

Data deck for May 13 - May 19: