10 minute read

The U.S. economy has been remarkably resilient in the face of tightening Fed policy. This was supposed to be the year of a likely recession. That has yet to happen; in fact, global equities continued to rally in the second quarter of the year, led again by surging U.S. mega-cap growth stocks. The S&P 500 index gained 6.6% in June and 8.7% in the second quarter driving its year-to-date return to 16.9%. Developed international stocks (MSCI EAFE Index) rallied 4.6% in June, gaining 3% for the quarter, and 11.7% YTD. Emerging markets stocks (MSCI EM Index) rose 3.8% in June, resulting in a .9% gain for the second quarter and a 4.9% return YTD.

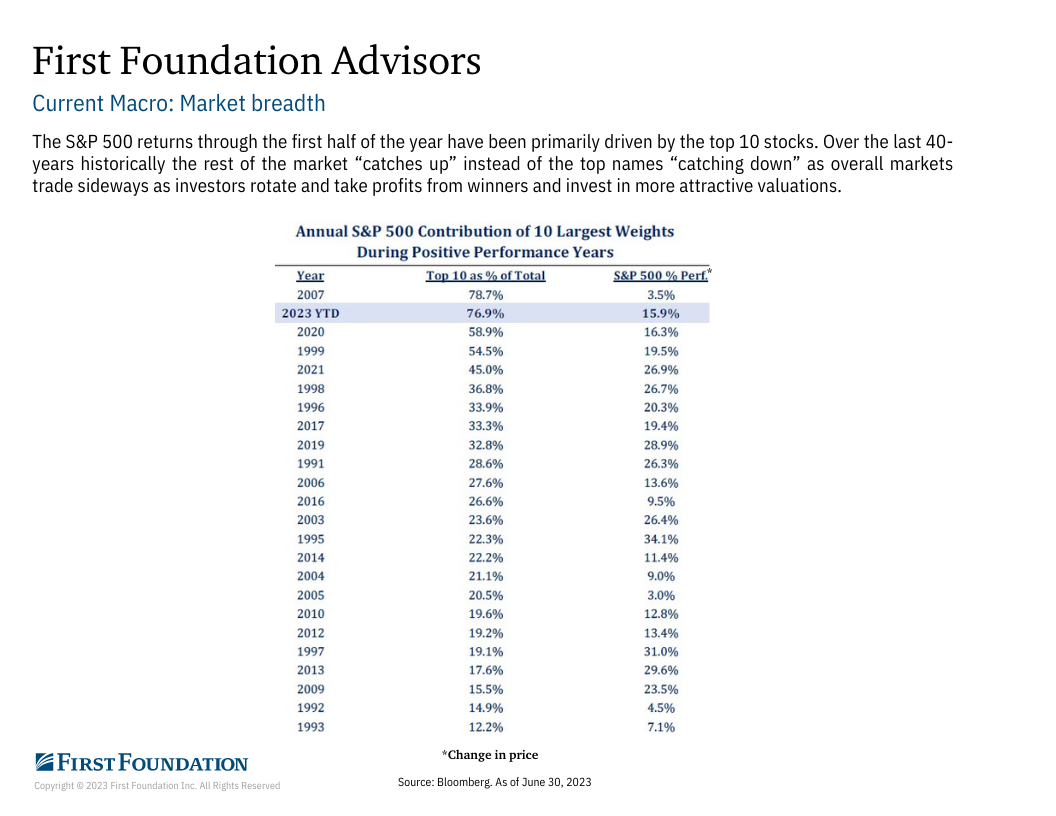

The market-cap weighted S&P 500 Index’s rally this year has been the “narrowest” on record, with less than 28% of the index’s constituents beating the overall index return (through June 14). In an average year, around 49% of the index’s 500 companies beat the overall index. As shown in the chart below, 77% of the market returns this year came from the largest ten stocks.

With the sudden frenzy in artificial intelligence (AI), the average YTD return for Amazon, Google, Meta, Microsoft, NVIDIA, and Tesla is 96%, contributing almost the entire S&P 500 return for the year. The combined market cap of the seven largest companies in the S&P 500 – the so-called “Magnificent Seven” – now comprises over 27% of the total index, the largest share in history for the top seven.

However, the market rally is starting to broaden, as the small-cap Russell Index shot up 8.1% in June (and is up the same amount YTD), while the large-cap Russell 1000 Value and 1000 Growth Indexes had similar 7% returns in June. It remains to be seen whether this extremely narrow market rally resolves via the rest of the market catching up or the so-called Magnificent Seven “catching down.” We think the rest of the market will catch up. Improved market breadth would be a positive indicator for the market’s continued bull run.

Moving to the fixed income markets, core bond returns (Bloomberg U.S. Aggregate Bond Index) were slightly negative for the quarter as interest rates slightly rose, and prices fell. The benchmark 10-year Treasury yield ended the second quarter at 3.8%, up from 3.5% at the end of March. Riskier high-yield bonds gained 1.6% for the quarter and are up 5.4% YTD. Municipal bonds were generally flat on the quarter and up 1.9% YTD.

Finally, our alternative strategies, which include real estate, private credit, and equity, have outperformed core bond for the year but have underperformed equities right in line with our expectations.

We are pleased with our Global Asset allocation strategies as most have outperformed their strategic benchmarks for the year. Absolute returns were positive across the board, with higher returns from our more growth-oriented strategies as would be expected in a strong period for equity returns. Though we are pleased with the investment performance there is never any guarantee as to future profits or meeting or exceeding any specific benchmark.

Macro Outlook

The current macroeconomic data are sending some mixed signals. On the one hand, the U.S. economy has been more resilient than we and many others expected through the first half of the year. GDP has grown, albeit at a sub-par rate; the labor market has remained very strong, supporting consumer spending; and headline inflation has dropped meaningfully, thanks largely to a sharp decline in energy prices and consumer goods disinflation as supply and demand normalize after the pandemic disruptions.

On the other hand, key leading indicators of an impending recession are still flashing red – Conference Board Leading Indicators, deeply inverted yield curve, tightening credit conditions. And although the Federal Reserve paused its aggressive interest rate-hiking campaign in June, core inflation (excluding food and energy) remains stubbornly high, with the Fed signaling it will resume rate hikes later this year, further raising the likelihood of a recession.

We maintain our view that the most likely outcome over the next few quarters is a mild recession. Historically, the odds are unfavorable for the economy avoiding a recession after the Fed has been aggressively tightening. And we have yet to see the full (lagged) impact of this cycle’s monetary tightening on the real economy. There have been three instances out of 13 where the Fed tightening cycle ended without a recession. We don't expect a severe 2008 or 2020 type of recession. Household and corporate balance sheets are in good shape and raising rates to 5%, the Fed now has room to cut them again in the next recession, softening the downturn.

Inflation

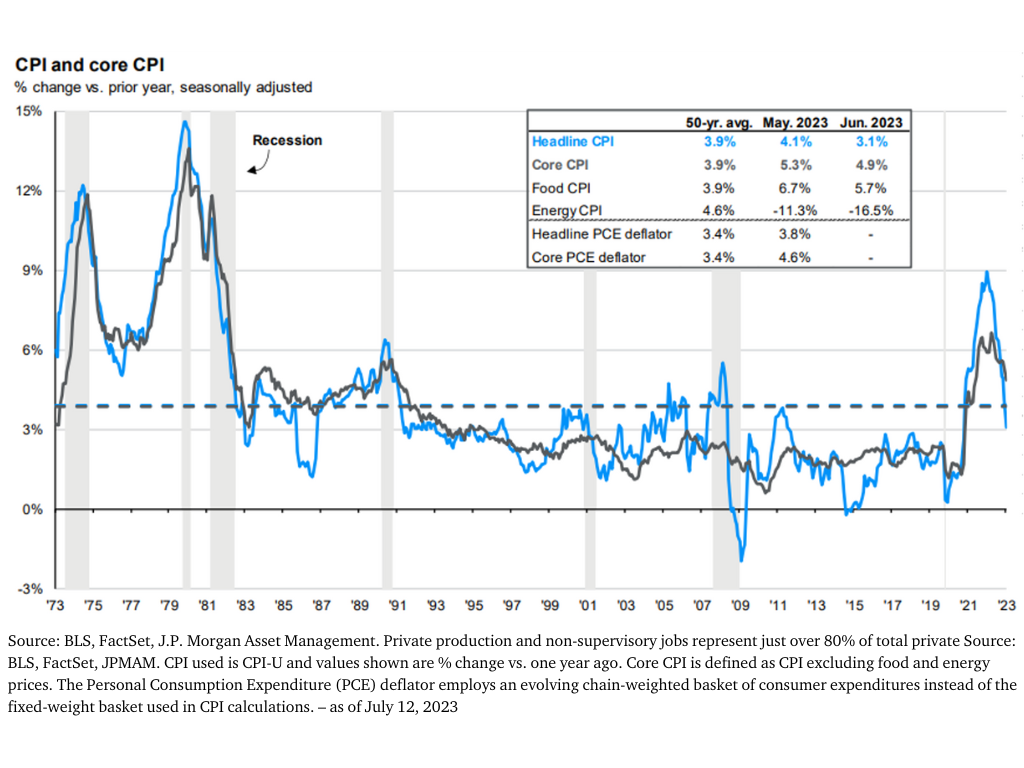

The good news is that headline CPI inflation (including energy and food prices) continues to fall, dropping to 3.0% in June on a year-over-year basis. Favorable base effects likely signal further declines in headline CPI over the next few months at least. The annualized inflation rate, based on just the past three months' data, is approaching the Fed's 2% target. The key driver has been falling energy prices.

Because of the volatility of food and energy prices (what goes down also goes up), the Fed focuses on core inflation, of which there are many measures. But the message is the same no matter which one you choose: core inflation remains stubbornly above the Fed's 2% long-term target. The June core CPI inflation rate was 4.8% and the last three months annualized was still above 4%. May core PCE inflation, the Fed's preferred measure, came in at 4.6%. We expect core inflation to fall as the year goes on, driven by a sharp drop in shelter/rent inflation. Shelter is the largest component of core inflation indexes, comprising over 40% of core CPI and nearly 20% of core PCE. The CPI shelter inflation index measures average rent price changes over the past one-year period and was a whopping 8% in May. However, more timely new lease rent price inflation has plunged this year, from mid-teens a year ago to under 2% in May. As these more recent rent prices feed into the shelter inflation calculation, it should pull the core CPI inflation readings materially lower as the year goes on.

The Fed

Despite the still high core inflation readings, the Fed (FOMC) unanimously decided not to raise interest rates at its June 14 meeting, after 10 consecutive rate hikes since March 2022 totaling five percentage points. The Fed had signaled this pause was likely coming and the financial markets were expecting it. However, we would call it a "hawkish pause" because contrary to expectations, the Fed projected 50 basis points of rate hikes later this year. The markets were expecting maybe one more hike at most.

Of course, the Fed's projections of its own behavior are often wrong. No one knows, not even the Fed itself, what it will do three or six months from now. There is too much uncertainty and variability in the economy, at least in the current macro environment.

At his post-FOMC meeting press conference, Fed Chair Powell conveyed a hawkish message to those expecting Fed rate cuts any time soon. "Nearly all committee participants view it as likely that some further rate increases will be likely this year," he said. "Not a single person on the committee wrote down a rate cut this year, nor do I think it is at all likely to be appropriate if you think about it." Nevertheless, the markets remain skeptical the Fed will actually hike twice more.

We think it will take a sharp economic downturn or surging unemployment for the Fed to start cutting rates. But they may continue to hold the Fed funds rate at the current level if core inflation drops convincingly toward 2% over the second half of the year.

The Fed is still hoping they can land the economy softly without causing a recession and a large increase in unemployment. This occurred in the 1965, 1995, and 2018 hiking cycle. But history is not on the Fed's side. The challenge is daunting given the task at hand. A recession usually started on average 7-8 months after the last Fed rate hike. Based on the historical average, if the Fed's last rate hike is at the July FOMC meeting, the recession would begin in early 2024.

We'd also point out that the Fed itself is projecting roughly a one percentage point increase in the unemployment rate over the next year. The U.S. economy has never experienced more than a 0.5% rise in unemployment from its cyclical low without the economy falling into a recession.

Economic Growth

So far this year, the U.S. and global economy have held up better than we expected with subpar growth but no recession. This is due to the continued strength in the services sector (a PMI above 50 is expansionary), while manufacturing activity has been contracting.

However, many key economic leading indicators have shown no signs of improvement over the past quarter. In addition, we do not think the Fed is close to loosening monetary policy any time soon, barring a recession. And the full, lagged, economic effects of the Fed’s aggressive monetary policy tightening have not yet played out.

Revisiting our key leading indicators, the Conference Board Leading Economic Index (LEI) has declined for 14 straight months, the longest negative streak since the 2008 financial crisis, and its six-month rate of change is deeply in recessionary territory.

The second key recession indicator is the inverted Treasury yield curve – meaning short-term Treasury yields are above longer-term Treasury Bond yields. An inverted yield curve is usually (but not always) a leading indicator of recession. As with the LEI, the depth and duration of the current inversion has never occurred without a subsequent recession in the U.S.

Bank lending standards remain tight and at levels consistent with recession in the past. And at this late stage in the economic cycle, credit conditions are likely to tighten further. This will further weigh on business investment, capex, and consumer spending.

A U.S. recession is not a certainty but weighing the evidence we believe a mild recession is still the most likely outcome.

Financial Market Outlook and Portfolio Positioning

Just as the U.S. economy has been more resilient than expected in the face of aggressive Fed tightening this year, the S&P 500 stock index has been as well, gaining nearly 17%. The key drivers of market strength include the following:

- The economy has held up better than expected, reducing investor fears of an earnings recession.

- Corporate earnings, in aggregate, have come in better than expected.

- Market sentiment (a contrarian indicator) entered the year very pessimistic, creating opportunity for money to flow back into stocks as pessimism turned to optimism.

- With inflation dropping, markets are optimistic the Fed will end its tightening.

- The regional bank crisis in March seems to have subsided with no more damage.

- The debt ceiling issue was resolved (until 2025).

- AI euphoria has super-charged a handful of mega-cap growth stocks, driving the overmarket index sharply higher (it’s been a very narrow market).

Corporate earnings and valuations ultimately drive equity returns. Although the markets can be driven by investor sentiment and momentum in the shorter-term, ultimately it is corporate earnings – “fundamentals” – and the price one pays for those earnings that drive stock prices and investor return over the medium to longer term.

Our assessment is that the market is fairly priced and that earnings will have a difficult time growing over the next year given the headwinds of a slowdown and higher interest rates. As a result, we believe the easy money has been made and anticipate U.S. equity returns will be modest over the next 6-9 months, and we may take some profits where appropriate.

Foreign markets are much less expensive than the U.S. market – reflecting low earnings expectations and depressed sentiment. We are modestly overweight international developed and underweight Emerging market stocks. We expect higher expected returns overseas given lower valuations and a declining U.S. dollar.

Fixed Income

One of our key changes last year was our significant increase in core bonds as a result of the rise in interest rates, which made bonds much more attractive from a risk and return perspective than they had been in years. With the recent rise in Treasury and municipal bonds yields to levels not seen since 2018 and prior to that, 2009, we have significantly increased our core fixed income by purchasing high-quality municipal bonds and Treasury bonds while reducing our credit risk. Our credit strategies performed well during rising interest rates, and we have now tactically shifted those positions into high-quality core fixed income. With the current yield, we believe core bonds now offer better downside protection and shorter-term return potential in many different economic scenarios.

Alternative Strategies

Our alternative strategies were the bright spot in our globally diversified portfolios in 2022. In our opinion, alternatives provide powerful long-term portfolio benefits and non-correlated returns to traditional stock and bond holdings and improve risk-adjusted returns of balanced portfolios. Given the current macro risks and market backdrop, we think they are especially valuable.

We favor private real estate investment allocations to multi-family, industrial and self-storage, and selected grocery-anchored centers. We expect equity-like, long-term returns from these investments with built-in inflation protection and tax-efficient income generation. We also favor private equity and credit opportunities. A thorough understanding of private investment’s unique properties and risks is needed before investing. Your relationship team remains available to discuss the attributes of private investments with you.

Closing Thoughts

While a recession is still a likely outcome, it may be a mild one given the strength of the labor market, ample household savings, and solid business balance sheets. The Fed’s response will also be critical in terms of the timing and magnitude of when it starts cutting rates.

We expect more volatility as an economic slowdown or recession will likely lead to slowing corporate earnings. While challenging, it is critical for long-term investors to stay the course through these rough periods in the markets. The shorter-term turbulence and discomfort is the price one pays to earn the long-term equity risk premium that most investors need to build long-term wealth and achieve their financial objectives.

Outside of the U.S. stock market, we already see attractive medium-term expected returns from international and emerging stocks. A declining dollar, as we expect, would further fuel non-U.S. equity returns.

Fixed-income assets and high-quality bonds are also now attractively priced with mixed single-digit or better expected returns. Core bonds will also provide downside stability in the event of a recession. Our investments in alternative strategies should provide further resilience to our portfolio.

We sincerely thank you for your confidence and trust and please do not hesitate to reach out to us if you have any questions or concerns.