Welcome to “The Week Ahead” where we take a moment to provide our thoughts on what we can expect in markets and the economy during the upcoming week.

Equity markets pulled back last week as rates markets continued to sell off, given better-than-expected economic data and inflation expectations that came in above expectations. All told, there’s been a not-so-subtle shift in expectations toward more Fed rate hikes, as there is now chatter that the Fed will raise rates by a further 75 bps this year, with many now looking at three 25 bp moves. Some Fed speakers are even resurfacing the possibility of 50bp hikes.

This week we get the minutes of the January FOMC meeting. The minutes are dated, as data released in January (labor market, CPI, retail sales) has since informed that the labor market is much tighter than previously believed. However, they should shed light on the distribution of opinions, which should help guide expectations for the path forward. Rates markets are currently pricing in peak rates of 5.29% (implying 2.7 hikes priced in), and most of the ’23 cuts have been priced out. One of the most critical questions now becomes what it would take to change expectations for rate cuts in 2024. Our belief is that until we reach a level of economic weakness that sufficiently brings inflation down and the unemployment rate is consistently rising, the Fed is likely to continue indicating that it may continue to raise rates.

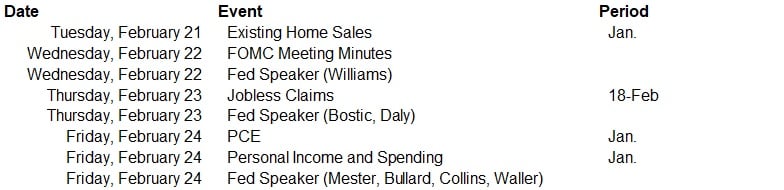

In addition to the minutes from the January FOMC meeting, this week there will also be several speaking engagements from Fed officials, including governors Jefferson and Waller; and presidents Williams, Bostic, Daly, Mester, Bullard, and Collins. Investors will also get readings on personal income, spending, PCE inflation, and new and existing home sales.

Data deck for February 18 - February 24: